- China

- /

- Construction

- /

- SZSE:000065

Exploring None's Top 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In recent weeks, global markets have seen significant gains, with small-cap indices like the Russell 2000 reaching record highs amid robust trading activity and geopolitical developments. As economic indicators such as personal income and spending continue to show strength despite a manufacturing slump, investors are increasingly attentive to small-cap stocks that may offer untapped potential in this dynamic environment. Identifying promising stocks often involves looking for companies with solid fundamentals and growth prospects that align well with current market trends and conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

NORINCO International Cooperation (SZSE:000065)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NORINCO International Cooperation Ltd. is an engineering contractor with operations across Asia, Africa, the Middle East, and other international markets, with a market cap of CN¥10.74 billion.

Operations: The company's revenue model is primarily driven by its engineering contracting services across various international markets. It has a market cap of CN¥10.74 billion, reflecting its scale in the industry.

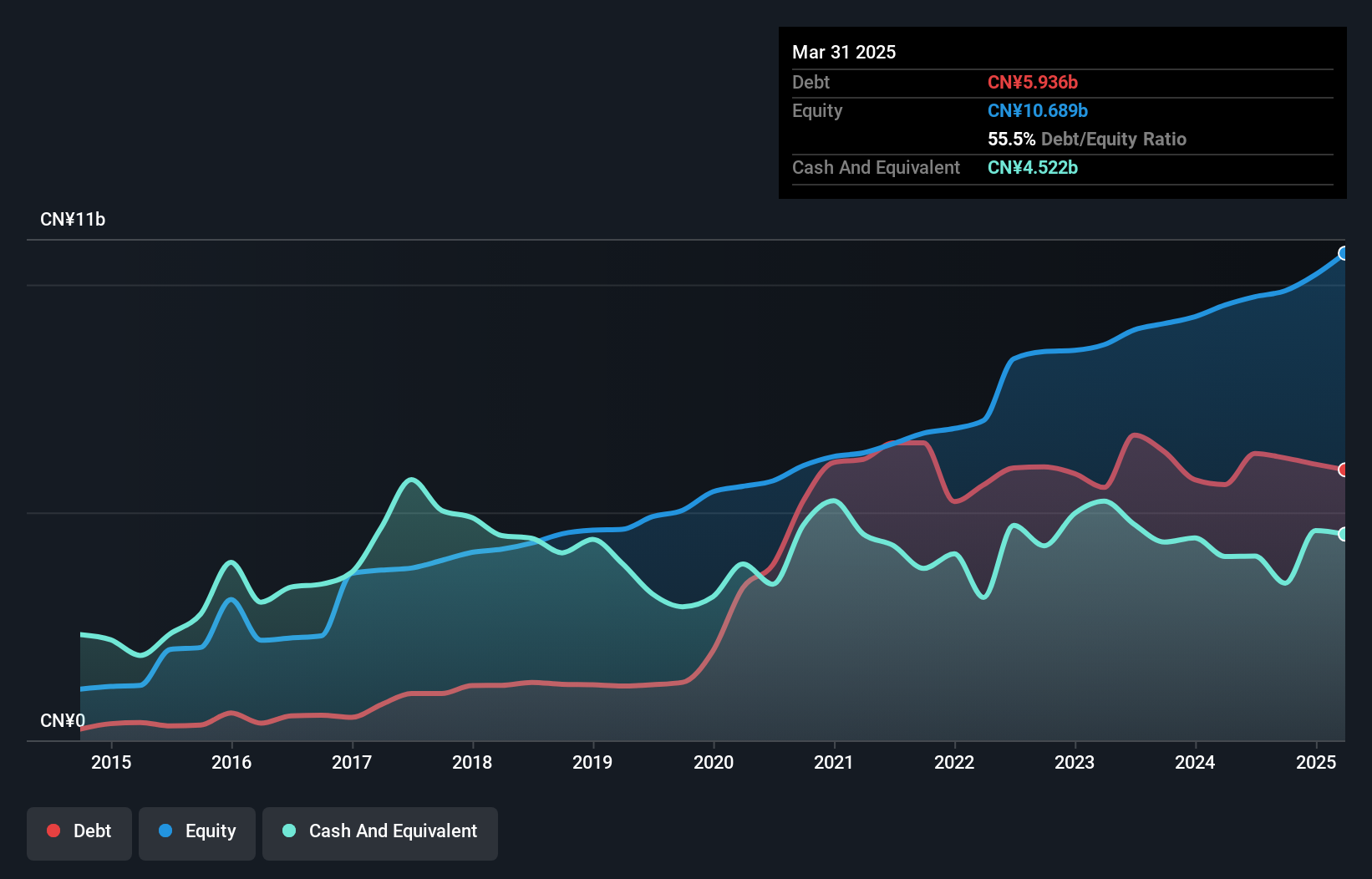

NORINCO International Cooperation, a player in the construction sector, has shown resilience with its earnings growing by 19% over the past year, outpacing the industry average of -3.9%. Its net income for nine months ended September 2024 was CNY 757.51 million, up from CNY 690.53 million last year, reflecting solid performance despite a slight dip in sales from CNY 14.63 billion to CNY 14.12 billion. The company's debt management appears sound with a net debt to equity ratio of 27.9%, deemed satisfactory and interest payments well covered by EBIT at an impressive 22.3 times coverage.

New Huadu Technology (SZSE:002264)

Simply Wall St Value Rating: ★★★★★★

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China with a market capitalization of CN¥5.10 billion.

Operations: The company generates revenue primarily through its Internet marketing operations in China. It has a market capitalization of CN¥5.10 billion.

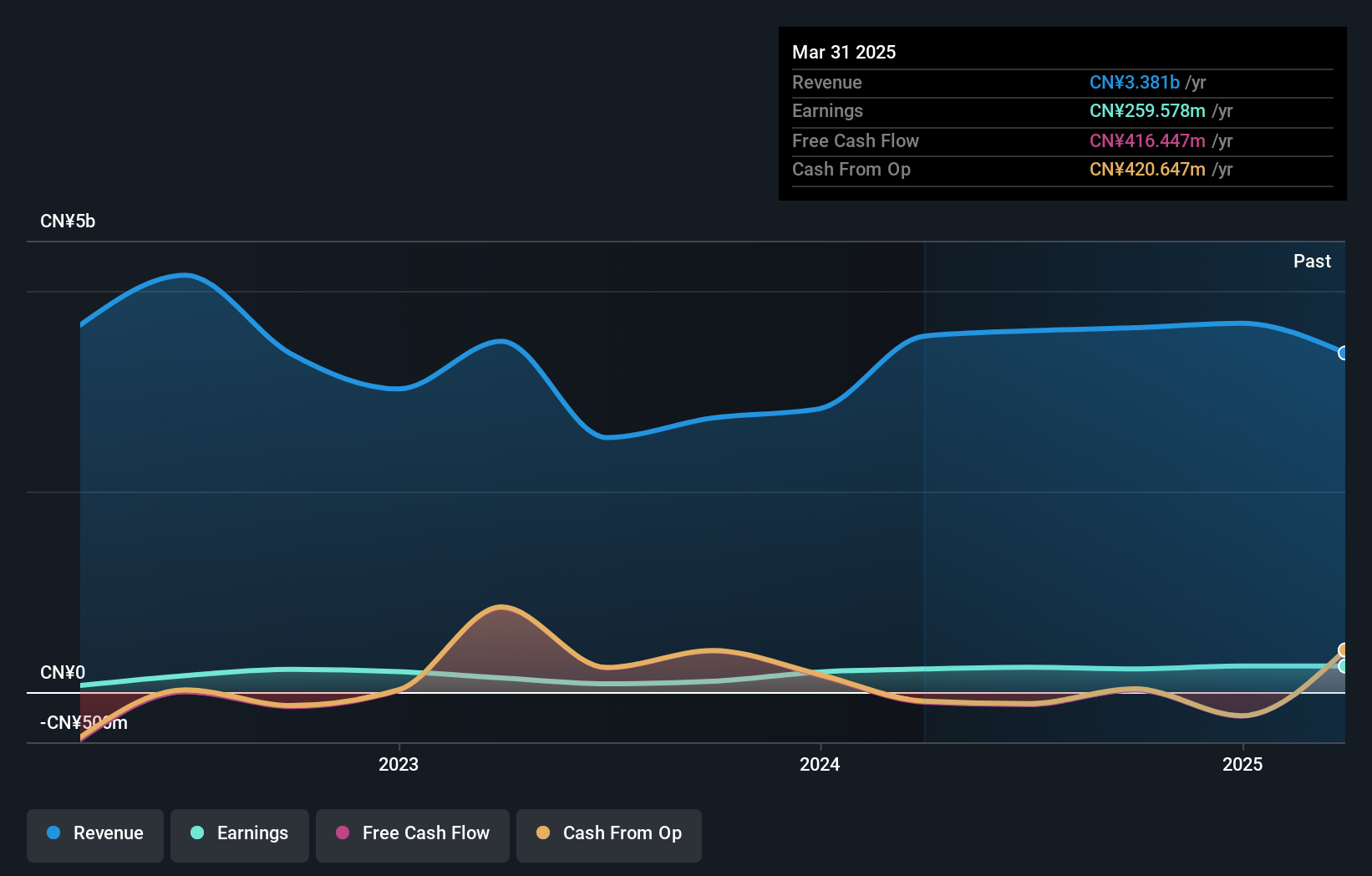

New Huadu Technology, a smaller player in the tech industry, has shown impressive financial strides recently. The company's earnings surged by 115.7% over the past year, outpacing the broader Consumer Retailing sector's 6%. With a debt-to-equity ratio now at 5%, down from 21.3% five years ago, it reflects prudent financial management. Additionally, its price-to-earnings ratio of 22x is more favorable compared to the CN market's average of 36.1x. For the nine months ending September 2024, sales climbed to CNY2.77 billion from CNY1.97 billion last year, with net income also rising to CNY190 million from CNY159 million previously—an encouraging sign for future growth potential.

- Get an in-depth perspective on New Huadu Technology's performance by reading our health report here.

Explore historical data to track New Huadu Technology's performance over time in our Past section.

Chief Telecom (TPEX:6561)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chief Telecom Inc. operates in Taiwan and internationally, offering network integration, internet data center, communications integration, and cloud application services with a market capitalization of approximately NT$40.49 billion.

Operations: The company generates revenue primarily from communications services, amounting to NT$3.58 billion.

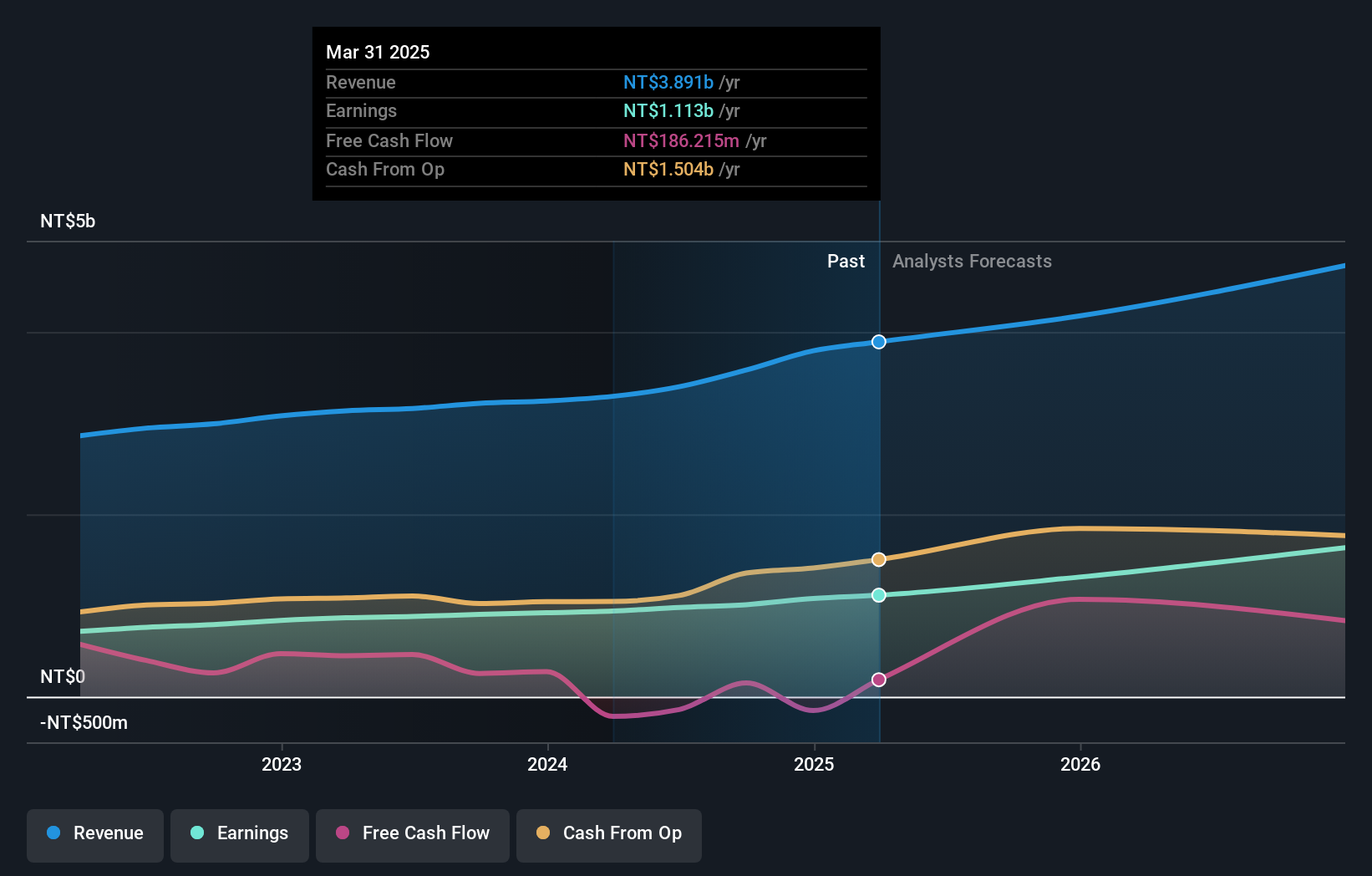

Chief Telecom is making waves with its recent performance and strategic moves. The company's earnings grew by 11.8% over the past year, outpacing the telecom industry's -26.4%. Trading at 43% below its estimated fair value, it seems an attractive prospect for value seekers. Its debt to equity ratio has increased slightly to 2.8% over five years, but with more cash than total debt and interest payments well-covered by EBIT (61x), financial stability remains strong. Recent executive changes and a collaboration with Zettabyte for AI infrastructure expansion further position Chief Telecom as a dynamic player in Taiwan's tech landscape.

- Click here to discover the nuances of Chief Telecom with our detailed analytical health report.

Understand Chief Telecom's track record by examining our Past report.

Seize The Opportunity

- Explore the 4638 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NORINCO International Cooperation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000065

NORINCO International Cooperation

Operates as an engineering contractor in Asia, Africa, the Middle East, and internationally.

Solid track record with adequate balance sheet and pays a dividend.