Stock Analysis

Xero (ASX:XRO) shareholders have earned a 17% CAGR over the last five years

Xero Limited (ASX:XRO) shareholders have seen the share price descend 10% over the month. But in stark contrast, the returns over the last half decade have impressed. In fact, the share price is 120% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Xero

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Xero has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So we might find other metrics can better explain the share price movements.

In contrast revenue growth of 22% per year is probably viewed as evidence that Xero is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

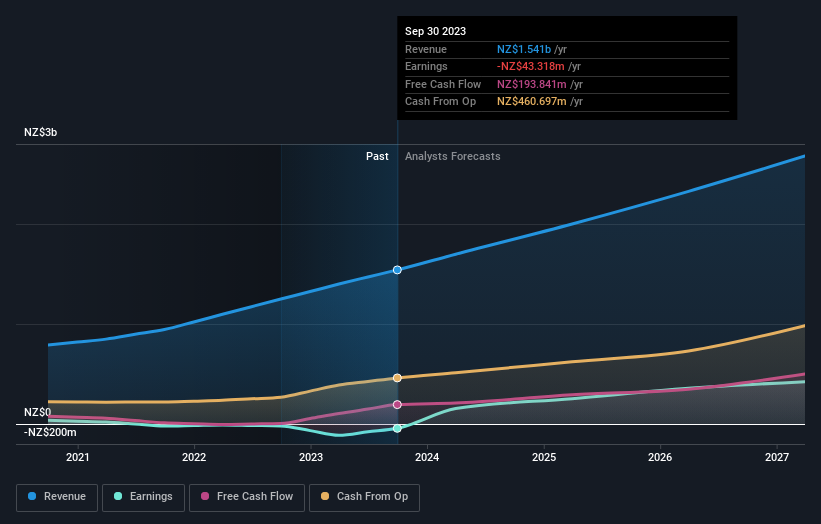

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Xero in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Xero has rewarded shareholders with a total shareholder return of 29% in the last twelve months. That's better than the annualised return of 17% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Xero may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Xero is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:XRO

Xero

Xero Limited, together with its subsidiaries, operates as a software as a service company in New Zealand, Australia, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.