Stock Analysis

- Canada

- /

- Oil and Gas

- /

- TSX:WCP

iA Financial Plus Two Other High Yielding Dividend Stocks In Canada

Reviewed by Kshitija Bhandaru

The Canadian market has recently experienced a shift in tone, with yields rising and most stock indexes dipping slightly. This comes after significant rallies in both the S&P 500 and the Canadian TSX, making a period of consolidation or profit-taking somewhat expected. As we navigate through this volatile phase, it's important to remember that high-yielding dividend stocks can offer a steady income stream. In light of current market conditions, stocks with robust dividends can be good additions to an investment portfolio as they may provide some stability during uncertain times.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| IGM Financial (TSX:IGM) | 6.64% | ★★★★★★ |

| Bank of Nova Scotia (TSX:BNS) | 6.57% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.04% | ★★★★★★ |

| iA Financial (TSX:IAG) | 3.90% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.42% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 4.06% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.02% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 3.99% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.64% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.80% | ★★★★★☆ |

Click here to see the full list of 39 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

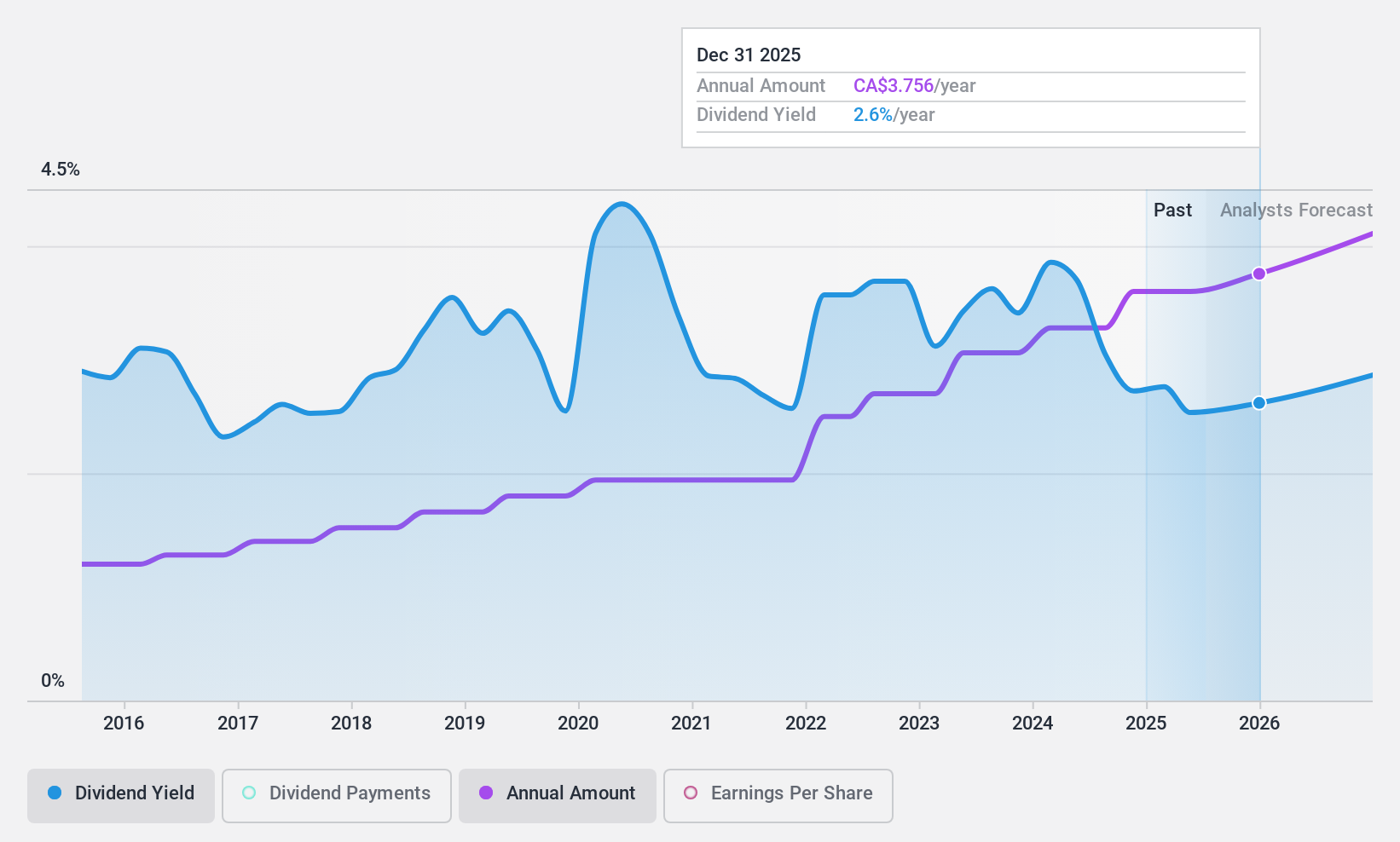

iA Financial (TSX:IAG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: iA Financial Corporation Inc., a company with a market cap of CA$8.23 billion, offers insurance and wealth management services in both Canada and the United States.

Operations: iA Financial Corporation Inc., a Canadian-based firm, generates its revenue from four key segments: Investment, US Operations, Insurance in Canada, and Wealth Management. These segments respectively contribute CA$0.61 billion, CA$1.46 billion, CA$3.70 billion and CA$2.24 billion to the company's total income.

Dividend Yield: 3.9%

iA Financial's dividend yield of 3.99% is lower than the top quartile of Canadian market dividend payers, but its earnings growth over the past year and forecasted growth rate suggest potential for future increases. With a payout ratio of 41.3%, dividends are well covered by earnings and free cash flow, indicating sustainability. Trading at 68.1% below estimated fair value presents a potential opportunity for investors seeking undervalued stocks with stable dividends. Recent shareholder proposals and a CAD$3 billion shelf registration filing may impact future performance.

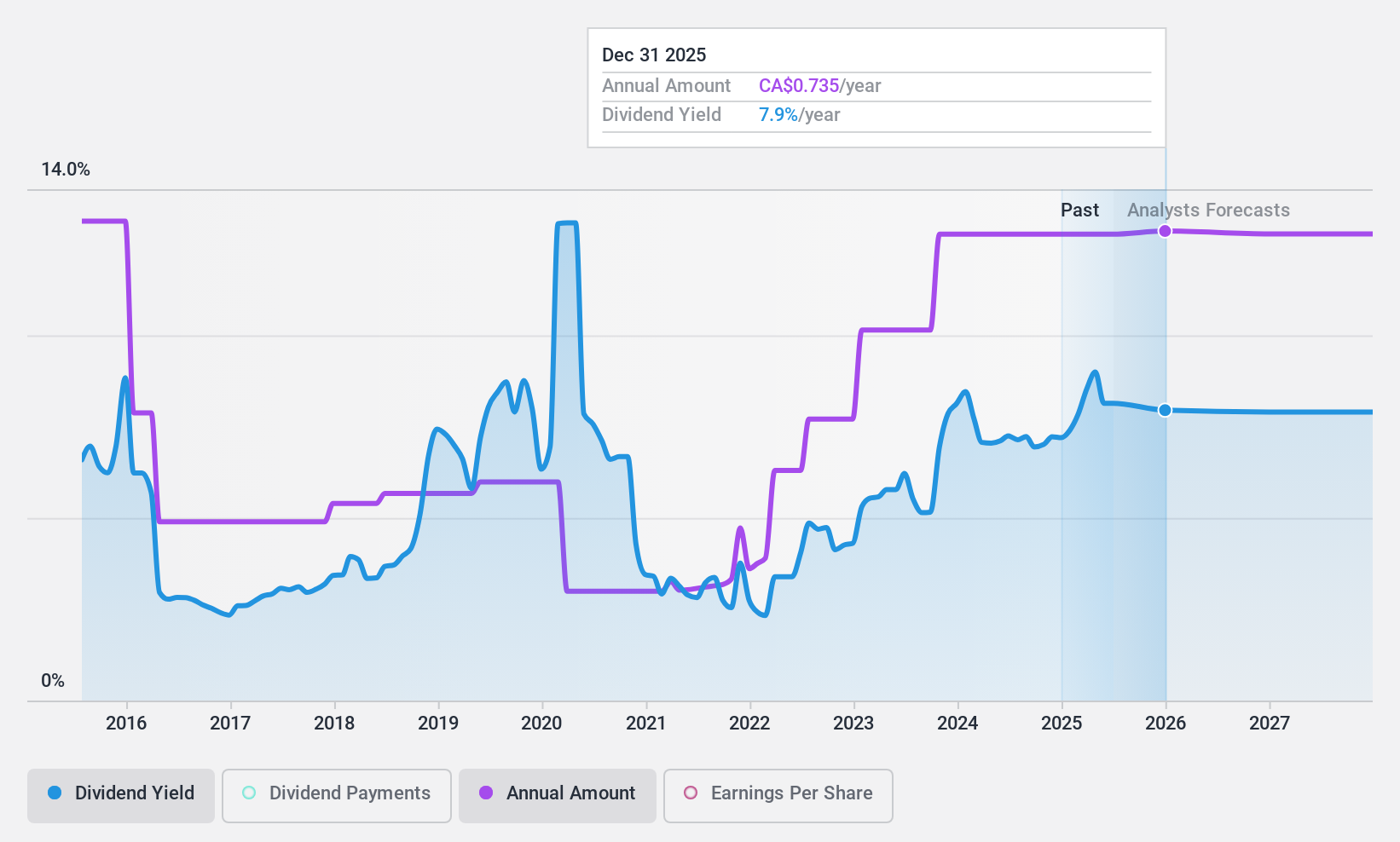

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is a Canadian oil and gas company, with operations primarily focused on the acquisition, development, and production of oil and gas assets in Western Canada, boasting a market cap of approximately CA$6.20 billion.

Operations: Whitecap Resources Inc., with its primary focus on the oil and gas sector, generates a significant portion of its revenue, CA$3.23 billion to be precise, from the exploration and production of these resources in Western Canada.

Dividend Yield: 7.0%

Whitecap Resources' dividend yield of 7.03% places it in the top quartile of Canadian market dividend payers. Despite a forecasted earnings decline, dividends are well covered by earnings (41.2% payout ratio) and free cash flow (55.3% cash payout ratio), indicating sustainability. Trading at 16.6% below estimated fair value, it offers potential value for investors seeking undervalued stocks with stable dividends. However, recent legal issues resulting in an CAD$80,000 penalty and lower profit margins compared to last year may affect future performance.

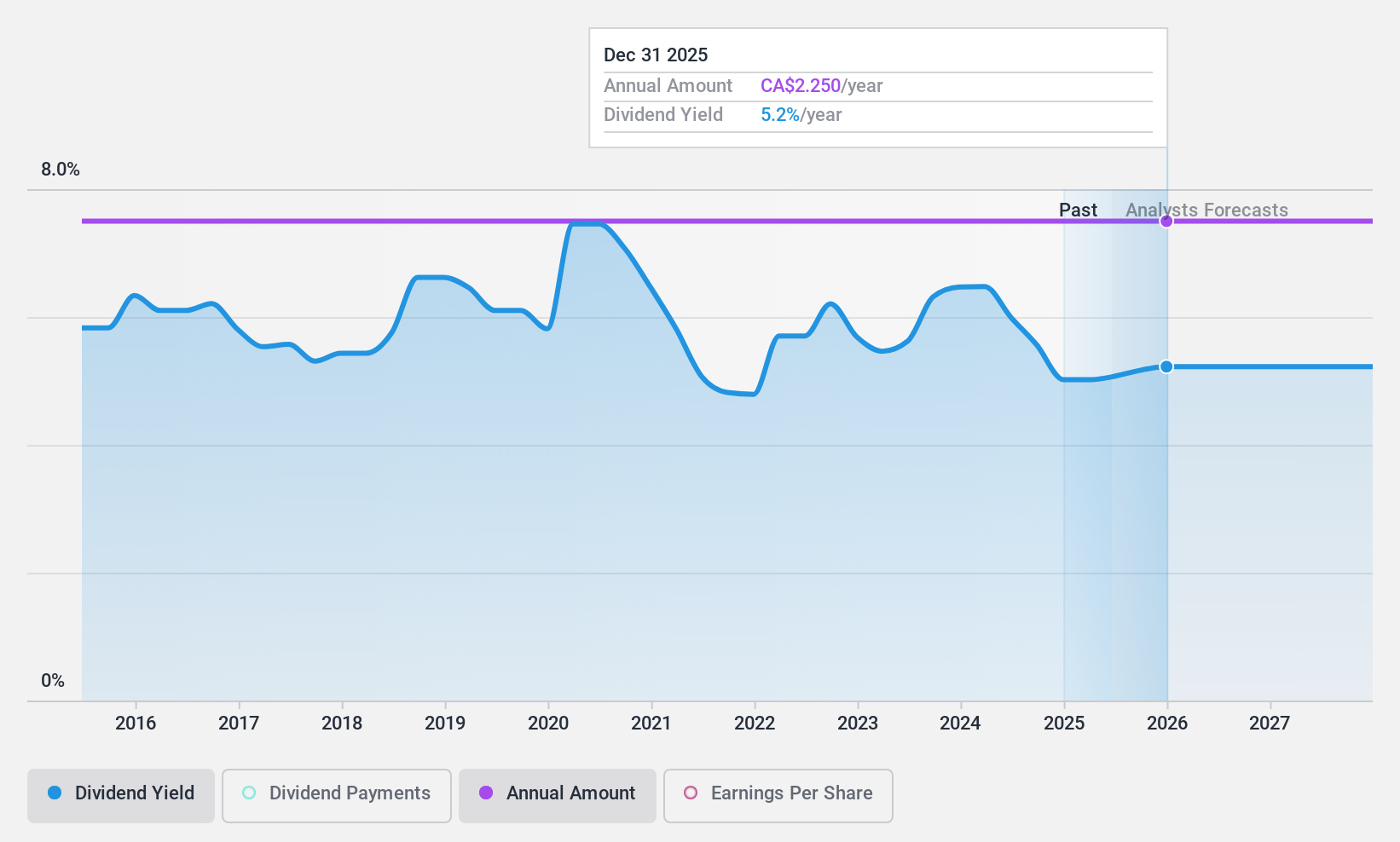

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★★

Overview: IGM Financial Inc., a Canadian wealth and asset management company, has a market capitalisation of approximately CA$8.06 billion.

Operations: IGM Financial Inc., a prominent player in the Canadian financial sector, generates its revenue primarily from two segments: Asset Management and Wealth Management. The company's Asset Management segment contributes CA$1.18 billion, while its larger Wealth Management segment brings in approximately CA$2.22 billion to the firm's overall revenue.

Dividend Yield: 6.6%

IGM Financial's dividend payments are stable and well-covered by earnings (57.9% payout ratio) and cash flows (78.3% cash payout ratio), indicating potential sustainability. Its high dividend yield of 6.7% ranks in the top 25% of Canadian market dividend payers, offering an attractive income source for investors. However, analysts forecast a decline in earnings over the next three years, which may impact future dividends. Despite this, IGM is trading at a significant discount to its estimated fair value.

Next Steps

- Navigate through the entire inventory of 39 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Whitecap Resources is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

Whitecap Resources Inc., an oil and gas company, focuses on the acquisition, development, and production of oil and gas assets in Western Canada.

Very undervalued 6 star dividend payer.