- China

- /

- Commercial Services

- /

- SZSE:300422

Anhui Bossco Environmental Protection TechnologyLtd (SZSE:300422 shareholders incur further losses as stock declines 13% this week, taking five-year losses to 58%

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Anhui Bossco Environmental Protection Technology Co.,Ltd. (SZSE:300422) share price dropped 59% over five years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 40%. Furthermore, it's down 18% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 13% decline in the broader market, throughout the period.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Anhui Bossco Environmental Protection TechnologyLtd

Anhui Bossco Environmental Protection TechnologyLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Anhui Bossco Environmental Protection TechnologyLtd reduced its trailing twelve month revenue by 11% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 10% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

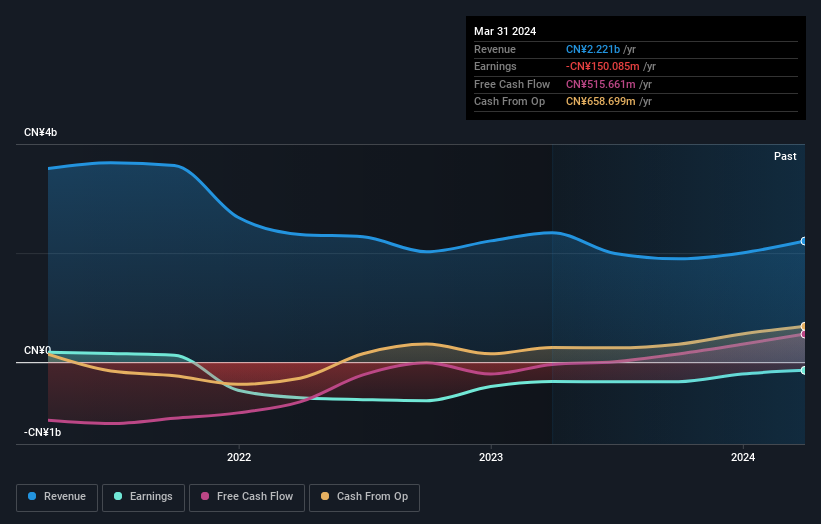

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Anhui Bossco Environmental Protection TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 17% in the twelve months, Anhui Bossco Environmental Protection TechnologyLtd shareholders did even worse, losing 40%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Anhui Bossco Environmental Protection TechnologyLtd better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Anhui Bossco Environmental Protection TechnologyLtd (of which 1 is concerning!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300422

Anhui Bossco Environmental Protection TechnologyLtd

Anhui Bossco Environmental Protection Technology Co.,Ltd.

Good value with mediocre balance sheet.