- China

- /

- Communications

- /

- SZSE:300136

3 Growth Companies Insiders Own With Up To 15% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate mixed trading and economic indicators, investors are increasingly focused on identifying robust growth opportunities. In this environment, companies with high insider ownership and consistent revenue growth stand out as potential strong performers.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.6% | 52.1% |

| Medley (TSE:4480) | 34% | 30.5% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 60.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

We'll examine a selection from our screener results.

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunway Communication Co., Ltd. specializes in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions with a market cap of CN¥17.39 billion.

Operations: The company's revenue from electronic components amounts to CN¥7.95 billion.

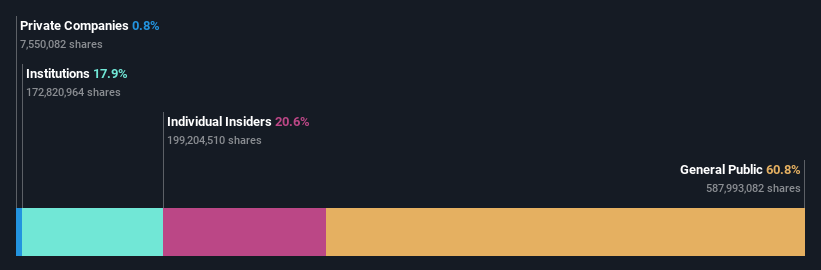

Insider Ownership: 20.6%

Revenue Growth Forecast: 14.1% p.a.

Shenzhen Sunway Communication's earnings are forecast to grow significantly at 30.6% per year, outpacing the CN market. Despite a volatile share price, its Price-To-Earnings ratio of 33.3x is below the industry average, suggesting good value. Recent events include a CNY 400 million share repurchase program and half-year revenues of CNY 3.75 billion, up from CNY 3.35 billion last year, indicating strong financial performance and commitment to shareholder value through buybacks and dividends.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Sunway Communication.

- According our valuation report, there's an indication that Shenzhen Sunway Communication's share price might be on the expensive side.

Wens Foodstuff Group (SZSE:300498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wens Foodstuff Group Co., Ltd. operates as a livestock and poultry farming company in China with a market cap of CN¥112.43 billion.

Operations: Wens Foodstuff Group Co., Ltd. generates revenue primarily from its livestock and poultry farming operations in China, with a market cap of CN¥112.43 billion.

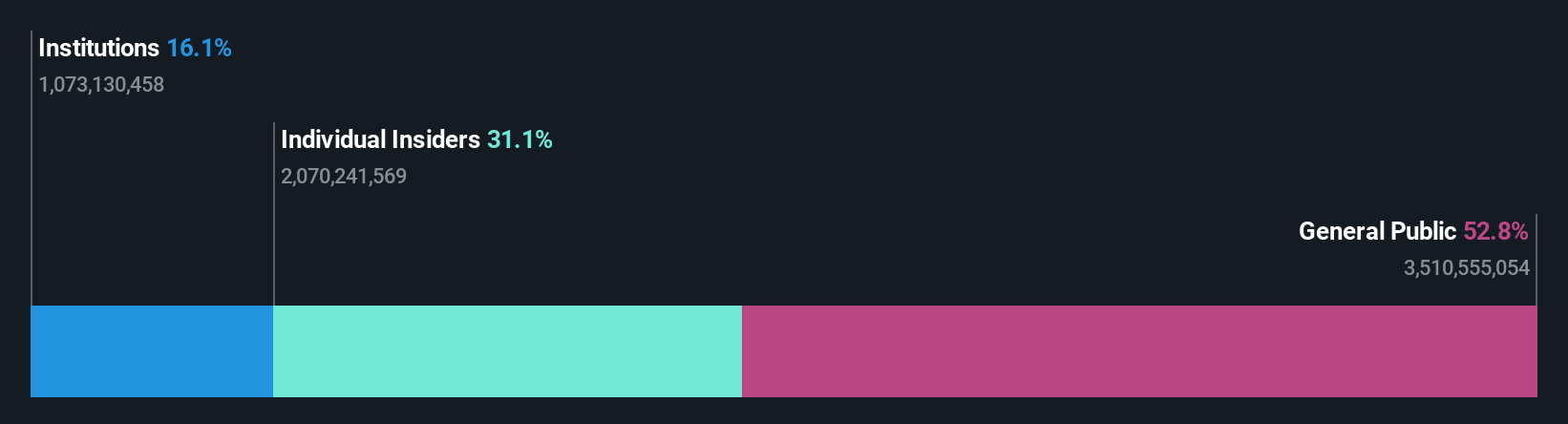

Insider Ownership: 32.4%

Revenue Growth Forecast: 13.5% p.a.

Wens Foodstuff Group's revenue is forecast to grow at 13.5% annually, slightly above the CN market average. The company reported half-year sales of CNY 46.69 billion, up from CNY 41.14 billion a year ago, and net income of CNY 1.33 billion compared to a loss last year, indicating improving profitability. Analysts expect the stock price to rise by 35%, with earnings projected to grow at an impressive rate of 60.84% per year over the next three years.

- Take a closer look at Wens Foodstuff Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Wens Foodstuff Group shares in the market.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that designs, manufactures, processes, and distributes multilayer printed circuit boards with a market cap of NT$101.72 billion.

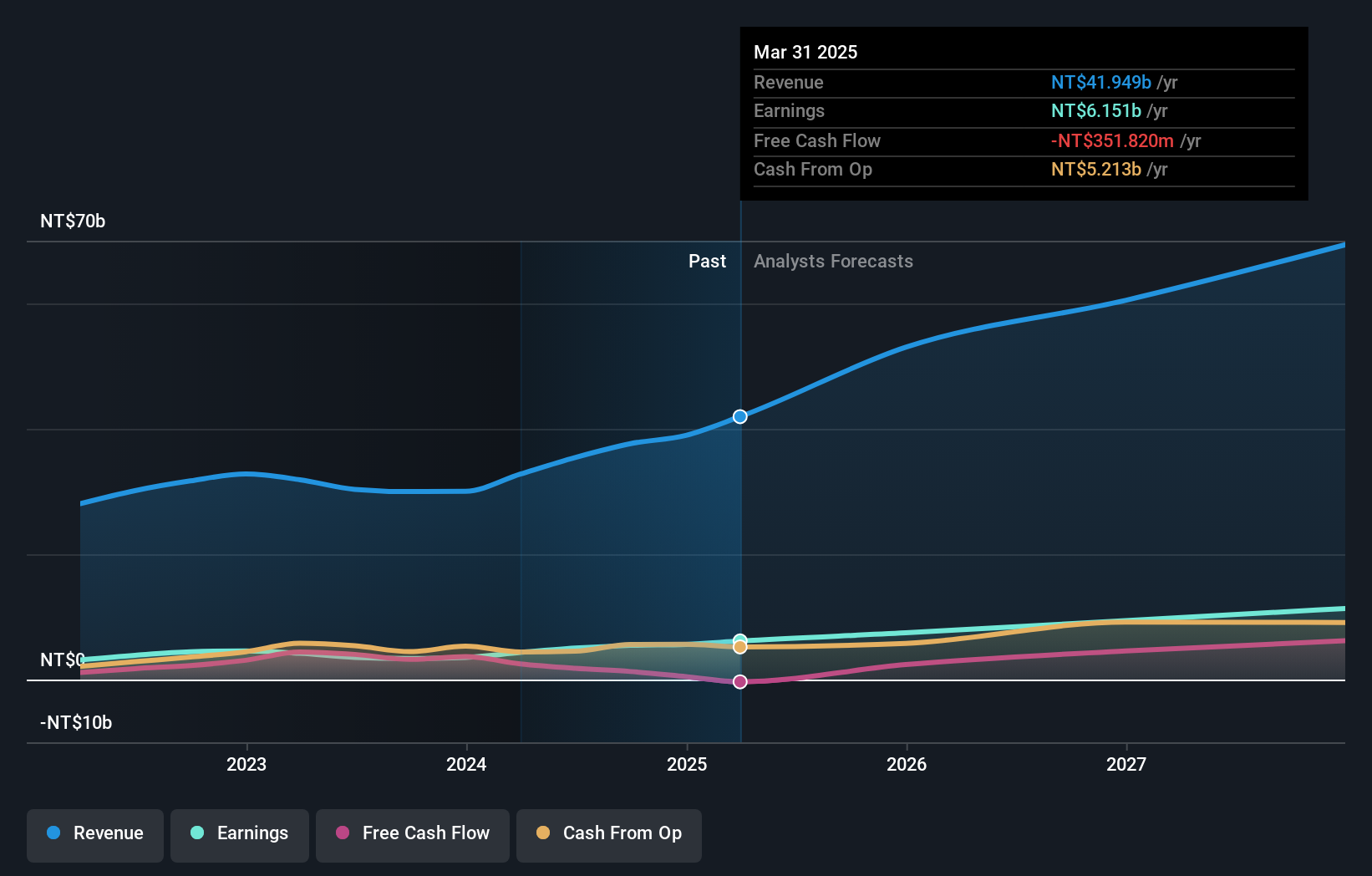

Operations: The company's revenue from the manufacturing and sales of printed circuit boards is NT$35.42 billion.

Insider Ownership: 31.4%

Revenue Growth Forecast: 15.3% p.a.

Gold Circuit Electronics reported significant earnings growth, with net income for the second quarter rising to TWD 1.52 billion from TWD 817.42 million a year ago. The company's earnings per share also increased, reflecting improved profitability. Despite high volatility in its share price over the past three months, analysts forecast a 24.5% rise in stock price and expect annual profit growth of 19.8%, outpacing the TW market average of 18.4%.

- Click to explore a detailed breakdown of our findings in Gold Circuit Electronics' earnings growth report.

- Upon reviewing our latest valuation report, Gold Circuit Electronics' share price might be too pessimistic.

Key Takeaways

- Access the full spectrum of 1508 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300136

Shenzhen Sunway Communication

Engages in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions in China and internationally.

Flawless balance sheet with reasonable growth potential.