Stock Analysis

- United States

- /

- Communications

- /

- NasdaqCM:GNSS

Investors in Genasys (NASDAQ:GNSS) from three years ago are still down 61%, even after 10% gain this past week

It is doubtless a positive to see that the Genasys Inc. (NASDAQ:GNSS) share price has gained some 45% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 61%. So it is really good to see an improvement. Perhaps the company has turned over a new leaf.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Genasys

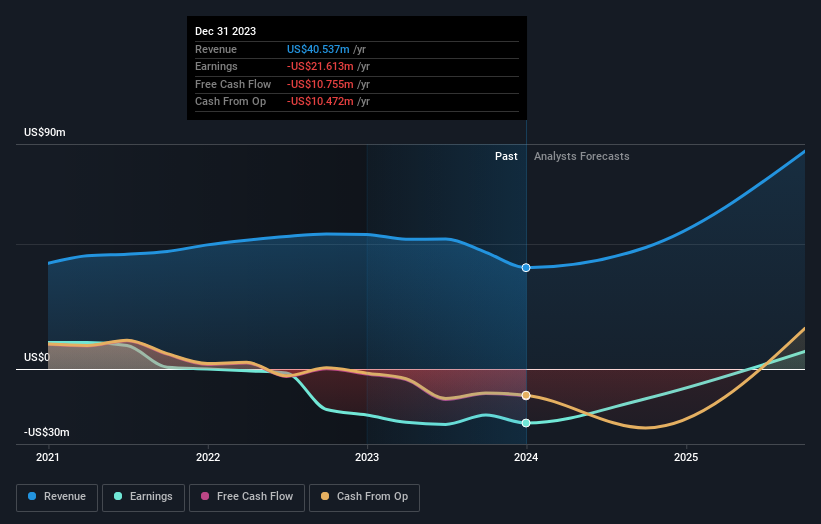

Because Genasys made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Genasys saw its revenue grow by 2.1% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 17% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Genasys stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Genasys shareholders are down 24% for the year, but the market itself is up 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Genasys (1 is a bit unpleasant) that you should be aware of.

Genasys is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Genasys is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GNSS

Genasys

Engages in the design, development, and commercialization of critical communications hardware and software solutions to alert, inform, and protect people principally in North and South America, Europe, the Middle East, Asia, and internationally.

Flawless balance sheet and slightly overvalued.