Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:JRV

Jervois Global (ASX:JRV) dips 17% this week as increasing losses might not be inspiring confidence among its investors

Over the last month the Jervois Global Limited (ASX:JRV) has been much stronger than before, rebounding by 33%. But that is meagre solace when you consider how the price has plummeted over the last year. To wit, the stock has dropped 88% over the last year. Arguably, the recent bounce is to be expected after such a bad drop. The real question is whether the company can turn around its fortunes. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

After losing 17% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Jervois Global

Because Jervois Global made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Jervois Global's revenue didn't grow at all in the last year. In fact, it fell 14%. That looks pretty grim, at a glance. The share price fall of 88% in a year tells the story. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

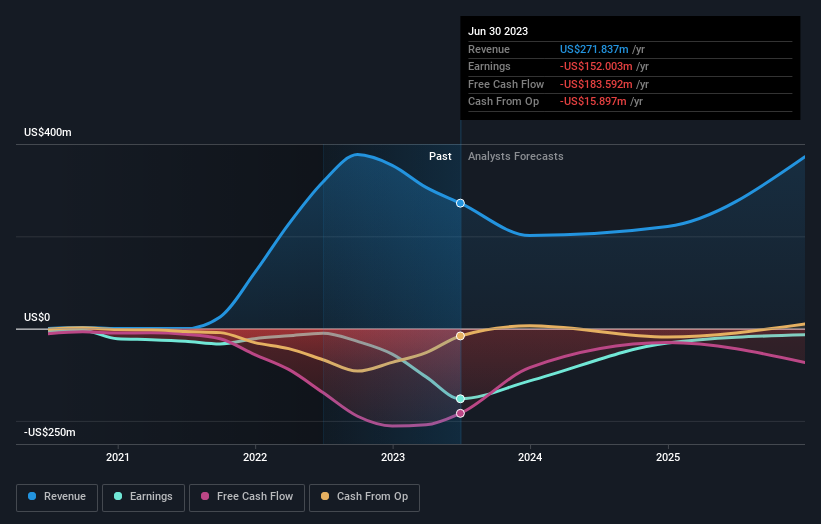

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Jervois Global stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 0.9% in the last year, Jervois Global shareholders lost 88%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Jervois Global , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Jervois Global is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:JRV

Jervois Global

Jervois Global Limited engages in the exploration, development, and production of mineral properties.

Fair value with imperfect balance sheet.