Stock Analysis

Exploring Three Chinese Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst a holiday-shortened week, Chinese stocks demonstrated resilience with the Shanghai Composite and CSI 300 indices posting gains. This positive movement reflects broader market optimism spurred by governmental pledges to enhance monetary and fiscal support, aiming to bolster demand within the nation's economy. In this context, exploring growth companies with high insider ownership in China becomes particularly compelling as these firms often benefit from aligned interests between management and shareholders, potentially leading to more robust governance and strategic decision-making during uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| UTour Group (SZSE:002707) | 24% | 27.3% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

We're going to check out a few of the best picks from our screener tool.

Hoshine Silicon Industry (SHSE:603260)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hoshine Silicon Industry Co., Ltd. is a company based in China that specializes in the production and sale of silicon-based materials, both domestically and internationally, with a market capitalization of approximately CN¥61.63 billion.

Operations: The company specializes in silicon-based materials, generating its revenue primarily through sales in both the Chinese and international markets.

Insider Ownership: 32.6%

Earnings Growth Forecast: 33.7% p.a.

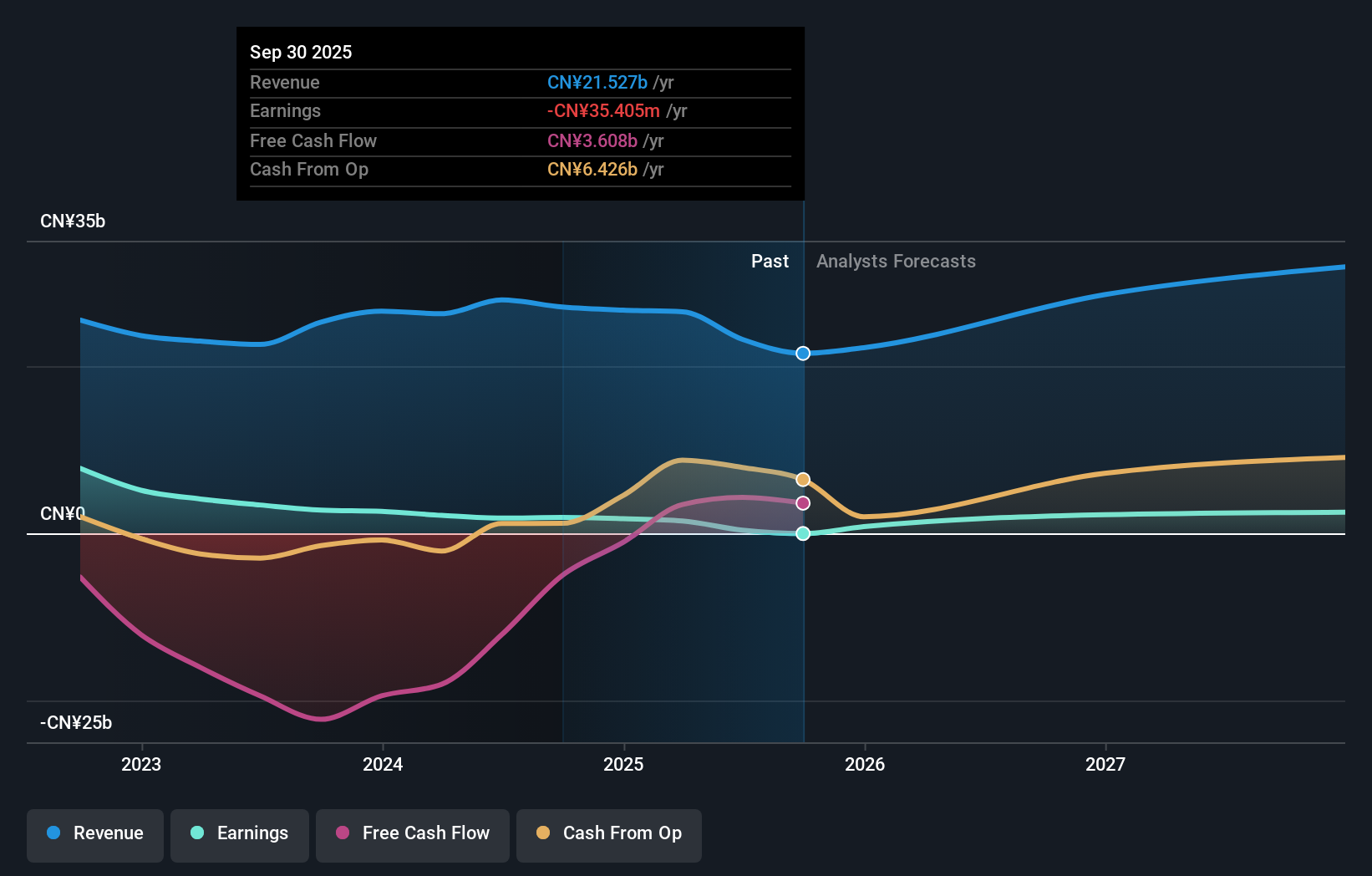

Hoshine Silicon Industry, a growth company in China with high insider ownership, is navigating mixed financial waters. Despite a recent dip in quarterly and annual earnings—CNY 527.84 million and CNY 2,622.83 million respectively—the firm's revenue and earnings are projected to grow significantly above the market average at 26.6% annually. However, challenges persist with lower profit margins compared to last year and debt not well covered by operating cash flow. The company's proactive approach includes a completed share buyback for CNY 391.07 million, aiming to bolster shareholder value amidst these conditions.

- Delve into the full analysis future growth report here for a deeper understanding of Hoshine Silicon Industry.

- Upon reviewing our latest valuation report, Hoshine Silicon Industry's share price might be too optimistic.

Wens Foodstuff Group (SZSE:300498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wens Foodstuff Group Co., Ltd. is a livestock and poultry farming company based in China, with a market capitalization of approximately CN¥135.37 billion.

Operations: The company generates its revenue primarily from livestock and poultry farming activities in China.

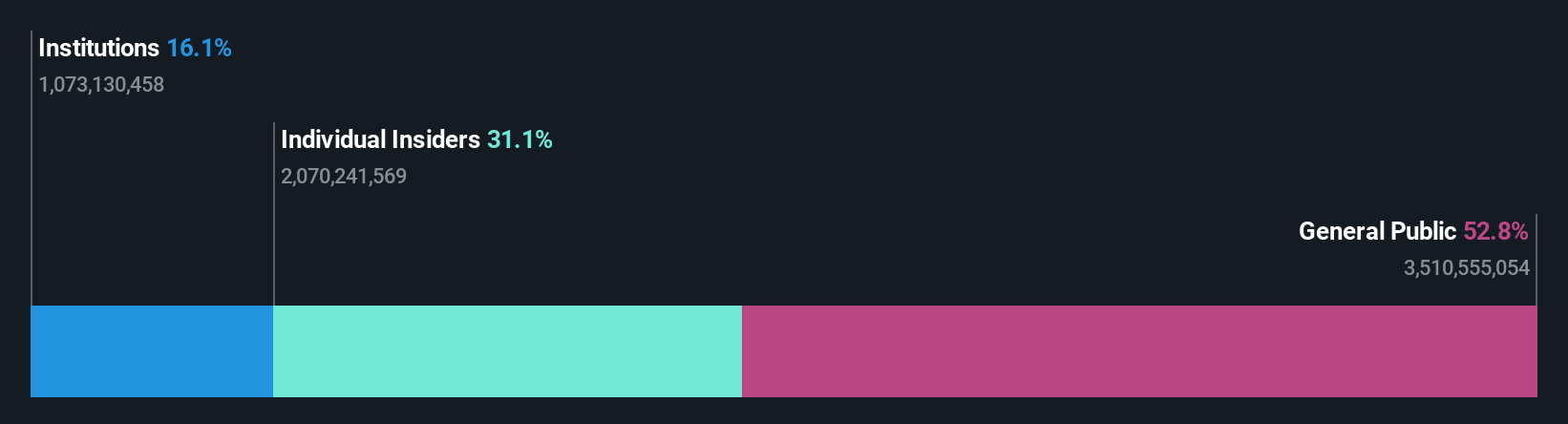

Insider Ownership: 32.4%

Earnings Growth Forecast: 81.9% p.a.

Wens Foodstuff Group, a Chinese growth company with high insider ownership, is poised for significant transformation. Although currently unprofitable with a net loss of CNY 1,236.02 million in Q1 2024 and a substantial net loss in the previous year, it's forecasted to reach profitability within three years. The company's revenue growth at 15.2% annually outpaces the broader Chinese market rate of 14.3%, signaling robust potential despite its high debt levels. Moreover, earnings are expected to surge by an impressive 81.85% annually, underpinned by a strong projected return on equity of 26.3%.

- Take a closer look at Wens Foodstuff Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Wens Foodstuff Group is trading beyond its estimated value.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a bio-medical company that focuses on the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both in China and abroad, with a market capitalization of approximately CN¥60.44 billion.

Operations: The company generates revenue primarily from its in vitro diagnostic segment, which amounted to CN¥4.08 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 22.8% p.a.

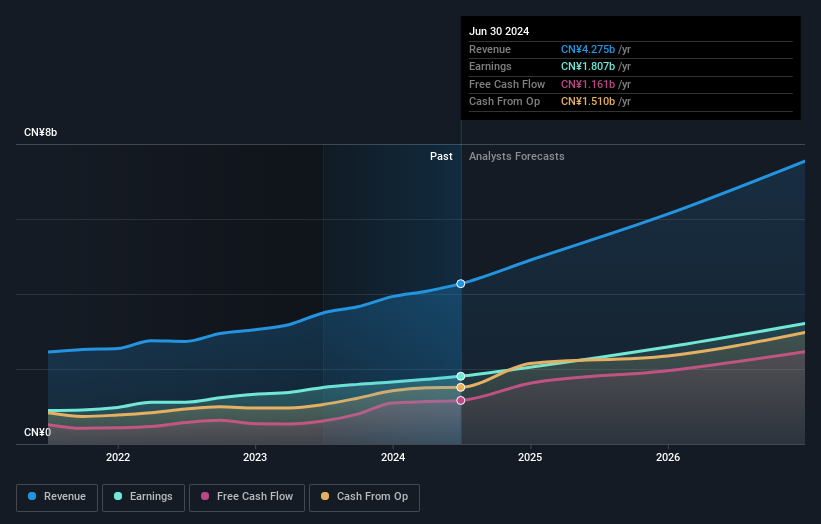

Shenzhen New Industries Biomedical Engineering, a notable player in China's growth sectors with high insider ownership, demonstrates robust financial health and growth prospects. Recently reporting a year-over-year revenue increase to CNY 1.02 billion and net income rising to CNY 426.22 million in Q1 2024, the company shows promise despite an unstable dividend track record. Forecasted annual earnings and revenue growth of approximately 22.83% and 22.5%, respectively, slightly lag behind the broader Chinese market's earnings growth but surpass its revenue expansion pace, positioning it well for future scalability.

- Click here to discover the nuances of Shenzhen New Industries Biomedical Engineering with our detailed analytical future growth report.

- Our expertly prepared valuation report Shenzhen New Industries Biomedical Engineering implies its share price may be too high.

Next Steps

- Navigate through the entire inventory of 406 Fast Growing Chinese Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Hoshine Silicon Industry is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603260

Hoshine Silicon Industry

Engages in the production and sale of silicon-based materials in China and internationally.

High growth potential and slightly overvalued.