- Switzerland

- /

- Media

- /

- SWX:TXGN

Top Dividend Stocks On The SIX Swiss Exchange For August 2024

Reviewed by Simply Wall St

The Swiss market has climbed 1.0% in the last 7 days and is up 8.6% over the past 12 months, with earnings forecasted to grow by 12% annually. In this favorable environment, identifying strong dividend stocks can provide both steady income and potential for capital appreciation.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.17% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.51% | ★★★★★☆ |

| Compagnie Financière Tradition (SWX:CFT) | 3.99% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.17% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.72% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.44% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.67% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.31% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

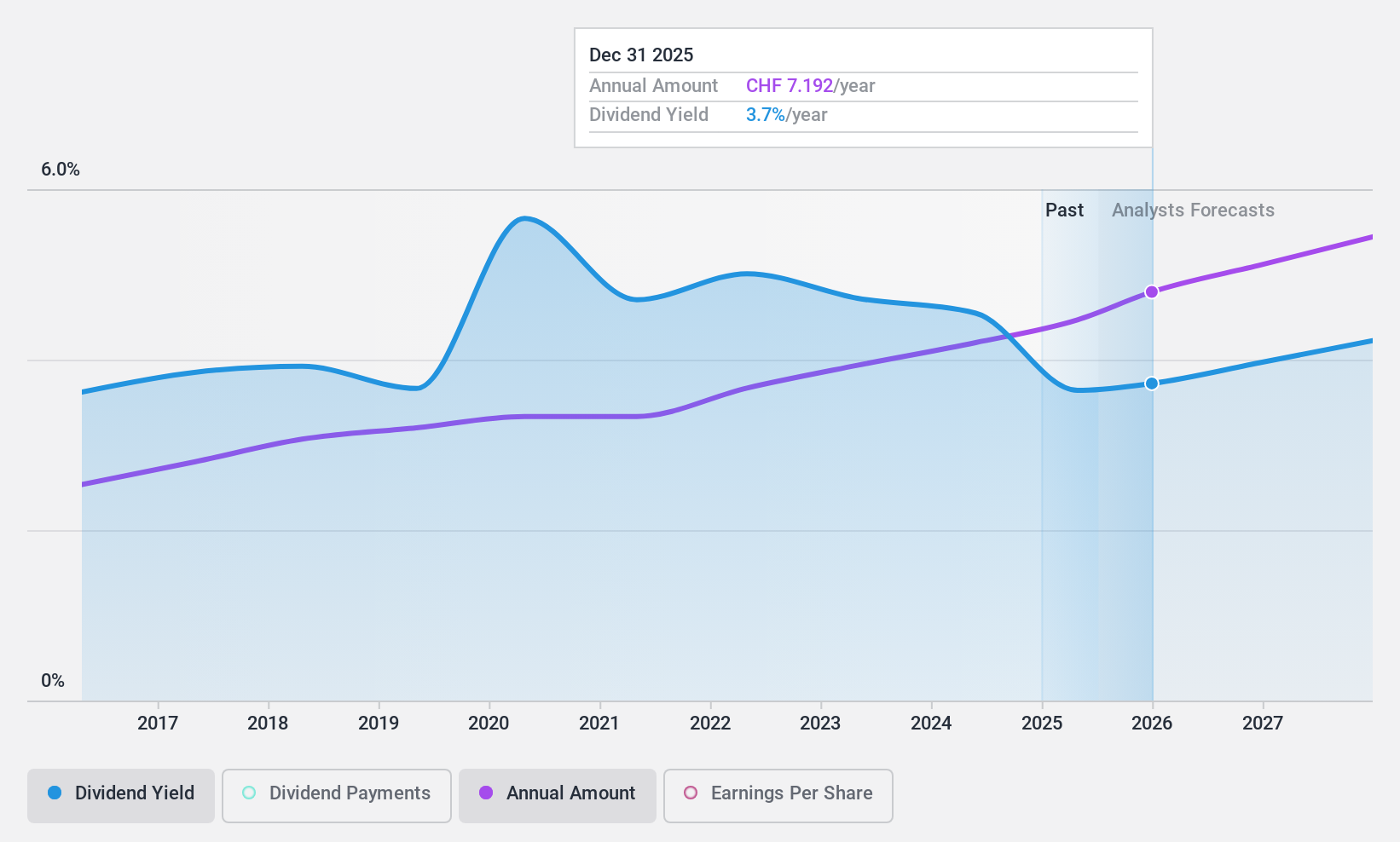

Helvetia Holding (SWX:HELN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helvetia Holding AG operates in life and non-life insurance, as well as reinsurance, across Switzerland, Germany, Austria, Spain, Italy, France, and internationally with a market cap of CHF7.05 billion.

Operations: Helvetia Holding AG's revenue segments include CHF1.81 billion from life insurance and CHF7.09 billion from non-life insurance.

Dividend Yield: 4.7%

Helvetia Holding's dividend yield of 4.72% ranks it in the top 25% of Swiss dividend payers, and its dividends have been stable and growing over the past decade. However, the company's high payout ratio (120.3%) indicates dividends are not covered by earnings, though they are well-covered by cash flows with a cash payout ratio of 36.5%. Despite lower profit margins this year (3%), Helvetia is trading at a significant discount to its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Helvetia Holding.

- The valuation report we've compiled suggests that Helvetia Holding's current price could be inflated.

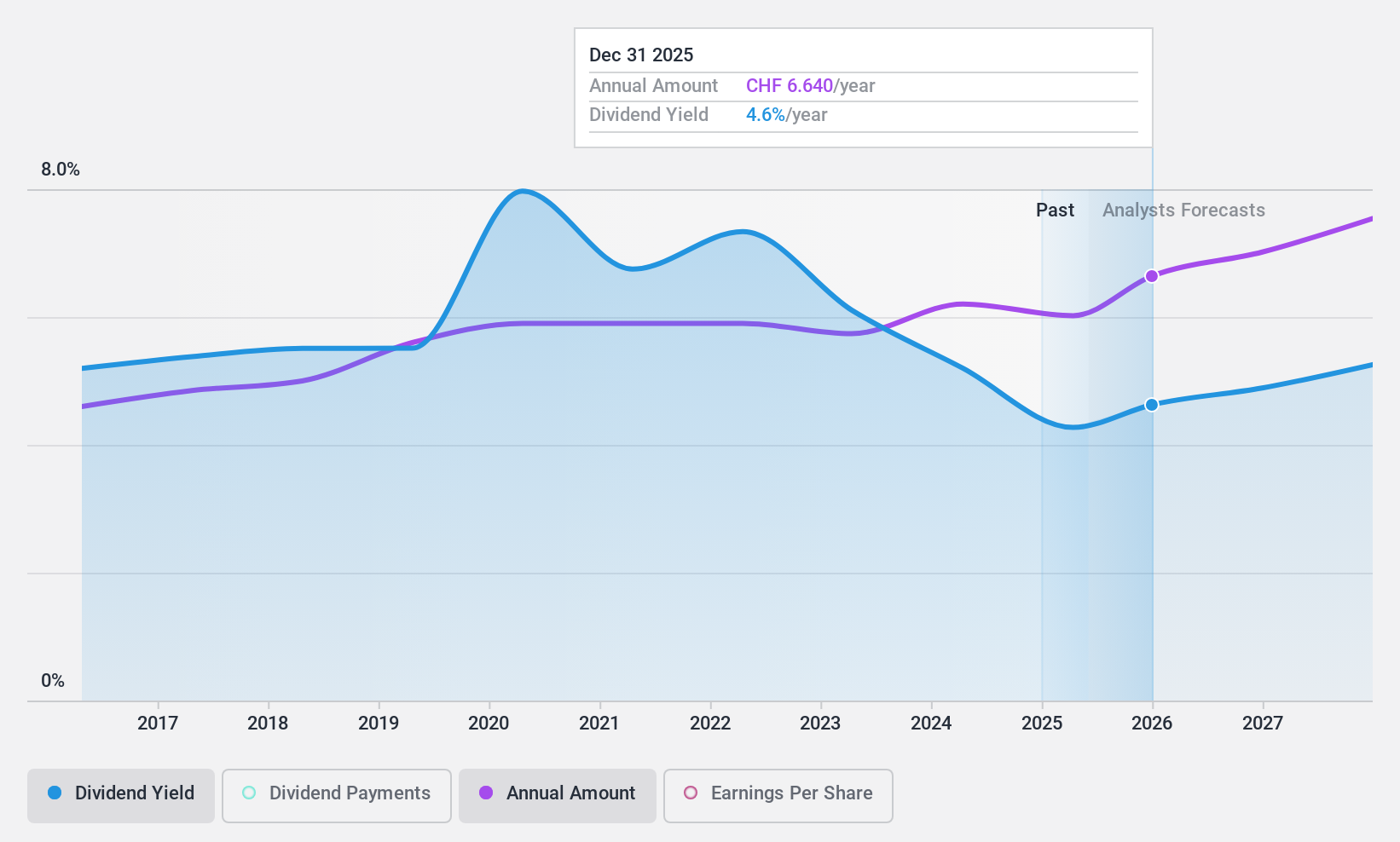

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF33.61 billion, operates globally offering wholesale reinsurance, insurance, risk transfer solutions, and various insurance-related services.

Operations: Swiss Re AG generates its revenue primarily from Property & Casualty Reinsurance ($25.39 billion), Life & Health Reinsurance ($18.71 billion), and Corporate Solutions ($6.10 billion).

Dividend Yield: 5%

Swiss Re reported a net income of US$2.09 billion for H1 2024, up from US$1.79 billion the previous year, with basic earnings per share rising to US$6.97 from US$5.87. Despite a high dividend yield within the top 25% of Swiss payers, its dividends have been volatile and declining over the past decade. However, with a payout ratio of 55.8%, dividends are reasonably covered by both earnings and cash flows, suggesting sustainability amid recent profit growth.

- Take a closer look at Swiss Re's potential here in our dividend report.

- The analysis detailed in our Swiss Re valuation report hints at an deflated share price compared to its estimated value.

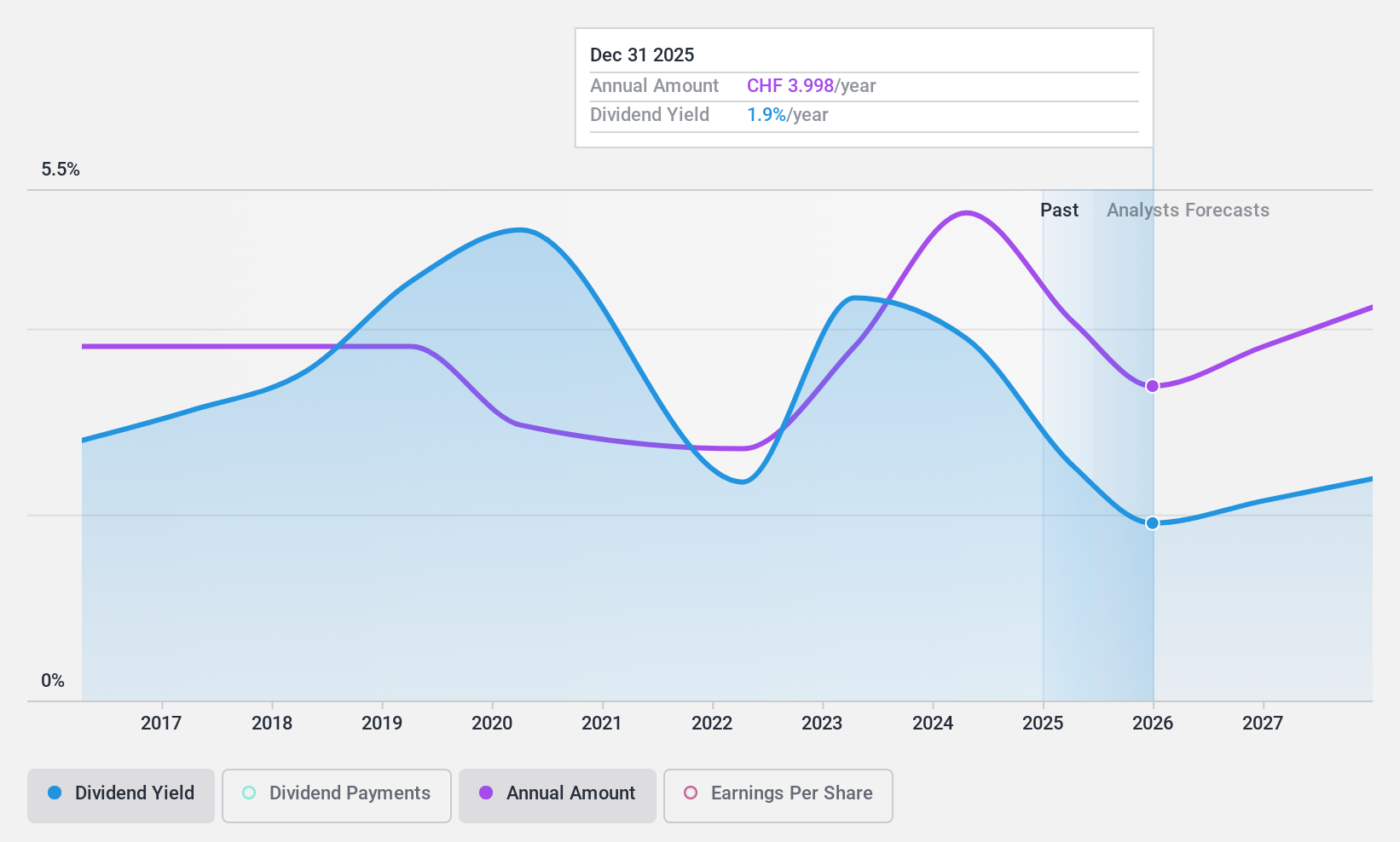

TX Group (SWX:TXGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms and participations offering information, orientation, entertainment, and support services in Switzerland with a market cap of CHF1.69 billion.

Operations: TX Group AG generates revenue from several segments, including Tamedia (CHF446.40 million), Goldbach (CHF274.70 million), 20 Minutes (CHF118.40 million), TX Markets (CHF133.80 million), and Groups & Ventures (CHF159.40 million).

Dividend Yield: 3.9%

TX Group's dividend payments are covered by earnings (payout ratio: 86.9%) and cash flows (cash payout ratio: 42.1%). Although the dividends have been volatile over the past decade, they have shown growth during this period. The company became profitable this year and is trading at 70.5% below its estimated fair value, but its current dividend yield of 3.89% is lower than the top quartile of Swiss dividend payers (4.28%).

- Unlock comprehensive insights into our analysis of TX Group stock in this dividend report.

- Our valuation report unveils the possibility TX Group's shares may be trading at a premium.

Where To Now?

- Reveal the 26 hidden gems among our Top SIX Swiss Exchange Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland.

Flawless balance sheet average dividend payer.