As Chinese stocks faced a downturn due to underwhelming corporate earnings and a challenging economic landscape, the Shanghai Composite Index and the blue-chip CSI 300 saw slight declines. This environment has prompted economists to lower growth forecasts, highlighting the importance of stable dividend-paying stocks as potential safe havens for investors. In such uncertain times, good dividend stocks are typically characterized by their ability to provide consistent payouts and financial stability, making them attractive options in a volatile market.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.63% | ★★★★★★ |

| Anhui Anke Biotechnology (Group) (SZSE:300009) | 3.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.80% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.08% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.57% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 5.08% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 4.00% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.83% | ★★★★★★ |

Click here to see the full list of 253 stocks from our Top Chinese Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lao Feng Xiang (SHSE:600612)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Lao Feng Xiang Co., Ltd. operates in the jewelry industry both in the People's Republic of China and internationally, with a market cap of CN¥21.51 billion.

Operations: Lao Feng Xiang Co., Ltd. generates revenue from its operations in the jewelry industry within China and internationally.

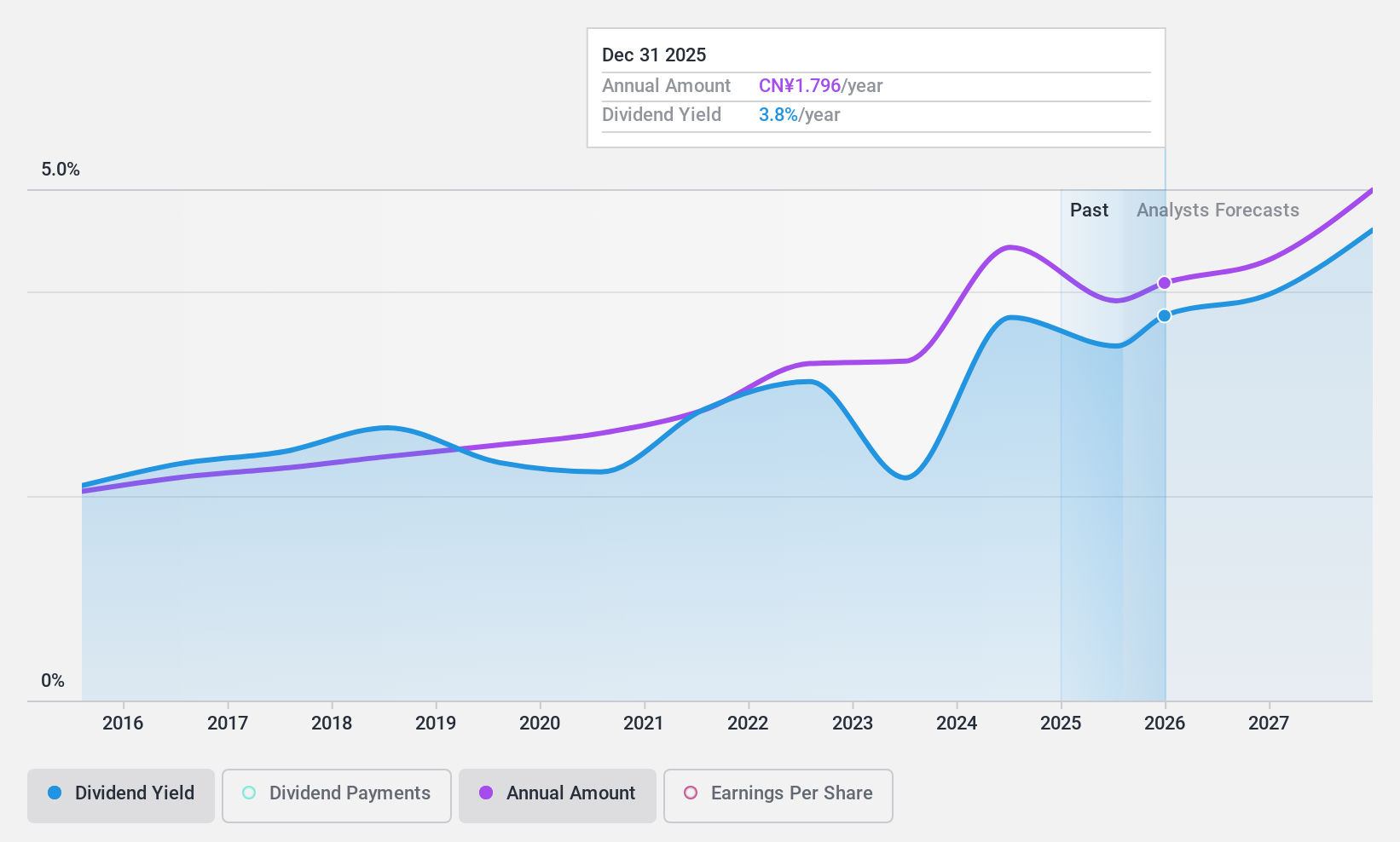

Dividend Yield: 3.8%

Lao Feng Xiang offers a compelling dividend profile with a payout ratio of 43.5%, ensuring dividends are well-covered by earnings. The cash payout ratio stands at 34%, indicating solid coverage by cash flows. Its dividend yield of 3.75% is among the top in the Chinese market, and payments have been stable and growing over the past decade. Recent earnings showed net income rising to CNY 1.40 billion for H1 2024, supporting its reliable dividend history.

- Click here and access our complete dividend analysis report to understand the dynamics of Lao Feng Xiang.

- According our valuation report, there's an indication that Lao Feng Xiang's share price might be on the cheaper side.

G-bits Network Technology (Xiamen) (SHSE:603444)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G-bits Network Technology (Xiamen) Co., Ltd. operates in the gaming industry, developing and publishing online games, with a market cap of CN¥13.88 billion.

Operations: G-bits Network Technology (Xiamen) Co., Ltd. generates revenue primarily from the development and publishing of online games.

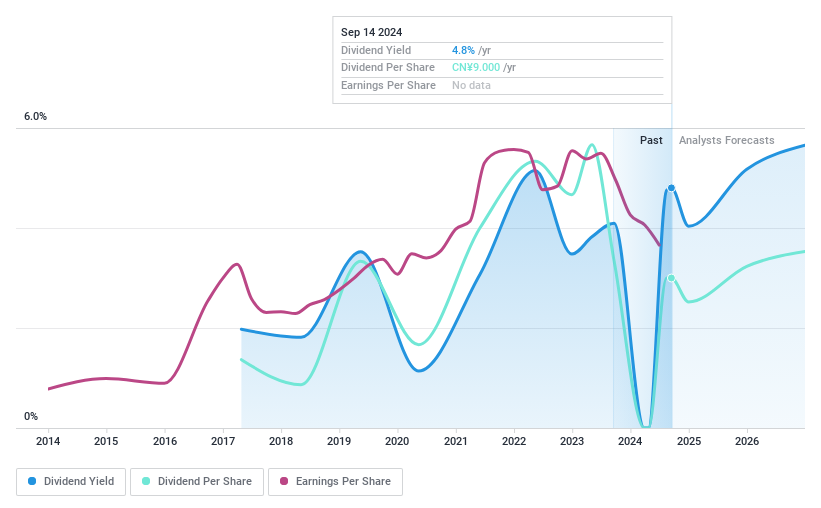

Dividend Yield: 4.7%

G-bits Network Technology (Xiamen) reported H1 2024 sales of CNY 1.96 billion, down from CNY 2.35 billion a year ago, with net income declining to CNY 517.83 million from CNY 675.97 million. Despite the drop in earnings, the company's dividend yield of 4.65% ranks in the top quartile of Chinese dividend payers and is well-covered by both earnings (payout ratio: 33.5%) and cash flows (cash payout ratio: 56.2%). However, its dividend payments have been volatile over the past seven years.

- Click here to discover the nuances of G-bits Network Technology (Xiamen) with our detailed analytical dividend report.

- The valuation report we've compiled suggests that G-bits Network Technology (Xiamen)'s current price could be quite moderate.

Zhejiang Jianye Chemical (SHSE:603948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jianye Chemical Co., Ltd. engages in the research, development, production, and sales of fine chemical products in China and has a market cap of CN¥2.56 billion.

Operations: Zhejiang Jianye Chemical Co., Ltd. generates revenue from the research, development, production, and sales of fine chemical products in China.

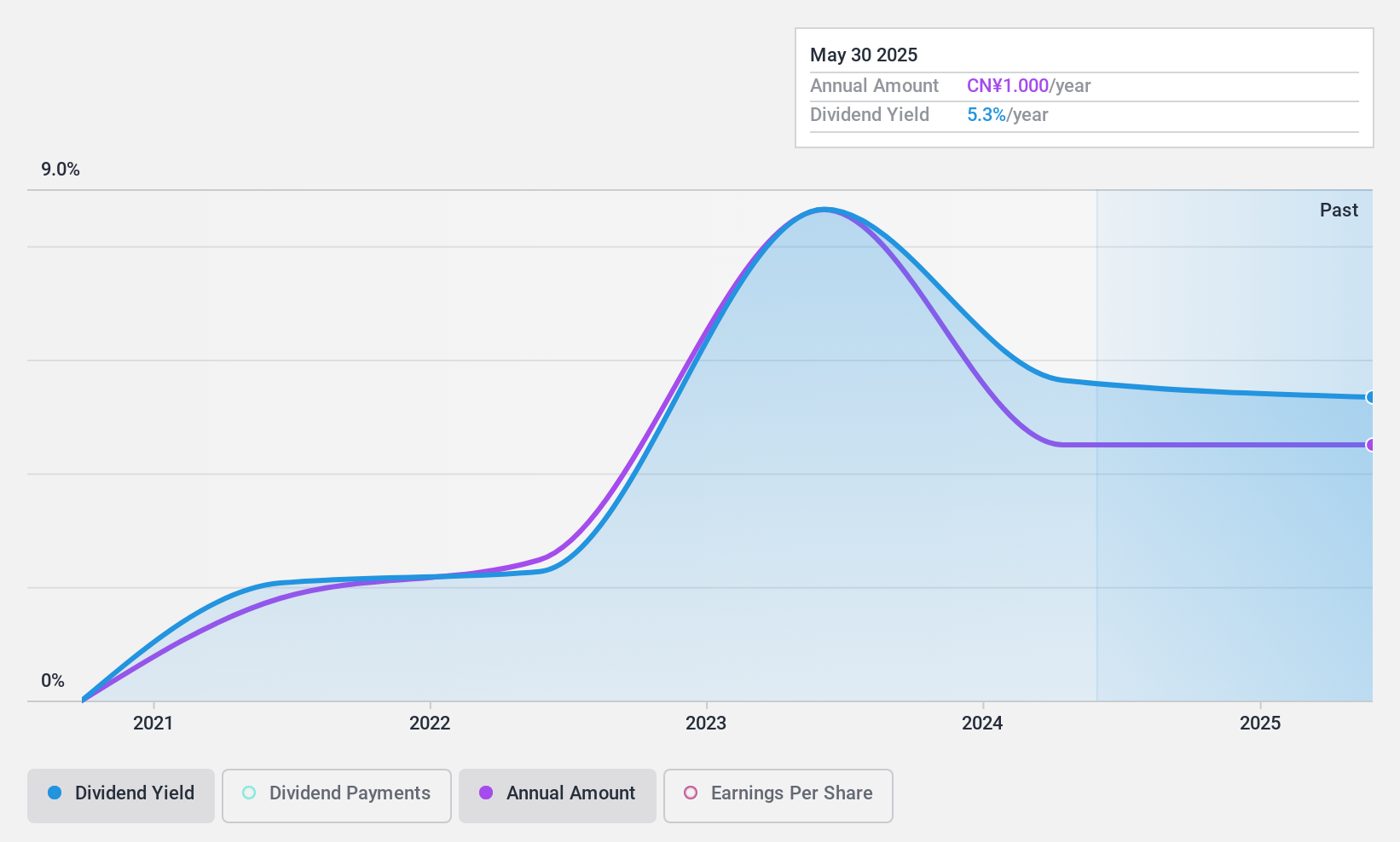

Dividend Yield: 6.4%

Zhejiang Jianye Chemical's H1 2024 earnings showed a decline, with sales at CNY 1.19 billion and net income at CNY 129.52 million, down from last year. The dividend yield of 6.36% is among the top in China but has been unreliable and volatile over the past four years. Despite this, dividends are covered by both earnings (payout ratio: 57.6%) and cash flows (cash payout ratio: 61.8%), indicating sustainability amidst fluctuating payments.

- Delve into the full analysis dividend report here for a deeper understanding of Zhejiang Jianye Chemical.

- Our valuation report here indicates Zhejiang Jianye Chemical may be undervalued.

Seize The Opportunity

- Navigate through the entire inventory of 253 Top Chinese Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jianye Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603948

Zhejiang Jianye Chemical

Engages in the research, development, production, and sales of fine chemical products in China.

Flawless balance sheet, good value and pays a dividend.