Global markets have shown a mixed performance recently, with major U.S. stock indexes like the S&P 500 and Nasdaq hitting record highs, while smaller-cap stocks faced declines. In this context of diverging market trends, penny stocks—often representing smaller or newer companies—continue to attract attention for their potential to offer both affordability and growth opportunities. Despite being considered somewhat outdated, the term 'penny stocks' remains relevant as these investments can still present compelling opportunities when backed by strong financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$144.03M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$65.64M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,699 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ercros (BME:ECR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €327.34 million.

Operations: The company generates revenue from three main segments: Chlorine Derivatives (€375.76 million), Intermediate Chemicals (€193.57 million), and Pharmaceuticals (€63.57 million).

Market Cap: €327.34M

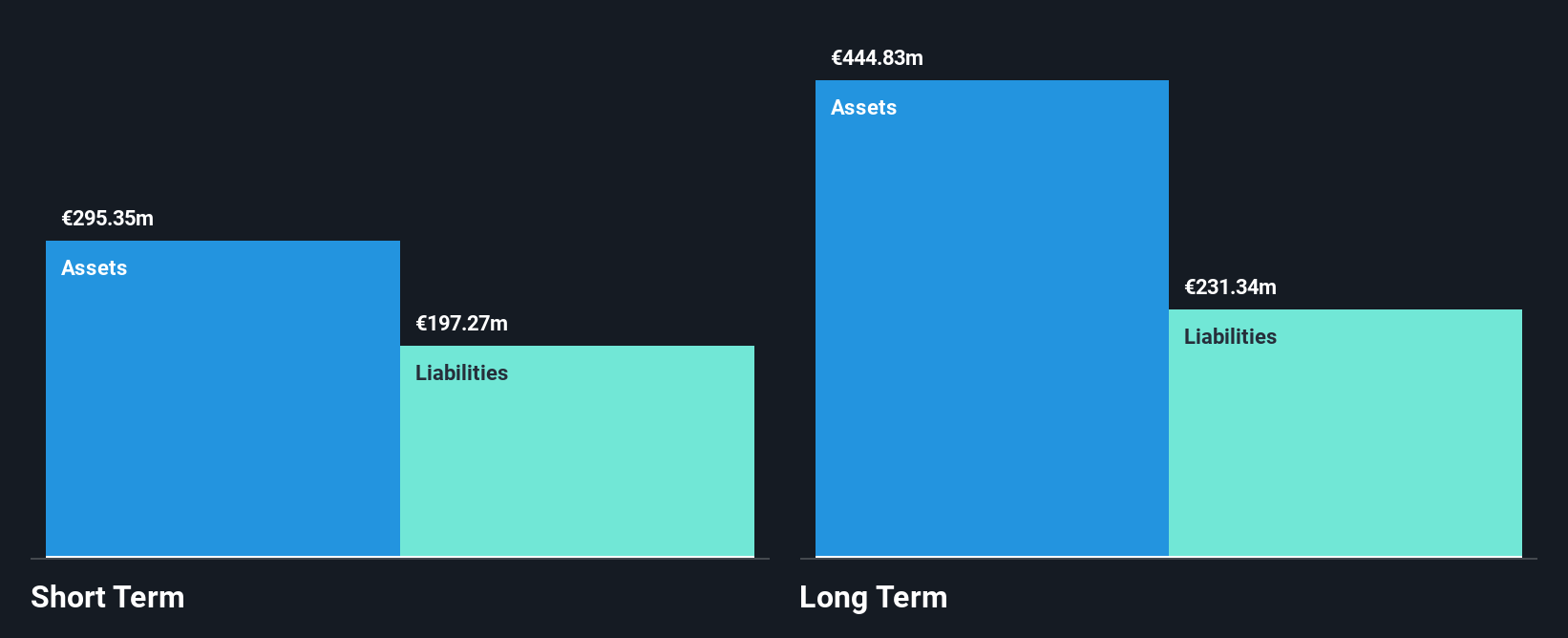

Ercros, S.A. operates in the chemicals sector with a market cap of €327.34 million, generating revenue from Chlorine Derivatives, Intermediate Chemicals, and Pharmaceuticals. Despite a satisfactory net debt to equity ratio of 36.3% and operating cash flow covering its debt well at 26.3%, Ercros faces challenges with declining earnings growth (-33.5%) and reduced revenue (€533.61 million) for the nine months ending September 2024 compared to the previous year (€600.94 million). The company reported a net loss of €7.8 million over this period, impacted by large one-off gains previously recorded.

- Dive into the specifics of Ercros here with our thorough balance sheet health report.

- Explore Ercros' analyst forecasts in our growth report.

Luzhou Bank (SEHK:1983)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. operates in the People’s Republic of China, offering corporate and retail banking, financial market services, and other related services, with a market cap of HK$5.38 billion.

Operations: Luzhou Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$5.38B

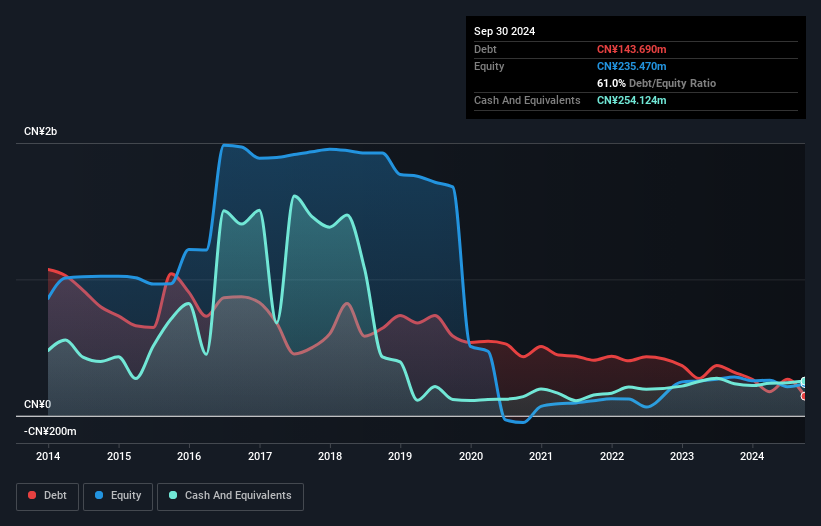

Luzhou Bank Co., Ltd., with a market cap of HK$5.38 billion, demonstrates moderate asset management with an assets to equity ratio of 14.5x and maintains high-quality earnings. The bank's recent earnings growth of 54.7% outpaces its five-year average, indicating accelerated profit growth and improved net profit margins from last year. It operates with primarily low-risk funding sources, evidenced by an appropriate loans to deposits ratio of 74%. Recent board changes include the resignation of Mr. TANG Baoqi and the election of Mr. FAN Jingdong as an independent director, reflecting ongoing governance adjustments within the bank's leadership structure.

- Click to explore a detailed breakdown of our findings in Luzhou Bank's financial health report.

- Evaluate Luzhou Bank's historical performance by accessing our past performance report.

Sichuan Shengda Forestry Industry (SZSE:002259)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Shengda Forestry Industry Co., Ltd is involved in the exploration, development, and production of liquefied natural gas (LNG) in China, with a market cap of CN¥2.02 billion.

Operations: The company generates revenue of CN¥685.80 million from its gas business segment.

Market Cap: CN¥2.02B

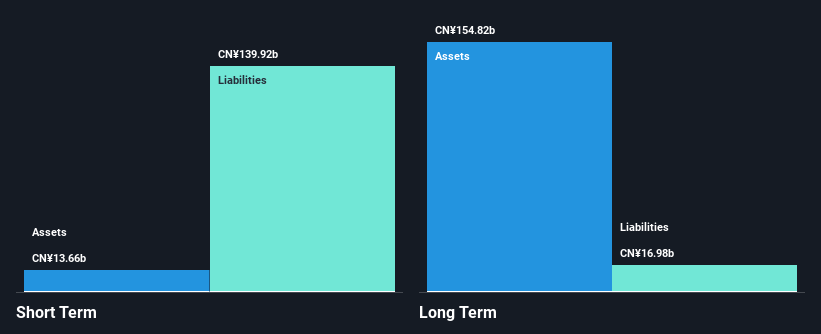

Sichuan Shengda Forestry Industry Co., Ltd, with a market cap of CN¥2.02 billion, is involved in the LNG sector in China. Despite being unprofitable, the company has managed to maintain a positive free cash flow and sufficient cash runway for over three years. Its short-term assets of CN¥309.8 million exceed its short-term liabilities but fall short against long-term liabilities of CN¥450.2 million. Recent earnings reports show a decline in revenue to CN¥509.49 million from last year's CN¥602.13 million and a net loss of CN¥20.31 million compared to last year's net income, highlighting ongoing financial challenges amidst operational activities.

- Unlock comprehensive insights into our analysis of Sichuan Shengda Forestry Industry stock in this financial health report.

- Examine Sichuan Shengda Forestry Industry's past performance report to understand how it has performed in prior years.

Key Takeaways

- Gain an insight into the universe of 5,699 Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Excellent balance sheet with reasonable growth potential.