Stock Analysis

- United States

- /

- Auto Components

- /

- NasdaqGS:DORM

Dorman Products, Inc. (NASDAQ:DORM) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Dorman Products' (NASDAQ:DORM) stock is up by a considerable 18% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Specifically, we decided to study Dorman Products' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Dorman Products

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Dorman Products is:

8.6% = US$97m ÷ US$1.1b (Based on the trailing twelve months to September 2023).

The 'return' is the yearly profit. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.09.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Dorman Products' Earnings Growth And 8.6% ROE

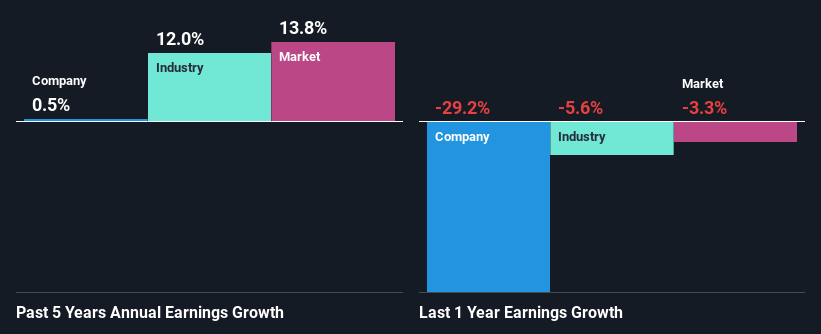

When you first look at it, Dorman Products' ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 12% either. As a result, Dorman Products' flat net income growth over the past five years doesn't come as a surprise given its lower ROE.

Next, on comparing with the industry net income growth, we found that Dorman Products' reported growth was lower than the industry growth of 12% over the last few years, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for DORM? You can find out in our latest intrinsic value infographic research report.

Is Dorman Products Using Its Retained Earnings Effectively?

Dorman Products doesn't pay any dividend, which means that it is retaining all of its earnings. This makes us question why the company is retaining so much of its profits and still generating almost no growth? So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Summary

On the whole, we feel that the performance shown by Dorman Products can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're helping make it simple.

Find out whether Dorman Products is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DORM

Dorman Products

Supplies replacement and upgrade parts for passenger cars, light trucks, medium- and heavy-duty trucks, utility terrain vehicles, and all-terrain vehicles in the motor vehicle aftermarket industry in the United States and internationally.

Solid track record with adequate balance sheet.