Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:CKA

Investors bid Cokal (ASX:CKA) up AU$24m despite increasing losses YoY, taking three-year CAGR to 15%

Cokal Limited (ASX:CKA) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 52% during that period.

The past week has proven to be lucrative for Cokal investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for Cokal

Cokal recorded just US$2,536,874 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Cokal will find or develop a valuable new mine before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as Cokal investors might know.

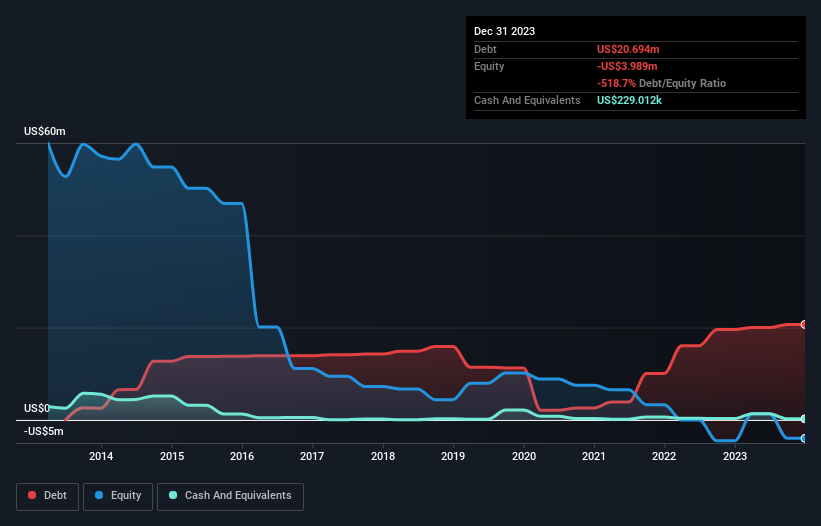

Our data indicates that Cokal had US$44m more in total liabilities than it had cash, when it last reported in December 2023. That makes it extremely high risk, in our view. So we're surprised to see the stock up 123% per year, over 3 years , but we're happy for holders. Investors must really like its potential. You can click on the image below to see (in greater detail) how Cokal's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

While the broader market gained around 15% in the last year, Cokal shareholders lost 44%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 6 warning signs for Cokal (3 are concerning!) that you should be aware of before investing here.

But note: Cokal may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Cokal is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CKA

Cokal

Engages in the identification and development of coal in Indonesia.

Overvalued with weak fundamentals.