Stock Analysis

- Brazil

- /

- Healthcare Services

- /

- BOVESPA:QUAL3

Why Investors Shouldn't Be Surprised By Qualicorp Consultoria e Corretora de Seguros S.A.'s (BVMF:QUAL3) 28% Share Price Plunge

Unfortunately for some shareholders, the Qualicorp Consultoria e Corretora de Seguros S.A. (BVMF:QUAL3) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

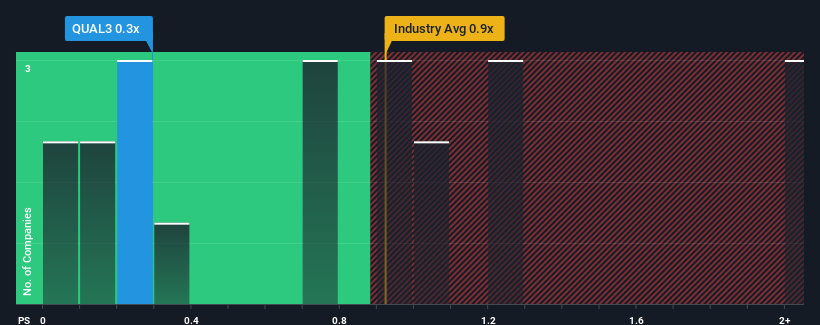

After such a large drop in price, considering around half the companies operating in Brazil's Healthcare industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Qualicorp Consultoria e Corretora de Seguros as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Qualicorp Consultoria e Corretora de Seguros

What Does Qualicorp Consultoria e Corretora de Seguros' P/S Mean For Shareholders?

Qualicorp Consultoria e Corretora de Seguros hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Qualicorp Consultoria e Corretora de Seguros' future stacks up against the industry? In that case, our free report is a great place to start.How Is Qualicorp Consultoria e Corretora de Seguros' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Qualicorp Consultoria e Corretora de Seguros' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. The last three years don't look nice either as the company has shrunk revenue by 14% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 4.7% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 10% per year.

In light of this, it's understandable that Qualicorp Consultoria e Corretora de Seguros' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Qualicorp Consultoria e Corretora de Seguros' P/S Mean For Investors?

Qualicorp Consultoria e Corretora de Seguros' recently weak share price has pulled its P/S back below other Healthcare companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Qualicorp Consultoria e Corretora de Seguros' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Qualicorp Consultoria e Corretora de Seguros (2 are significant!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Qualicorp Consultoria e Corretora de Seguros is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:QUAL3

Qualicorp Consultoria e Corretora de Seguros

Qualicorp Consultoria e Corretora de Seguros S.A.

Undervalued with moderate growth potential.