- Brazil

- /

- Consumer Durables

- /

- BOVESPA:MRVE3

MRV Engenharia e Participações S.A. (BVMF:MRVE3) Might Not Be As Mispriced As It Looks

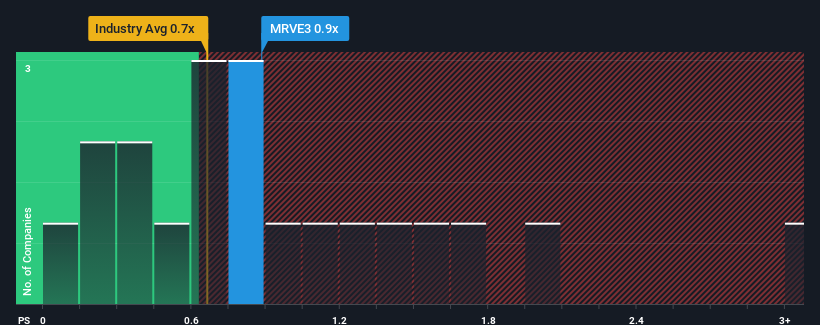

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Consumer Durables industry in Brazil, you could be forgiven for feeling indifferent about MRV Engenharia e Participações S.A.'s (BVMF:MRVE3) P/S ratio of 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for MRV Engenharia e Participações

What Does MRV Engenharia e Participações' P/S Mean For Shareholders?

MRV Engenharia e Participações could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MRV Engenharia e Participações.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like MRV Engenharia e Participações' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.0% gain to the company's revenues. Revenue has also lifted 12% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 9.6% each year as estimated by the eleven analysts watching the company. That's shaping up to be materially higher than the 4.8% each year growth forecast for the broader industry.

With this information, we find it interesting that MRV Engenharia e Participações is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, MRV Engenharia e Participações' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware MRV Engenharia e Participações is showing 4 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of MRV Engenharia e Participações' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MRVE3

MRV Engenharia e Participações

Operates as a real estate developer in Brazil and the United States.

Undervalued with moderate growth potential.