The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Gear Energy (TSE:GXE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Gear Energy

Gear Energy's Improving Profits

Gear Energy has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Gear Energy's EPS shot from CA$0.14 to CA$0.35, over the last year. Year on year growth of 157% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

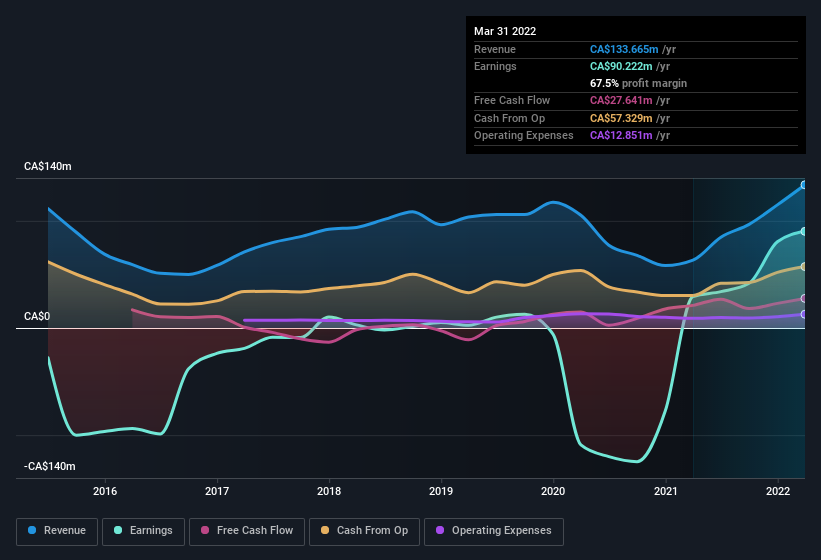

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Gear Energy is growing revenues, and EBIT margins improved by 138.7 percentage points to 45%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Gear Energy is no giant, with a market capitalisation of CA$353m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Gear Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Gear Energy insiders did net CA$189k selling stock over the last year, they invested CA$875k, a much higher figure. This overall confidence in the company at current the valuation signals their optimism. We also note that it was the Independent Chairman of the Board, Donald Gray, who made the biggest single acquisition, paying CA$172k for shares at about CA$1.65 each.

On top of the insider buying, it's good to see that Gear Energy insiders have a valuable investment in the business. As a matter of fact, their holding is valued at CA$20m. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 5.8% of the shares on issue for the business, an appreciable amount considering the market cap.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Ingram Gillmore is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Gear Energy, with market caps between CA$129m and CA$517m, is around CA$972k.

Gear Energy offered total compensation worth CA$701k to its CEO in the year to December 2021. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Gear Energy To Your Watchlist?

Gear Energy's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Gear Energy belongs near the top of your watchlist. Still, you should learn about the 3 warning signs we've spotted with Gear Energy (including 1 which is significant).

Keen growth investors love to see insider buying. Thankfully, Gear Energy isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GXE

Gear Energy

An exploration and production company, engages in the acquiring, developing, and holding of interests in petroleum and natural gas properties and assets in Canada.

Excellent balance sheet second-rate dividend payer.