Stock Analysis

High Growth Tech Stocks To Watch In Switzerland September 2024

Reviewed by Simply Wall St

The Switzerland market ended notably lower on Thursday due to sustained selling at several counters amid concerns about a slowdown in global economic growth. Despite the downturn and an increase in Swiss unemployment, high-growth tech stocks remain an area of interest for investors seeking potential opportunities. In this environment, identifying companies with robust innovation and strong fundamentals becomes crucial for navigating market volatility effectively.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 9.25% | 18.37% | ★★★★☆☆ |

| ALSO Holding | 11.99% | 23.95% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 22.30% | 32.48% | ★★★★★★ |

| Temenos | 7.59% | 14.32% | ★★★★☆☆ |

| Comet Holding | 21.67% | 48.51% | ★★★★★★ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| SoftwareONE Holding | 8.67% | 52.28% | ★★★★★☆ |

| Basilea Pharmaceutica | 8.99% | 36.39% | ★★★★★☆ |

| Sensirion Holding | 13.96% | 104.68% | ★★★★☆☆ |

| MCH Group | 5.18% | 83.82% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

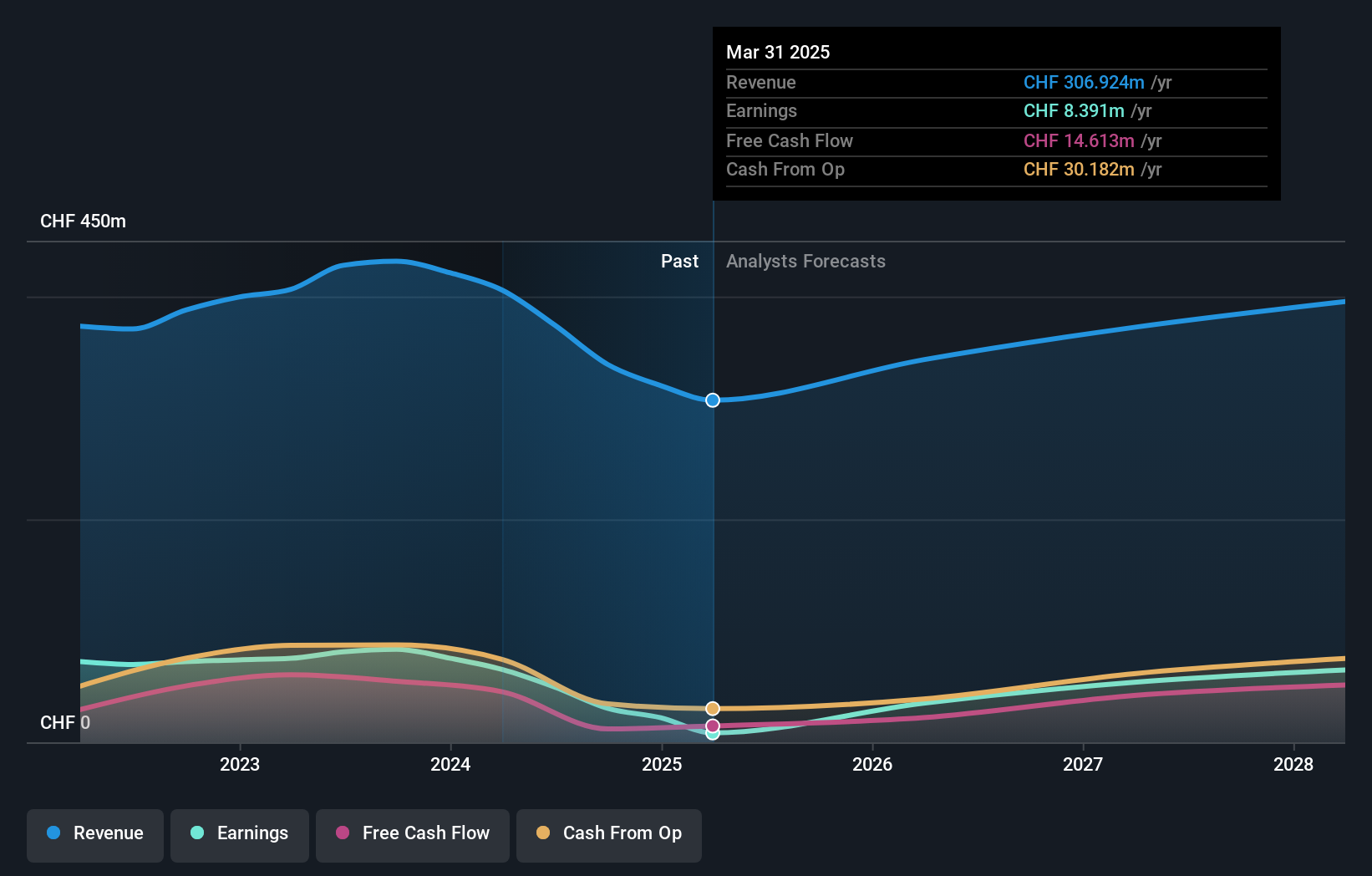

Overview: ALSO Holding AG operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.14 billion.

Operations: ALSO Holding AG generates revenue primarily from its Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion) segments, with a negative reconciliation of -€449.34 million. The company serves the ICT industry across multiple countries, leveraging its extensive market presence to drive business operations and growth.

ALSO Holding AG reported half-year sales of €4.28 billion, down from €4.83 billion the previous year, with net income at €41.66 million compared to €52.53 million previously. Despite this, earnings are forecast to grow 24% annually, outpacing the Swiss market's 11.7%. The company has a strong focus on R&D, investing significantly in innovation to stay competitive in the tech industry. Earnings per share also dropped from €4.24 to €3.40.

- Take a closer look at ALSO Holding's potential here in our health report.

Review our historical performance report to gain insights into ALSO Holding's's past performance.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing products for oncology and anti-infectives, with a market cap of CHF539.99 million.

Operations: Basilea Pharmaceutica AG generates revenue primarily through the discovery, development, and commercialization of innovative pharmaceutical products, totaling CHF149.02 million. The company's focus is on addressing medical needs in oncology and anti-infectives.

Basilea Pharmaceutica, a notable player in the biotech sector, has recently seen its revenue dip to CHF 76.29 million from CHF 84.91 million year-over-year, with net income also decreasing to CHF 20.74 million from CHF 31.84 million. Despite this, the company is forecasted to grow earnings by an impressive 36.39% annually over the next three years and expects revenue growth of around 9% per year, outpacing the Swiss market's average of 4.4%. Basilea's strategic focus on R&D is evident with significant investments contributing to advancements like Cresemba®'s extended indications for pediatric use and additional market exclusivity in Europe until October 2027, which triggered a milestone payment of CHF 10 million from Pfizer Inc., highlighting its commitment to innovation and long-term growth potential in high-growth tech sectors within Switzerland’s biotech landscape.

- Click here to discover the nuances of Basilea Pharmaceutica with our detailed analytical health report.

Gain insights into Basilea Pharmaceutica's past trends and performance with our Past report.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market cap of CHF1.36 billion.

Operations: LEM Holding SA generates revenue by providing solutions for measuring electrical parameters across multiple regions worldwide. The company focuses on markets including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

LEM Holding, a prominent player in the tech sector, has experienced a notable decline in sales to CHF 80.96 million from CHF 112.34 million year-over-year, while net income also dropped to CHF 4.78 million from CHF 20.54 million. Despite these setbacks, LEM's revenue is forecasted to grow at an impressive rate of 9.2% annually, outpacing the Swiss market's average of 4.4%. The company's commitment to innovation is evident with substantial R&D expenses contributing significantly towards future growth prospects and maintaining its competitive edge in the industry.

- Click to explore a detailed breakdown of our findings in LEM Holding's health report.

Explore historical data to track LEM Holding's performance over time in our Past section.

Summing It All Up

- Explore the 11 names from our SIX Swiss Exchange High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALSN

ALSO Holding

Operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally.