Stock Analysis

- China

- /

- Professional Services

- /

- SHSE:603357

There's No Escaping Anhui Transport Consulting & Design Institute Co.,Ltd.'s (SHSE:603357) Muted Earnings Despite A 34% Share Price Rise

Anhui Transport Consulting & Design Institute Co.,Ltd. (SHSE:603357) shareholders have had their patience rewarded with a 34% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

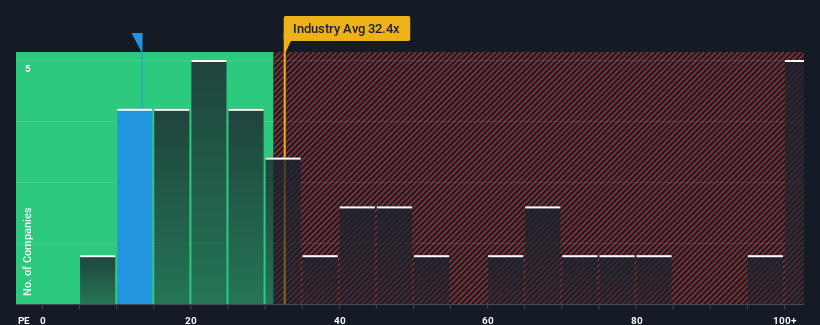

In spite of the firm bounce in price, Anhui Transport Consulting & Design InstituteLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.3x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 54x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Anhui Transport Consulting & Design InstituteLtd has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Anhui Transport Consulting & Design InstituteLtd

How Is Anhui Transport Consulting & Design InstituteLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Anhui Transport Consulting & Design InstituteLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see EPS up by 31% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the three analysts watching the company. With the market predicted to deliver 21% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Anhui Transport Consulting & Design InstituteLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Anhui Transport Consulting & Design InstituteLtd's P/E

Shares in Anhui Transport Consulting & Design InstituteLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Anhui Transport Consulting & Design InstituteLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Anhui Transport Consulting & Design InstituteLtd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Anhui Transport Consulting & Design InstituteLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603357

Anhui Transport Consulting & Design InstituteLtd

Anhui Transport Consulting & Design Institute Co., Ltd., together with its subsidiaries, provides works survey, design, and consultation services in China and internationally.

Adequate balance sheet and fair value.