3 Chinese Growth Companies With High Insider Ownership Expecting Up To 33% Revenue Growth

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts by the U.S. Federal Reserve, Chinese stocks have experienced mixed performance, with the Shanghai Composite and CSI 300 Indexes seeing declines. Despite this volatility, certain growth companies in China stand out due to their high insider ownership and strong revenue growth projections. In the current market environment, stocks with significant insider ownership can signal confidence from those closest to the company's operations. This article will explore three such Chinese growth companies that are expecting up to 33% revenue growth.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 26.9% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Shandong Longhua New Material (SZSE:301149) | 34.4% | 42.5% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 85.3% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 40.1% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

Here's a peek at a few of the choices from the screener.

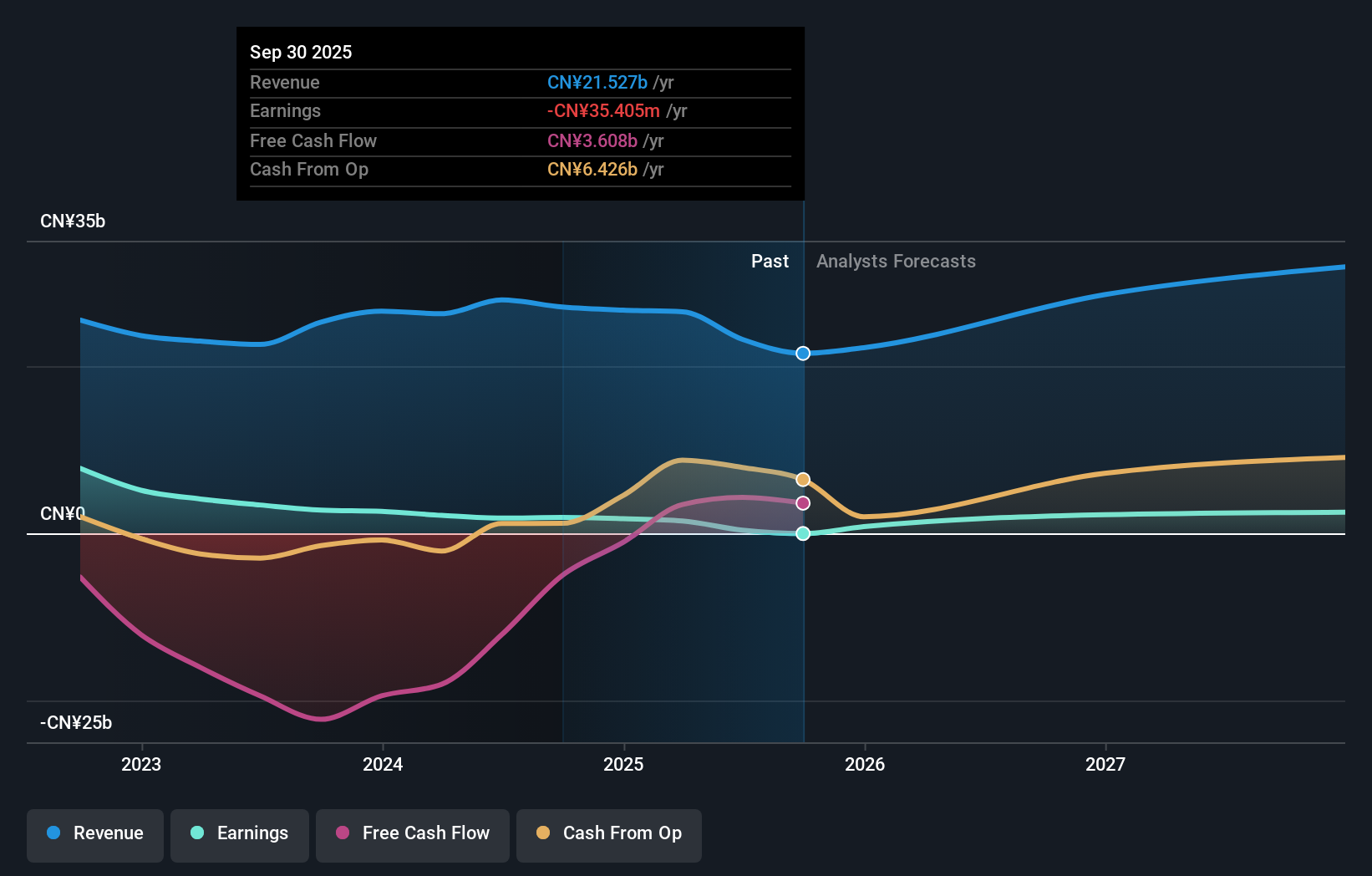

Hoshine Silicon Industry (SHSE:603260)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hoshine Silicon Industry Co., Ltd. produces and sells silicon-based materials in China and internationally, with a market cap of CN¥54.37 billion.

Operations: Hoshine Silicon Industry Co., Ltd. generates revenue from the production and sale of silicon-based materials both domestically and internationally.

Insider Ownership: 32.6%

Revenue Growth Forecast: 26.5% p.a.

Hoshine Silicon Industry, a growth company with high insider ownership in China, is forecast to achieve significant earnings growth of 31.7% annually over the next three years, outpacing the CN market's 22.1%. However, profit margins have decreased from 17.8% to 8.2% year-over-year and its return on equity is expected to be low at 12.1%. Despite recent removal from key indices like SSE 180 and a buyback completion of CNY391.07 million shares, it maintains strong revenue growth projections at 26.5% per year.

- Take a closer look at Hoshine Silicon Industry's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Hoshine Silicon Industry is trading behind its estimated value.

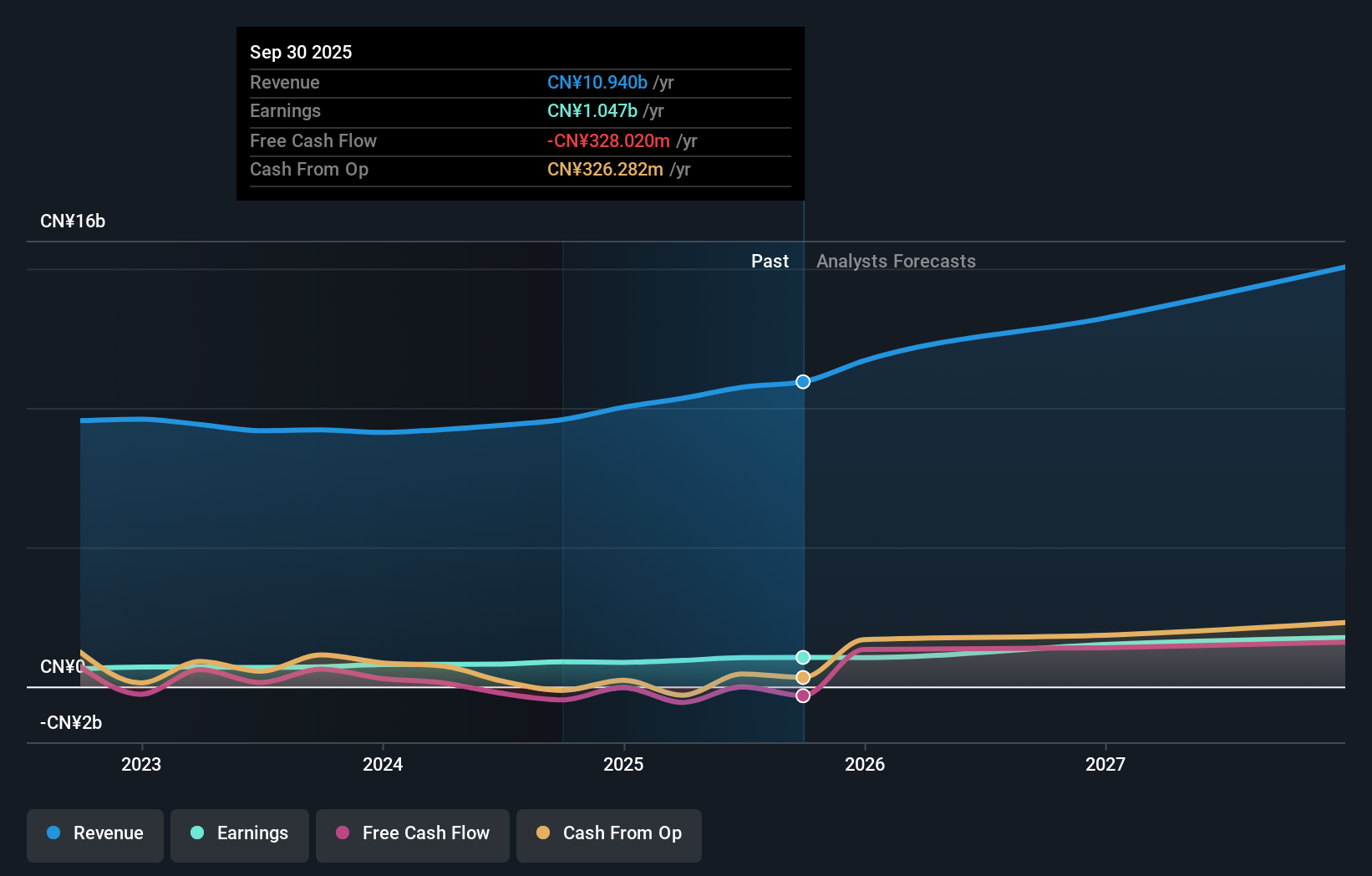

Jinan Shengquan Group Share Holding (SHSE:605589)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jinan Shengquan Group Share Holding Co., Ltd. operates in the manufacturing sector and has a market cap of CN¥15.47 billion.

Operations: Jinan Shengquan Group Share Holding Co., Ltd. generates revenue through its primary business operations in the manufacturing sector, with a market cap of CN¥15.47 billion.

Insider Ownership: 28.5%

Revenue Growth Forecast: 15.2% p.a.

Jinan Shengquan Group Share Holding is expected to see earnings grow 23.2% per year, outpacing the CN market's 22.1%. Despite a modest past year's earnings growth of 18.1%, recent half-year results showed sales rising to CNY4.63 billion from CNY4.37 billion and net income increasing slightly to CNY331.32 million from CNY313.02 million year-over-year. The company also announced a share repurchase program worth up to CNY250 million, aimed at boosting investor confidence and reducing registered capital through buybacks funded by its own resources.

- Get an in-depth perspective on Jinan Shengquan Group Share Holding's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Jinan Shengquan Group Share Holding's share price might be on the cheaper side.

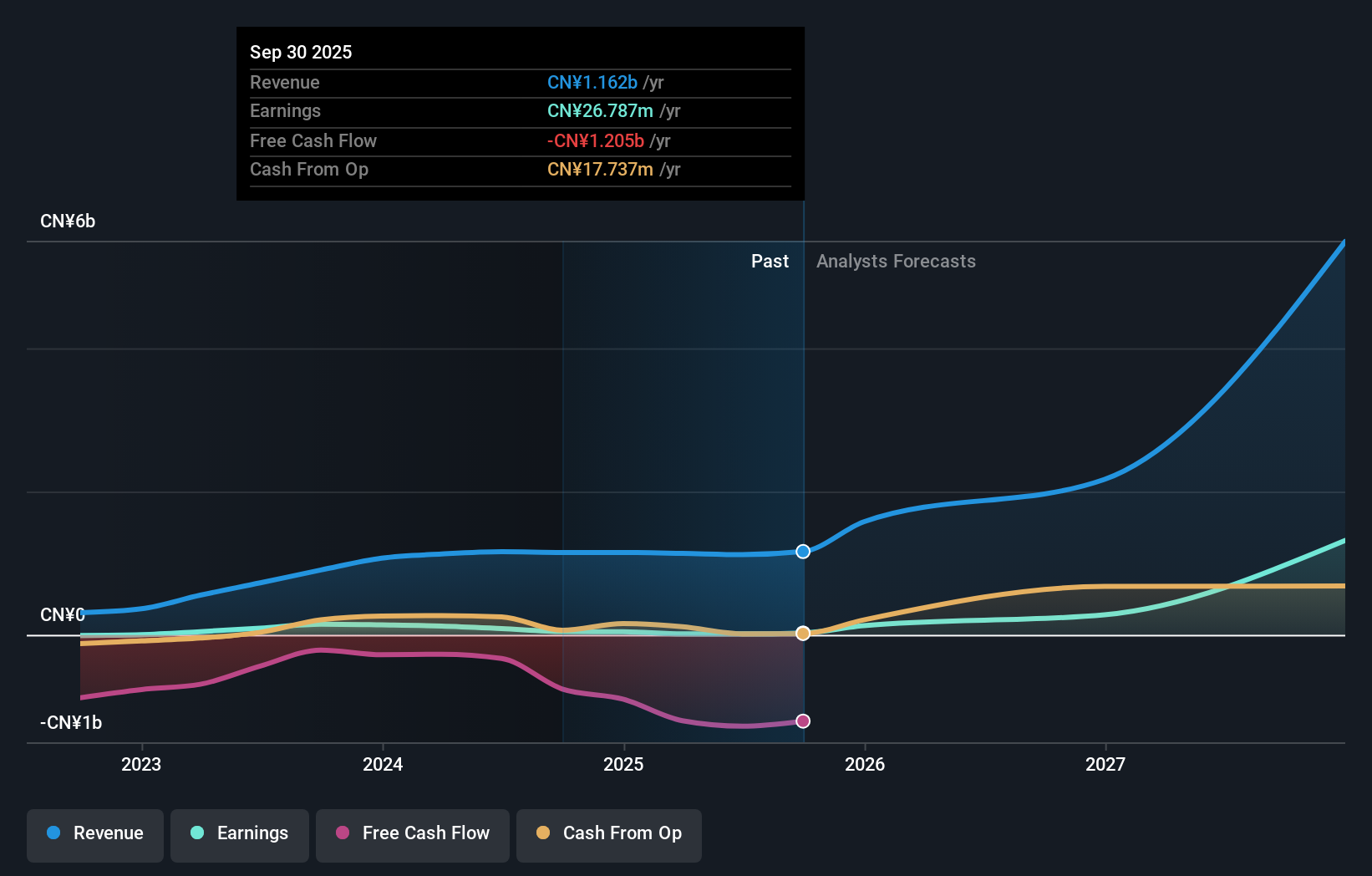

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) operates in the environmental technology sector and has a market cap of CN¥8.10 billion.

Operations: Qingdao Huicheng Environmental Technology Group generates revenue from various segments within the environmental technology sector.

Insider Ownership: 31.9%

Revenue Growth Forecast: 33.2% p.a.

Qingdao Huicheng Environmental Technology Group’s revenue is forecast to grow 33.2% annually, significantly outpacing the CN market's 13.4%. Despite a recent dip in profit margins to 7.5%, the company's earnings are expected to grow substantially at 58.47% per year over the next three years. Insider ownership remains high, with Zhang Min acquiring a further 5% stake for CNY300 million recently, reinforcing confidence in its growth trajectory despite volatile share prices and interest payment concerns.

- Click here and access our complete growth analysis report to understand the dynamics of Qingdao Huicheng Environmental Technology Group.

- The valuation report we've compiled suggests that Qingdao Huicheng Environmental Technology Group's current price could be inflated.

Seize The Opportunity

- Reveal the 377 hidden gems among our Fast Growing Chinese Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605589

Jinan Shengquan Group Share Holding

Jinan Shengquan Group Share Holding Co., Ltd.

Solid track record with excellent balance sheet.