IREN Investment Thesis Update: The Institutional Awakening and the Path to $70

For those following the IREN story, the transformation from a Bitcoin miner into a premier AI infrastructure provider is no longer a forecast: it’s a reality. The recent market activity is not a random surge but a structured, multi-phase evolution. My conviction remains strong, and this update outlines the sequential phases of IREN’s re-rating and the powerful future ahead.

The Four Phases of IREN’s Transformation

We are witnessing a classic market re-rating unfolding in four distinct stages:

Phase 1: Achieving Book Value ($5 → $15)

This initial move reflected the market’s overdue recognition of IREN’s tangible assets: its power infrastructure, strategic land holdings, existing data centre shells, and high-efficiency Bitcoin mining business. Valuation was simply catching up to the physical reality of what the company already owned.

This is where we got in. Back then the thesis wasn’t as clear. IREN was a very well-run BTC miner with aspirations to become an AI data centre, but honestly, I was somewhat sceptical, thinking it might just be a PR move to attract attention.

Phase 2: The Great Re-Rating – From BTC Miner to “Neocloud” ($15 → $35)

This was the pivotal narrative shift. The market began to see IREN’s assets not just as mining infrastructure but as perfectly positioned for the exploding demand in High-Performance Computing (HPC) and AI. Execution highlights included:

- Aggressive HPC Pivot: A $674 million investment in nearly 24,000 NVIDIA GPUs to build out its own Cloud Service Provider (CSP) business in Canada.

- Proven Demand: Customers have already committed to these GPUs before installation, validating the self-build strategy.

- Strategic Halt: A deliberate decision to pause Bitcoin mining expansion at the 750 MW Childress site to prioritise dedicated HPC data centres (“Horizon 1 & 2”).

Phase 3: The Institutional Awakening (Current Phase)

We are now in the critical third phase, still in its early innings. This is where the story shifts from retail hype to institutional conviction. The days of tentative $25 price targets are over, firms like Roth Capital ($82 target) and now Bernstein ($75, up from $20) are coming in with heavyweight backing.

What’s notable about Bernstein’s call is not just the price target, but the why:

- They see IREN’s AI pivot as credible, overcoming early scepticism about its ability to execute such a capital-intensive build-out.

- They model $500 million in ARR by Q1 2026 on 23,300 GPUs, up from just ~$14 million in Q1 2025, a massive step-change.

- Their sum-of-parts model assigns 87% of enterprise value to AI cloud and co-location potential, with just 13% from BTC mining.

- At $75, IREN would still trade at ~$7.5M per MW, above other miners but well below established AI peers like CoreWeave, implying significant headroom for multiple expansion.

This is a profound shift: IREN is no longer valued primarily as a miner with optionality, but as a credible, standalone AI cloud operator.

Phase 4: The Earnings Flywheel (The Future)

The fourth and most powerful phase will be the “Earnings Flywheel,” driven by compounding growth:

- As the 24,000 GPUs and HPC sites come online, they’ll deliver significant, high-margin revenue.

- Predictable earnings growth will draw more institutional capital, pushing the stock higher.

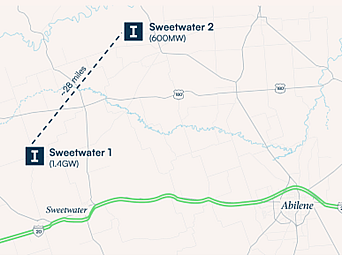

- A higher share price provides cheaper access to capital, accelerating development of crown-jewel assets like the 2-gigawatt Sweetwater hub.

This creates a virtuous cycle of growth → higher valuation → more growth.

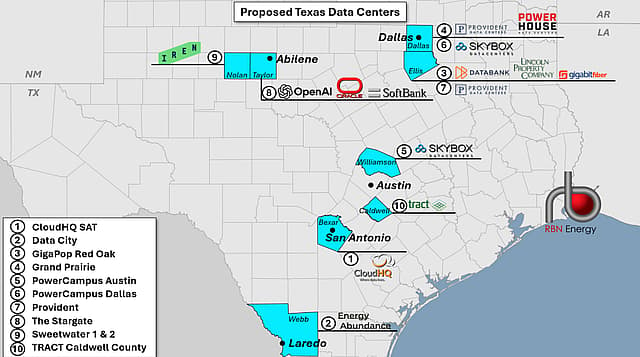

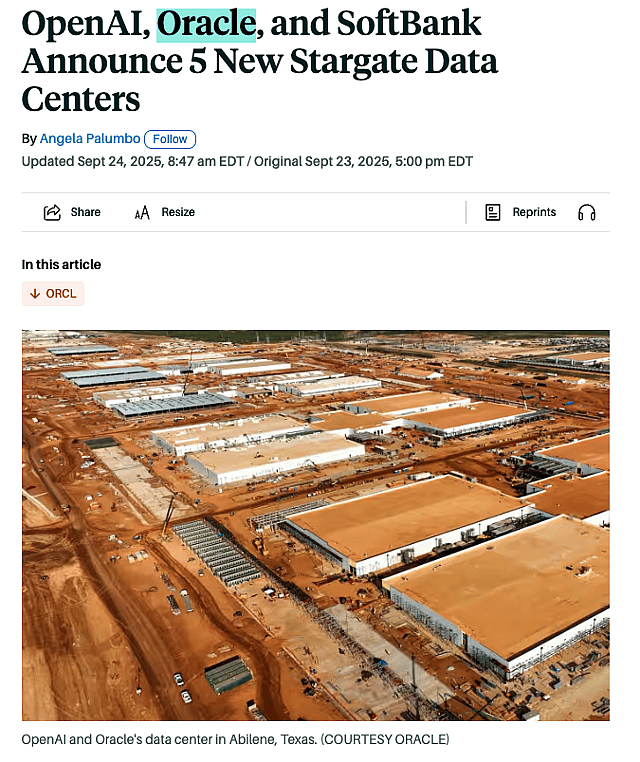

A hyperscaler contract with a player like Oracle (ORCL) could act as a major catalyst, accelerating this process dramatically. While nothing has been confirmed, there are circulating rumours of potential partnerships, particularly as Oracle begins developing new Stargate data centres in Abilene, TX, just a short distance from IREN’s operations.

Underpinning the Narrative: Irreplaceable Assets, Secure Power, and Proven Execution

> IREN’s multi-phase growth is anchored in a foundation few can match: long-term contracted energy supply, strategically advantaged sites, and a management team with a track record of delivering complex infrastructure at scale.

- The Crown Jewel – Sweetwater Hub (2 GW): IREN’s moat. With guaranteed energy supply and capacity for 600,000 next-gen GPUs, this is a world-class site that cannot be replicated quickly. Energisation of the first 1.4 GW is slated for April 2026, making the timeline clear and imminent.

- Strategic Flexibility – Childress (750 MW): CEO Dan has made it clear the entire site could be converted to HPC if the right deal arises, evidence of a relentless focus on maximising shareholder value.

- Dual Engine: Importantly, IREN still operates one of the largest Bitcoin fleets (50 EH/s), generating ~$600M in annualised EBITDA at current BTC prices. This cash flow is actively funding the AI expansion, providing balance and flexibility.

- Proven Execution: With a background in large-scale infrastructure (Macquarie), IREN’s management team has consistently executed at speed and scale. They aren’t just acquiring power—they’re expert developers.

Conclusion & Conviction

The market is beginning to grasp the true scale of IREN’s opportunity. This is no longer a company valued on Bitcoin prices, but one positioned to capture the multi-trillion-dollar AI capex cycle. As each megawatt is contracted for HPC, the value of IREN’s remaining portfolio rises.

My conviction, grounded in this multi-phase evolution and strong industry tailwinds, keeps my price target around $70, barring major macro shocks. We remain early in the institutional awakening, with the earnings flywheel still ahead.

That said, caution is warranted. The stock has gone parabolic in recent weeks, and social media sentiment is euphoric right now; never a good sign... Many early investors are already taking profits, and any setback in securing a hyperscaler contract could weigh heavily on sentiment.

For new investors, this is a tricky moment. I wouldn’t chase the rally at this stage. While the price could potentially double in the next 12 months if everything goes perfectly, the risks are substantial considering how stretched the price is. I’d rather wait for a potential correction or explore other opportunities offering a better risk/reward profile.

For current holders, remember that IREN remains highly volatile and is now priced on future expectations of flawless execution. Don’t be surprised by 20–30% swings. While the company is executing well and is strategically well-positioned, the stock is still heavily influenced by market sentiment and expectations around a hyperscaler deal.

Personally, I’ve already taken some profits to sleep better at night, while still maintaining a substantial position. I remain confident in IREN and its strategy, but if this euphoric phase continues without tangible customer wins in the next 3 months, I may trim further. For now, I’m watching with conviction, but also with discipline.

Good luck.

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:IREN. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.