Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:EMH

Even after rising 21% this past week, European Metals Holdings (ASX:EMH) shareholders are still down 66% over the past three years

European Metals Holdings Limited (ASX:EMH) shareholders will doubtless be very grateful to see the share price up 55% in the last month. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 66% in that period. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added AU$16m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for European Metals Holdings

We don't think European Metals Holdings' revenue of AU$1,536,632 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that European Metals Holdings will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some European Metals Holdings investors have already had a taste of the bitterness stocks like this can leave in the mouth.

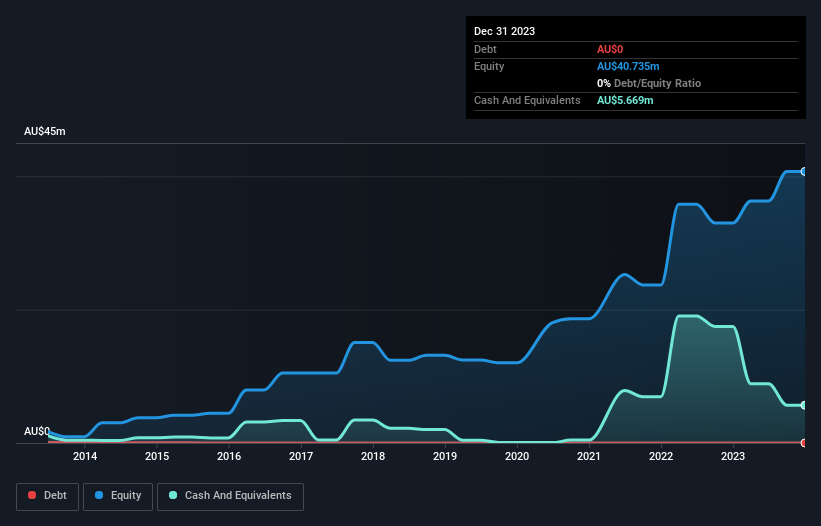

European Metals Holdings had cash in excess of all liabilities of AU$5.2m when it last reported (December 2023). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 18% per year, over 3 years , it seems likely that the need for cash is weighing on investors' minds. The image below shows how European Metals Holdings' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

Investors in European Metals Holdings had a tough year, with a total loss of 29%, against a market gain of about 8.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 1.7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with European Metals Holdings (at least 1 which is significant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether European Metals Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EMH

European Metals Holdings

Engages in the exploration and development of Cinovec lithium and tin resources projects in the Czech Republic.

Flawless balance sheet and overvalued.