Stock Analysis

Heritage Cannabis Holdings (CSE:CANN) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Heritage Cannabis Holdings Corp. (CSE:CANN) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Heritage Cannabis Holdings

What Is Heritage Cannabis Holdings's Debt?

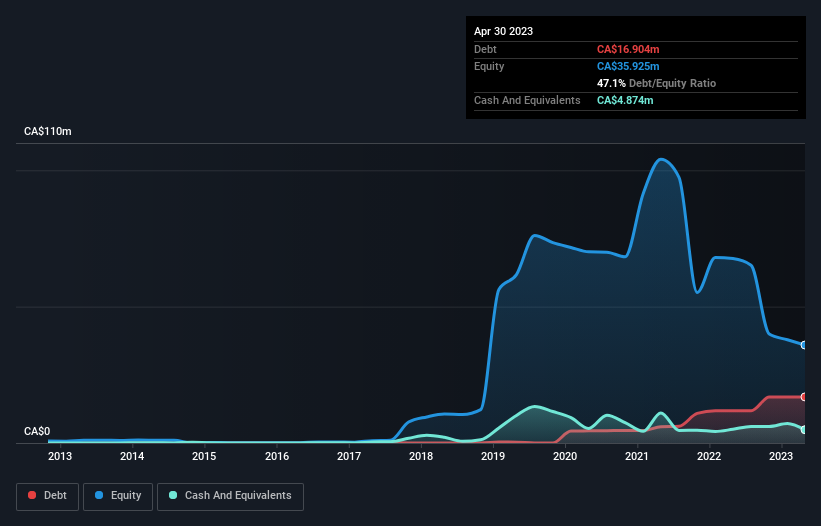

As you can see below, at the end of April 2023, Heritage Cannabis Holdings had CA$16.9m of debt, up from CA$11.8m a year ago. Click the image for more detail. However, it does have CA$4.87m in cash offsetting this, leading to net debt of about CA$12.0m.

How Strong Is Heritage Cannabis Holdings' Balance Sheet?

According to the last reported balance sheet, Heritage Cannabis Holdings had liabilities of CA$22.2m due within 12 months, and liabilities of CA$19.8m due beyond 12 months. Offsetting these obligations, it had cash of CA$4.87m as well as receivables valued at CA$8.06m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$29.1m.

The deficiency here weighs heavily on the CA$14.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Heritage Cannabis Holdings would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Heritage Cannabis Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Heritage Cannabis Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 27%, to CA$29m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Heritage Cannabis Holdings managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable CA$13m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through CA$1.3m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Heritage Cannabis Holdings (including 2 which are potentially serious) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're helping make it simple.

Find out whether Heritage Cannabis Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:CANN

Heritage Cannabis Holdings

Heritage Cannabis Holdings Corp., through its subsidiaries, operates as a cannabinoid company in Canada and the United States.

Excellent balance sheet and slightly overvalued.