Stock Analysis

As global markets navigate a complex landscape of economic shifts, including the European Central Bank's rate cuts and fluctuating oil prices, investors are seeking opportunities that align with these evolving conditions. Penny stocks, though an older term, remain a relevant area for investment due to their potential for combining value and growth. This article will explore several penny stocks that stand out for their financial strength and resilience, offering intriguing possibilities for those interested in under-the-radar companies with long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.59 | MYR2.93B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.75 | MYR129.91M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.39 | CN¥2.11B | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £183.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.235 | £307.76M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.45 | MYR2.5B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,805 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shanghai MicuRx Pharmaceutical (SHSE:688373)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai MicuRx Pharmaceutical Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for unmet medical needs, with a market cap of CN¥3.06 billion.

Operations: The company's revenue primarily comes from its research and development of drugs and other businesses, amounting to CN¥109.40 million.

Market Cap: CN¥3.06B

Shanghai MicuRx Pharmaceutical, with a market cap of CN¥3.06 billion, is currently pre-revenue and unprofitable, reporting a net loss of CN¥291.3 million for the nine months ended September 2024. Despite this, the company has shown revenue growth from CN¥68.27 million to CN¥97.56 million year-over-year for the same period. Its short-term assets (CN¥896.4M) comfortably cover both short-term (CN¥108.4M) and long-term liabilities (CN¥239.8M), while having more cash than debt enhances financial stability amidst ongoing losses and negative equity five years ago now turned positive.

- Dive into the specifics of Shanghai MicuRx Pharmaceutical here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Shanghai MicuRx Pharmaceutical's future.

Goldlok Holdings(Guangdong)Ltd (SZSE:002348)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Goldlok Holdings (Guangdong) Co., Ltd. operates in the toys and Internet education sectors in China, with a market capitalization of CN¥2.71 billion.

Operations: The company's revenue is derived from the Toy Manufacturing Industry (CN¥193.42 million), Wholesale and Retail (CN¥53.42 million), and Educational Informationization (CN¥3.74 million) segments.

Market Cap: CN¥2.71B

Goldlok Holdings (Guangdong) Co., Ltd. has a market cap of CN¥2.71 billion and operates in the toys and Internet education sectors, reporting revenues from Toy Manufacturing (CN¥193.42 million), Wholesale and Retail (CN¥53.42 million), and Educational Informationization (CN¥3.74 million). Despite being unprofitable with a net loss of CN¥35.81 million for the half-year ending June 2024, it maintains a satisfactory net debt to equity ratio of 30.6% and sufficient cash runway exceeding three years due to positive free cash flow growth. However, short-term liabilities slightly exceed short-term assets by CN¥6.9M, indicating potential liquidity challenges.

- Click to explore a detailed breakdown of our findings in Goldlok Holdings(Guangdong)Ltd's financial health report.

- Examine Goldlok Holdings(Guangdong)Ltd's past performance report to understand how it has performed in prior years.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. is involved in the research, development, production, and sale of fermented meat products both in China and internationally, with a market cap of CN¥5.52 billion.

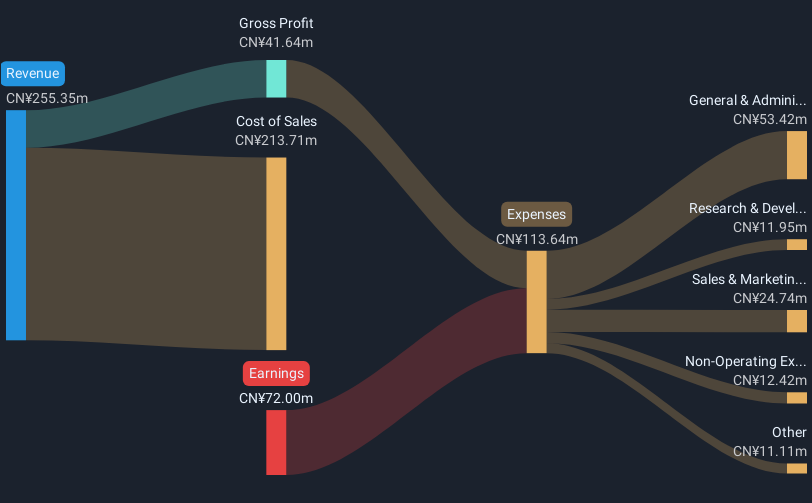

Operations: The company's revenue primarily comes from the Ham Meat Industry, generating CN¥289.68 million, followed by the Cold Chain Industry with CN¥25.01 million.

Market Cap: CN¥5.52B

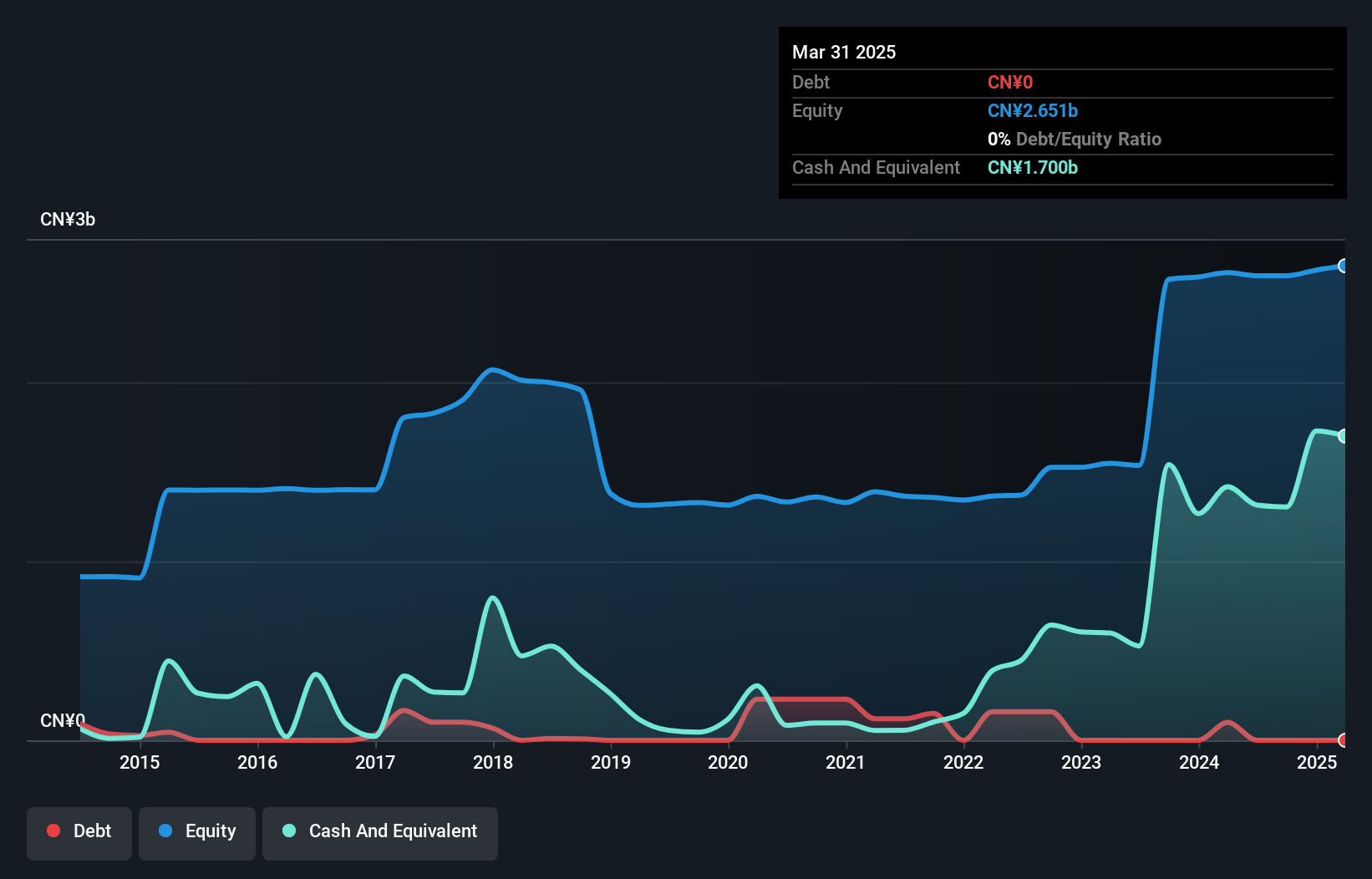

Jinzi Ham Co., Ltd. boasts a market cap of CN¥5.52 billion, with robust sales in the Ham Meat Industry generating CN¥289.68 million. The company is debt-free, alleviating concerns over interest payments and showcasing financial stability with short-term assets of CN¥1.6 billion covering both short-term and long-term liabilities comfortably. Recent earnings results show revenue growth to CN¥199 million for the half-year ending June 2024, alongside a net income increase to CN¥30.61 million, reflecting improved profit margins from 7.9% to 13.1%. However, Return on Equity remains low at 1.7%, suggesting room for improvement in profitability metrics despite strong recent earnings growth of 57%.

- Click here and access our complete financial health analysis report to understand the dynamics of Jinzi HamLtd.

- Assess Jinzi HamLtd's previous results with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 5,805 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002515

Jinzi HamLtd

Engages in the research and development, production, and sale of fermented meat products in China and internationally.