- China

- /

- Life Sciences

- /

- SZSE:300347

3 Chinese Stocks That May Be Trading Below Their Estimated Value In September 2024

Reviewed by Simply Wall St

As Chinese stocks faced a challenging period with corporate earnings missing expectations and growth forecasts being trimmed, the Shanghai Composite Index and blue chip CSI 300 experienced slight declines. Despite these hurdles, the market's current conditions may present opportunities for discerning investors to identify undervalued stocks that could be trading below their estimated value. In this environment, a good stock is often characterized by strong fundamentals, resilience in adverse economic conditions, and potential for future growth. Here are three Chinese stocks that may fit this profile as of September 2024.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥38.86 | CN¥77.54 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥23.43 | CN¥45.48 | 48.5% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.56 | CN¥33.11 | 50% |

| Beijing SDL TechnologyLtd (SZSE:002658) | CN¥5.39 | CN¥10.52 | 48.8% |

| Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957) | CN¥42.05 | CN¥83.89 | 49.9% |

| Ecovacs Robotics (SHSE:603486) | CN¥40.17 | CN¥79.95 | 49.8% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.77 | CN¥15.20 | 48.9% |

| Aerospace CH UAVLtd (SZSE:002389) | CN¥13.59 | CN¥25.89 | 47.5% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.37 | CN¥8.65 | 49.5% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥8.85 | CN¥16.89 | 47.6% |

Here's a peek at a few of the choices from the screener.

EVE Energy (SZSE:300014)

Overview: EVE Energy Co., Ltd. is a company that provides lithium batteries both in China and internationally, with a market cap of CN¥68.37 billion.

Operations: EVE Energy generates revenue primarily from its electronic component manufacturing segment, which amounted to CN¥47.47 billion.

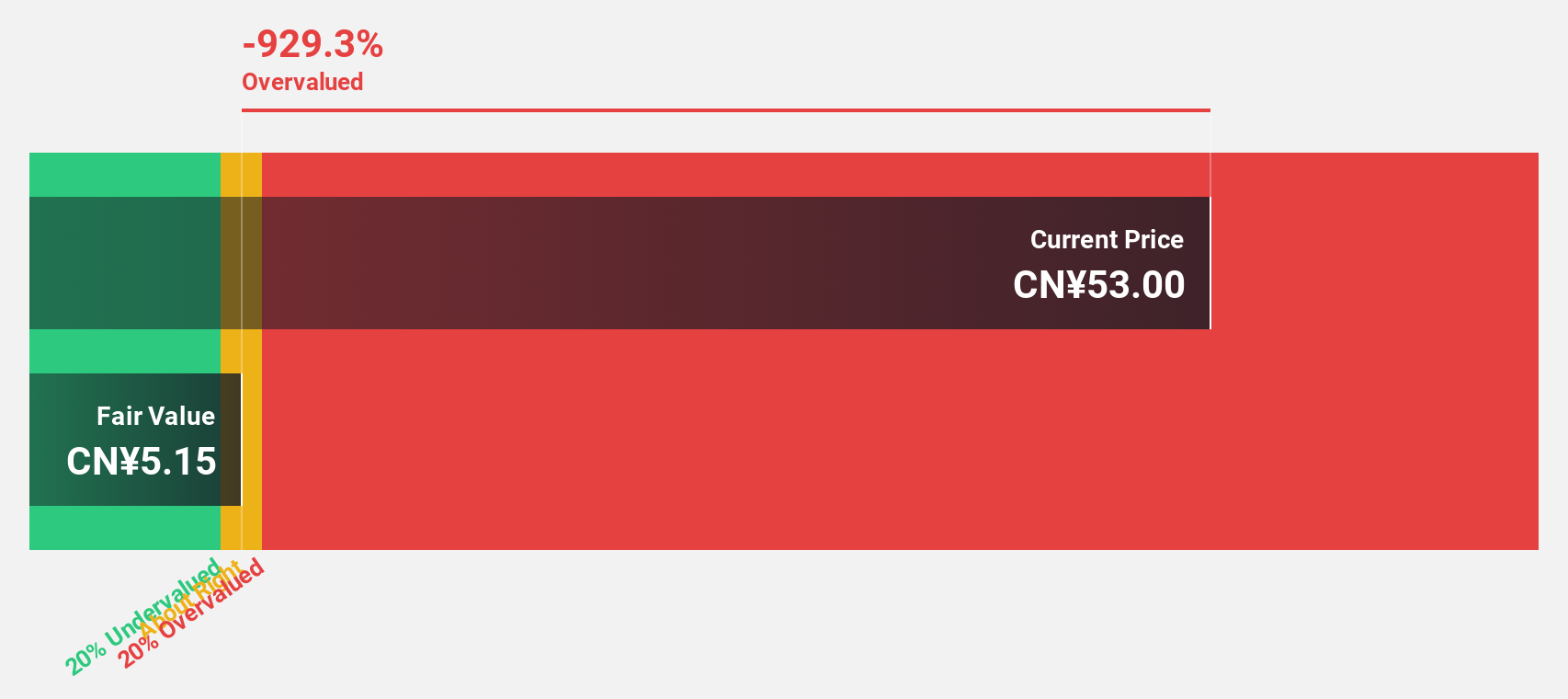

Estimated Discount To Fair Value: 29.5%

EVE Energy is trading at a significant discount to its estimated fair value, with current prices around CN¥33.5 compared to a fair value of CN¥47.51. Despite recent earnings showing a slight decline in revenue and net income, the company's cash flows remain robust. Revenue is forecasted to grow faster than both its peers and the broader Chinese market, while earnings are expected to increase significantly over the next three years, making it potentially undervalued based on cash flow analysis.

- Our earnings growth report unveils the potential for significant increases in EVE Energy's future results.

- Take a closer look at EVE Energy's balance sheet health here in our report.

Hangzhou Tigermed Consulting (SZSE:300347)

Overview: Hangzhou Tigermed Consulting Co., Ltd offers contract research organization services both in China and internationally, with a market cap of CN¥40.85 billion.

Operations: The company's revenue segments include Clinical Trial Solutions at CN¥3.45 billion, Clinical-related and Laboratory Services at CN¥1.78 billion, and Data Management Services at CN¥0.92 billion.

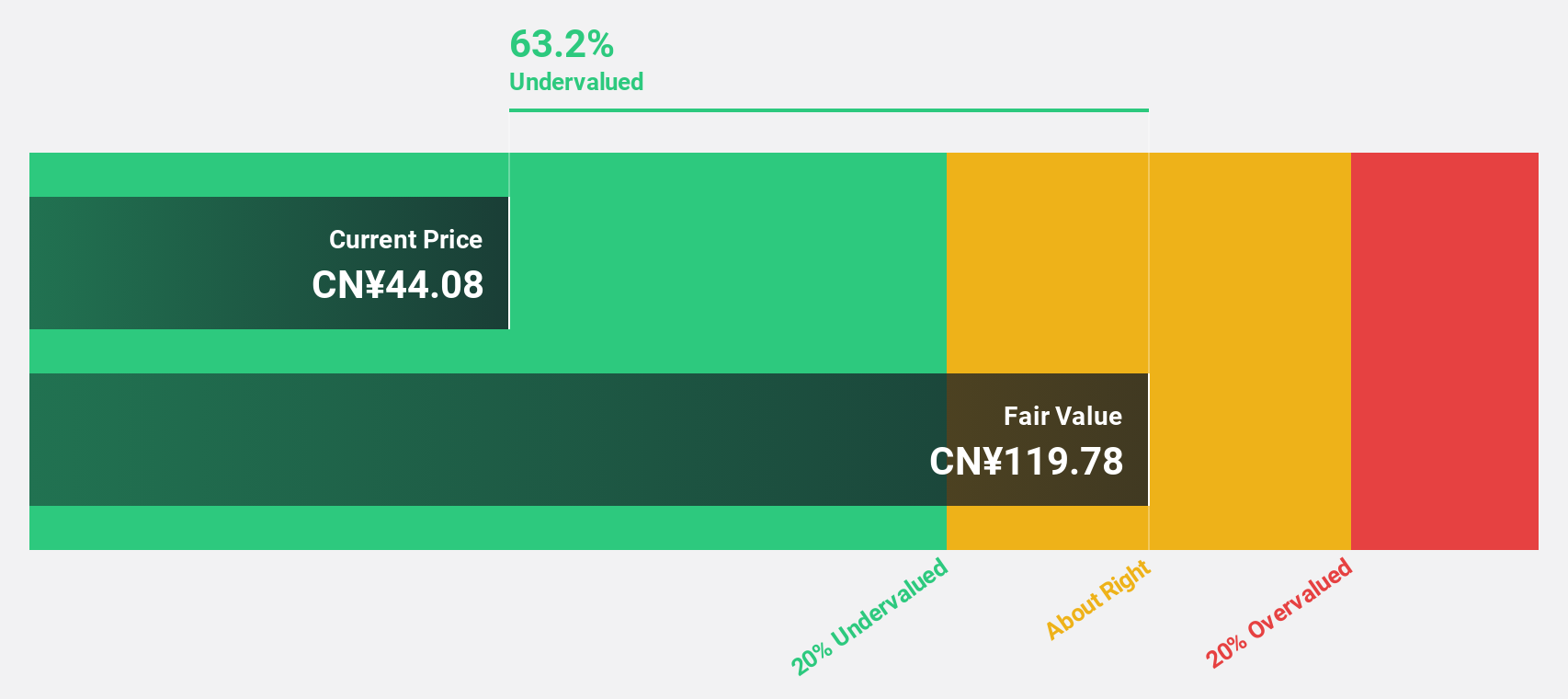

Estimated Discount To Fair Value: 43.2%

Hangzhou Tigermed Consulting is trading at CN¥50.87, significantly below its estimated fair value of CN¥89.55, suggesting it may be undervalued based on cash flows. Despite a recent decline in revenue and net income for the first half of 2024, the company’s earnings are forecast to grow 27.5% annually over the next three years, outpacing the broader Chinese market. However, profit margins have decreased from 30.6% to 16.1%.

- Our growth report here indicates Hangzhou Tigermed Consulting may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Hangzhou Tigermed Consulting.

iSoftStone Information Technology (Group) (SZSE:301236)

Overview: iSoftStone Information Technology (Group) Co., Ltd. (SZSE:301236) provides IT consulting and solutions services with a market cap of CN¥32.43 billion.

Operations: iSoftStone's revenue segments include IT consulting and solutions services.

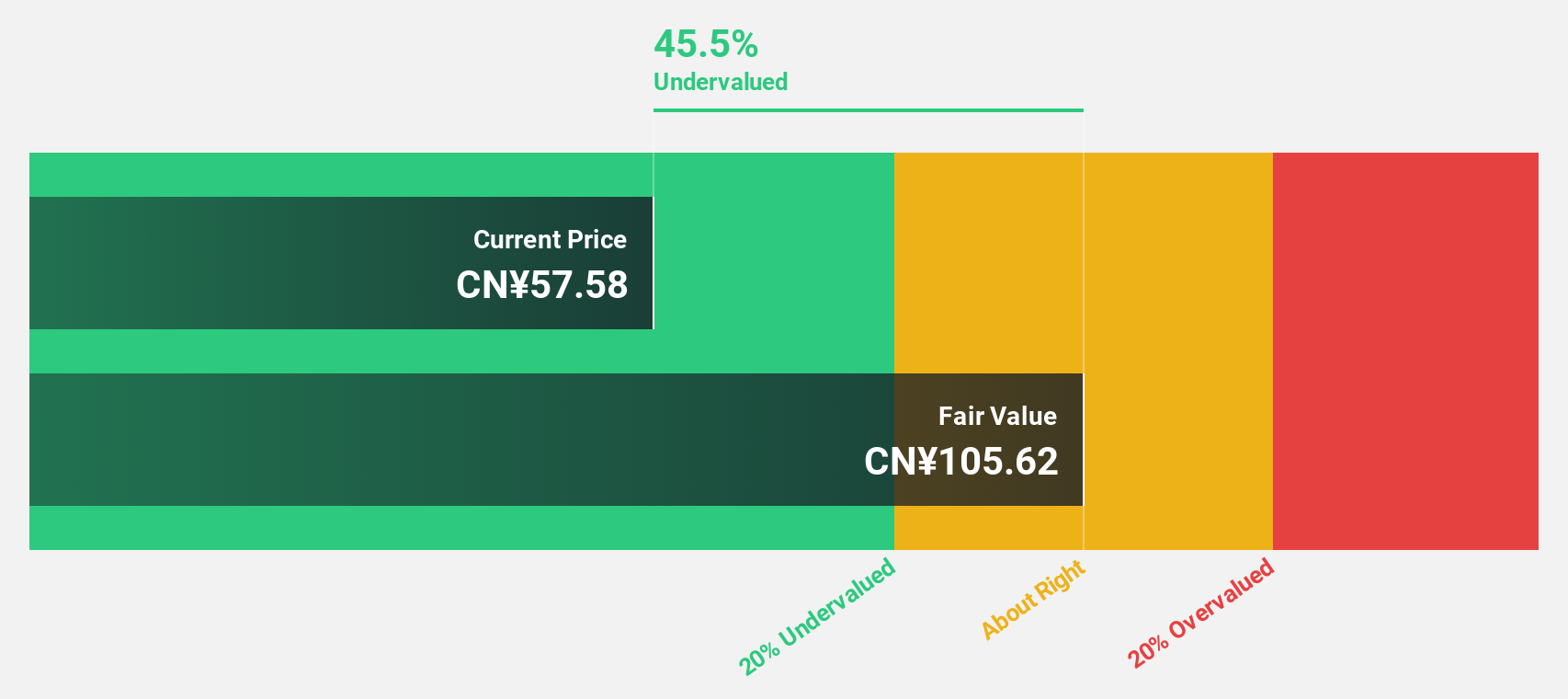

Estimated Discount To Fair Value: 41%

iSoftStone Information Technology (Group) is trading at CN¥34.03, well below its estimated fair value of CN¥57.72, indicating significant undervaluation based on cash flows. Despite a volatile share price and recent net loss of CN¥154.33 million for H1 2024, the company’s revenue grew to CN¥12.53 billion from CN¥8.58 billion year-over-year, and earnings are forecast to grow significantly at 49.6% annually over the next three years, outpacing market averages.

- Our expertly prepared growth report on iSoftStone Information Technology (Group) implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of iSoftStone Information Technology (Group) stock in this financial health report.

Make It Happen

- Explore the 108 names from our Undervalued Chinese Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Tigermed Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300347

Hangzhou Tigermed Consulting

Provides contract research organization services in the People’s Republic of China and internationally.

Flawless balance sheet established dividend payer.