Stock Analysis

- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Clover Health Investments, Corp.'s (NASDAQ:CLOV) 26% Dip In Price Shows Sentiment Is Matching Revenues

To the annoyance of some shareholders, Clover Health Investments, Corp. (NASDAQ:CLOV) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

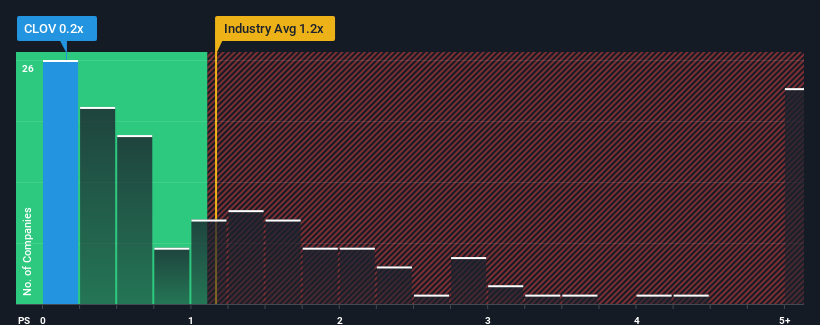

Following the heavy fall in price, given about half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Clover Health Investments as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Clover Health Investments

How Clover Health Investments Has Been Performing

Clover Health Investments hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clover Health Investments.Is There Any Revenue Growth Forecasted For Clover Health Investments?

Clover Health Investments' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. Even so, admirably revenue has lifted 195% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 12% per annum during the coming three years according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 7.7% each year, which paints a poor picture.

In light of this, it's understandable that Clover Health Investments' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Clover Health Investments' P/S

The southerly movements of Clover Health Investments' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Clover Health Investments' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Clover Health Investments' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Clover Health Investments that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Clover Health Investments is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLOV

Clover Health Investments

Clover Health Investments, Corp. provides medicare advantage plans in the United States.

Flawless balance sheet and fair value.