Stock Analysis

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So while Forbo Holding (VTX:FORN) has a high ROCE right now, lets see what we can decipher from how returns are changing.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Forbo Holding is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = CHF135m ÷ (CHF976m - CHF309m) (Based on the trailing twelve months to June 2023).

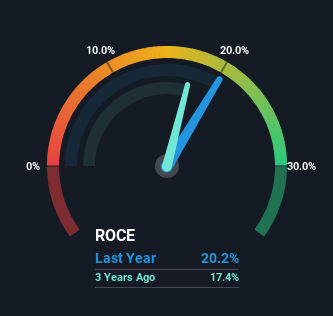

Therefore, Forbo Holding has an ROCE of 20%. While that is an outstanding return, the rest of the Building industry generates similar returns, on average.

See our latest analysis for Forbo Holding

In the above chart we have measured Forbo Holding's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Forbo Holding here for free.

What The Trend Of ROCE Can Tell Us

Things have been pretty stable at Forbo Holding, with its capital employed and returns on that capital staying somewhat the same for the last five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. Although current returns are high, we'd need more evidence of underlying growth for it to look like a multi-bagger going forward. With fewer investment opportunities, it makes sense that Forbo Holding has been paying out a decent 32% of its earnings to shareholders. Given the business isn't reinvesting in itself, it makes sense to distribute a portion of earnings among shareholders.

The Bottom Line On Forbo Holding's ROCE

In summary, Forbo Holding isn't compounding its earnings but is generating decent returns on the same amount of capital employed. And investors appear hesitant that the trends will pick up because the stock has fallen 24% in the last five years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

While Forbo Holding doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation on our platform.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're helping make it simple.

Find out whether Forbo Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:FORN

Forbo Holding

Produces and sells floor coverings, building and construction adhesives, and power transmission and conveyor belt solutions in Europe, the Americas, Asia Pacific, and Africa.

Flawless balance sheet, undervalued and pays a dividend.