August 2025 Update: Relentless Execution, Mounting Optionality

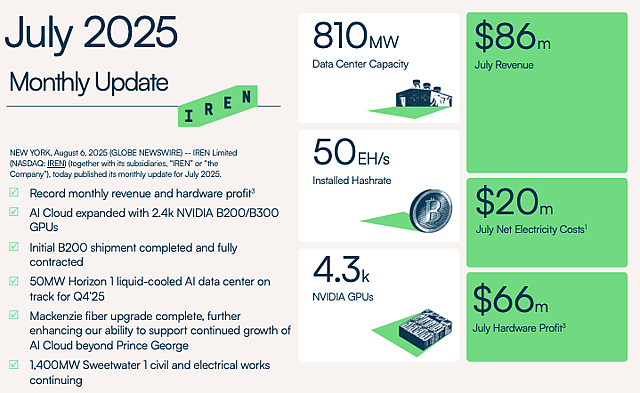

Since my last update, Iris Energy has continued to execute with precision. July’s operational update confirms the company remains firmly on track, scaling both its Bitcoin and AI infrastructure with discipline and speed.

https://iren.gcs-web.com/static-files/de0361c5-62fa-4aa4-a6a2-12755ff7edba

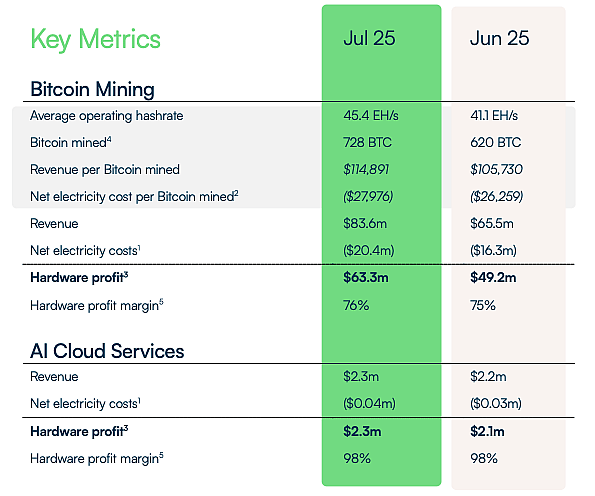

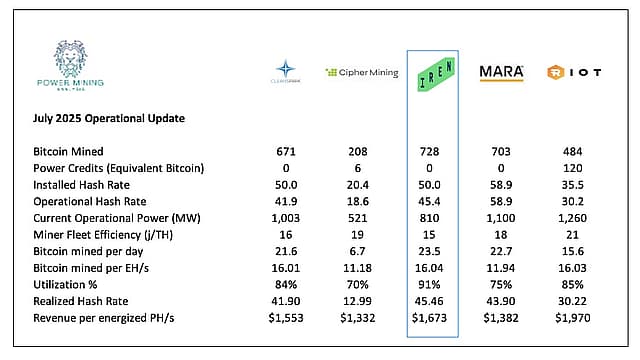

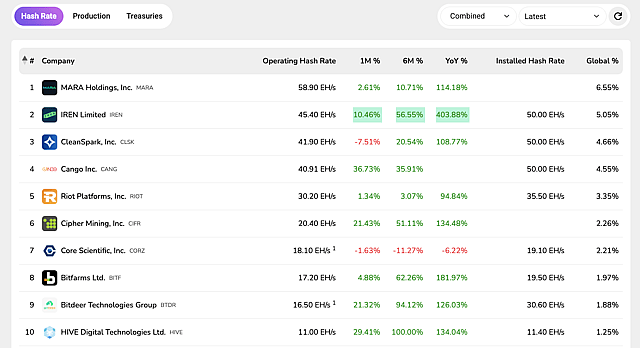

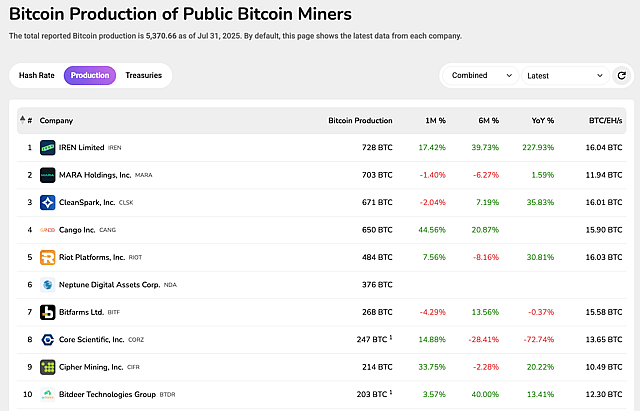

Operational strength IREN’s average operating hash rate reached 45.4 EH/s for July, up from 41.1 EH/s in June, driven by the energisation of its 500 MW Childress expansion. Despite weather-related curtailments, it mined 728 BTC in July and generated $83.6 million in mining revenue. The energy efficiency gains remain intact, and electricity costs were consistent with prior periods.

https://iren.gcs-web.com/static-files/de0361c5-62fa-4aa4-a6a2-12755ff7edba

More importantly, the company continues to convert energy into compute with elite-level efficiency, maintaining its position among the top BTC miners on metrics like BTC/EH and $/kWh. Importantly, IREN continues to reinvest proceeds into infrastructure rather than hoarding BTC, preserving capital discipline and fuelling growth.

Image credit: https://www.powermininganalysis.com/

Image credit: https://bitcoinminingstock.io/

AI buildout progressing

On the AI front, IREN is accelerating its pivot into high-performance compute. Following the announcement of its ~2,400 Nvidia Blackwell GPU purchase, infrastructure installation has already begun at Prince George. Liquid-cooling systems and dense rack layouts are being deployed, with phased delivery expected across FY26.

The company is now managing approximately 4,300 NVIDIA GPUs, positioning itself as one of the few scaled players outside Big Tech with the infrastructure and power to support generative AI workloads. This capacity remains fully self-funded, a critical point given the capital intensity of the AI race and the volatility of public equity markets.

“We are observing accelerating interest in our newly procured Blackwell GPUs, with the initial delivery of 256 B200 GPUs already contracted. Our ability to run ASICs and GPUs side-by-side at Prince George underscores the adaptability of our infrastructure and our ability to capture the market opportunity ahead.”

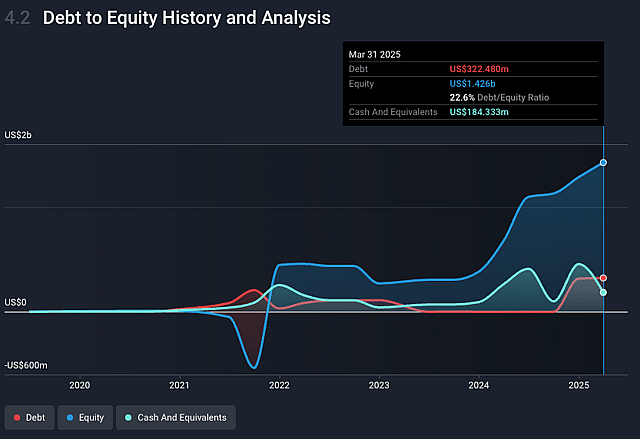

Capital structure remains robust

With over $180 million in cash, and 22.6% debt to equity ratio, and no convertible notes or off-balance sheet liabilities. Capex has ramped alongside buildouts, but remains aligned with growth. The addition of Chief Capital Officer Anthony Lewis, formerly Macquarie Co-Treasurer, has brought additional rigour to long-term funding strategy. His presence is already being felt across capital allocation planning.

Infrastructure compounding IREN now controls 820 MW of operational data centre capacity, and has locked in 2.9 GW of secured power pipeline. That’s more than any other public mining or AI infrastructure firm. This secured footprint provides visibility into multi-year expansion, de-risks execution, and reinforces the repeatability of its vertically integrated approach.

Looking ahead

The story remains unchanged and continues to strengthen. IREN is fast becoming a scaled compute infrastructure company, not just a miner. Its disciplined capital allocation, industry-leading efficiency, and growing AI vertical offer exposure to two structural trends: decentralised crypto and centralised AI compute.

With a clean balance sheet, proven playbook, and one of the largest energy footprints in the sector, IREN continues to compound optionality quarter after quarter.

I remain bullish.

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:IREN. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.