Stock Analysis

- Japan

- /

- Consumer Durables

- /

- TSE:8860

Exploring Three Japanese Dividend Stocks In May 2024

Reviewed by Kshitija Bhandaru

As of May 2024, the Japanese stock market is showing signs of resilience, with the Nikkei 225 and TOPIX indices experiencing gains amid government interventions to stabilize the yen. This environment could be conducive for investors interested in dividend stocks, as stable or appreciating currency values can enhance the returns from such investments when converted back to investors' local currencies. In assessing potential dividend stocks, factors like company fundamentals, sector performance, and macroeconomic conditions remain pivotal in making informed decisions.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Kanro (TSE:2216) | 3.27% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.59% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.45% | ★★★★★★ |

| AiphoneLtd (TSE:6718) | 3.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| Nissin (TSE:9066) | 4.00% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.28% | ★★★★★★ |

| Innotech (TSE:9880) | 3.87% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.53% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.23% | ★★★★★★ |

Click here to see the full list of 299 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

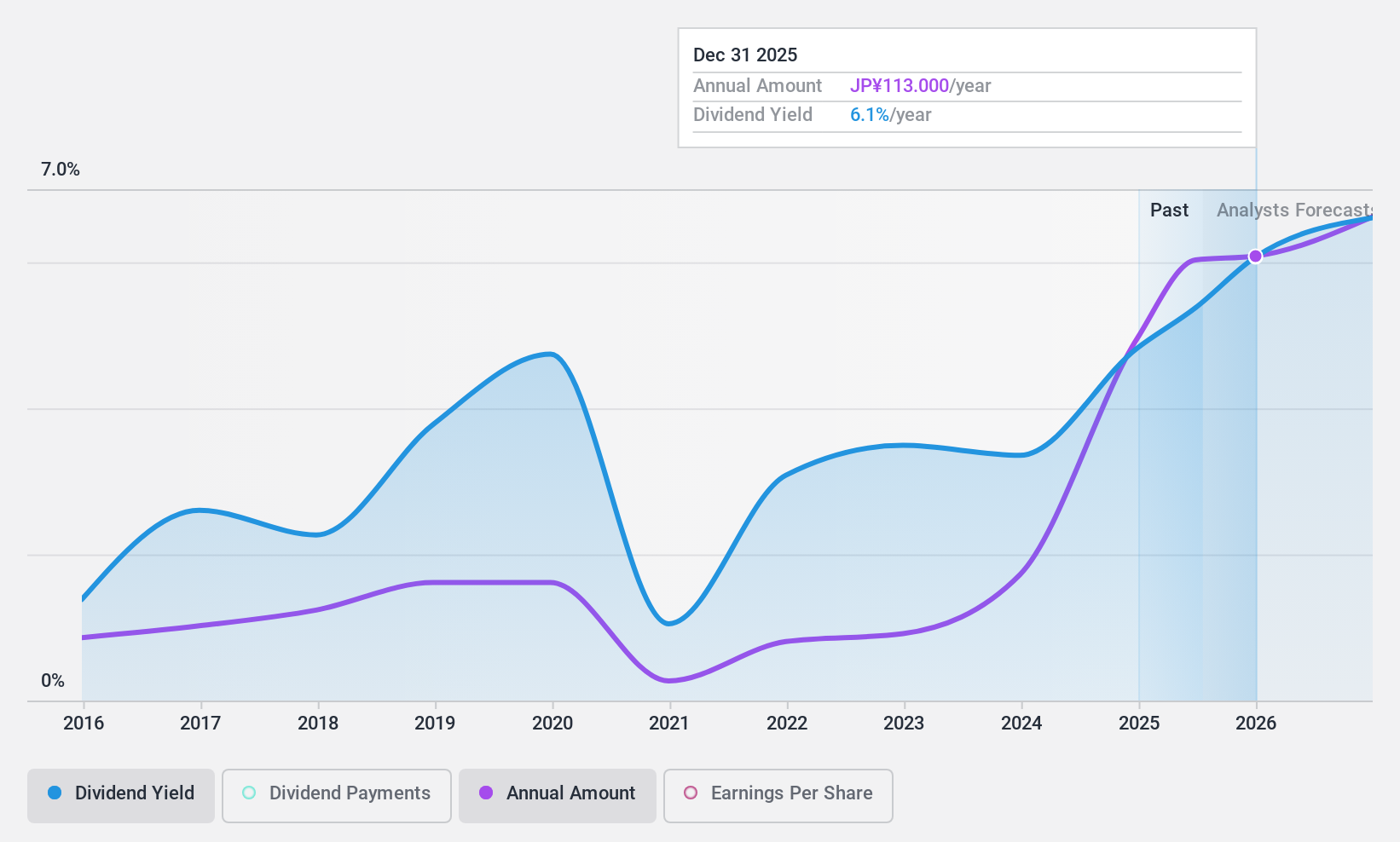

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MUGEN ESTATE Co., Ltd. is a Japanese company that specializes in purchasing and reselling used real estate properties, with a market capitalization of ¥34.43 billion.

Operations: MUGEN ESTATE Co., Ltd. generates revenue primarily through its real estate buying and selling business, which accounted for ¥49.35 billion, and its rental and other businesses segment, which contributed ¥2.31 billion.

Dividend Yield: 4.7%

MUGEN ESTATE Ltd. has demonstrated a strong dividend growth trajectory, with dividends increasing from JPY 20.00 to JPY 63.00 last year and an expected rise to JPY 68.00 this year. Despite a volatile dividend history over the past decade, recent performance suggests improvement, supported by earnings coverage (40.6% payout ratio) and cash flow (33% cash payout ratio). The stock trades at 43.7% below estimated fair value, offering potential value amidst high share price volatility and concerns about debt coverage by operating cash flow.

- Click here to discover the nuances of MUGEN ESTATELtd with our detailed analytical dividend report.

- Our expertly prepared valuation report MUGEN ESTATELtd implies its share price may be lower than expected.

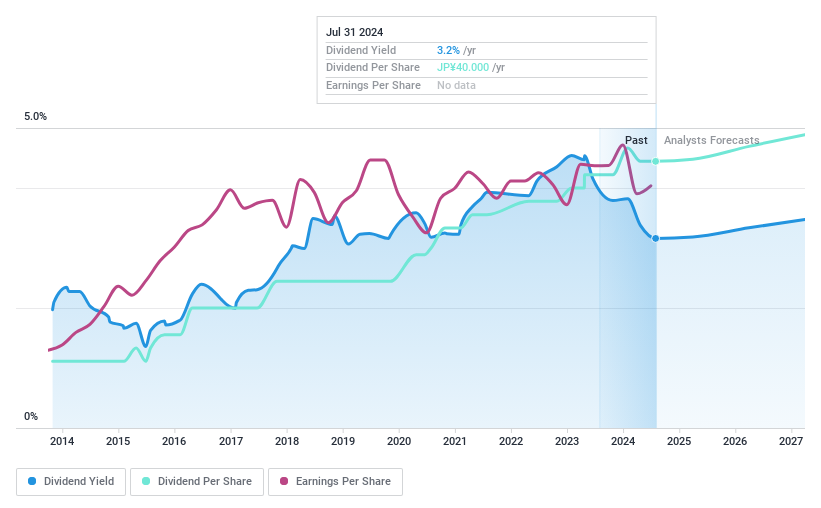

Aichi (TSE:6345)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aichi Corporation, operating globally, specializes in the production and sale of mechanized vehicles for various industries including electric utilities, telecommunications, construction, and more, with a market capitalization of approximately ¥85.89 billion.

Operations: Aichi Corporation generates its revenue primarily from the sale of mechanized vehicles used in industries such as electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail.

Dividend Yield: 3.5%

Aichi Corporation's dividends, with a yield of 3.47%, rank in the top 25% in the Japanese market. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 56.9% and 49.4%, respectively. Despite this, Aichi has experienced volatility and unreliability in its dividend payments over the past decade, including significant annual drops. However, it currently trades at a substantial 44.5% below its estimated fair value, suggesting potential for investors despite past inconsistencies.

- Dive into the specifics of Aichi here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Aichi is trading behind its estimated value.

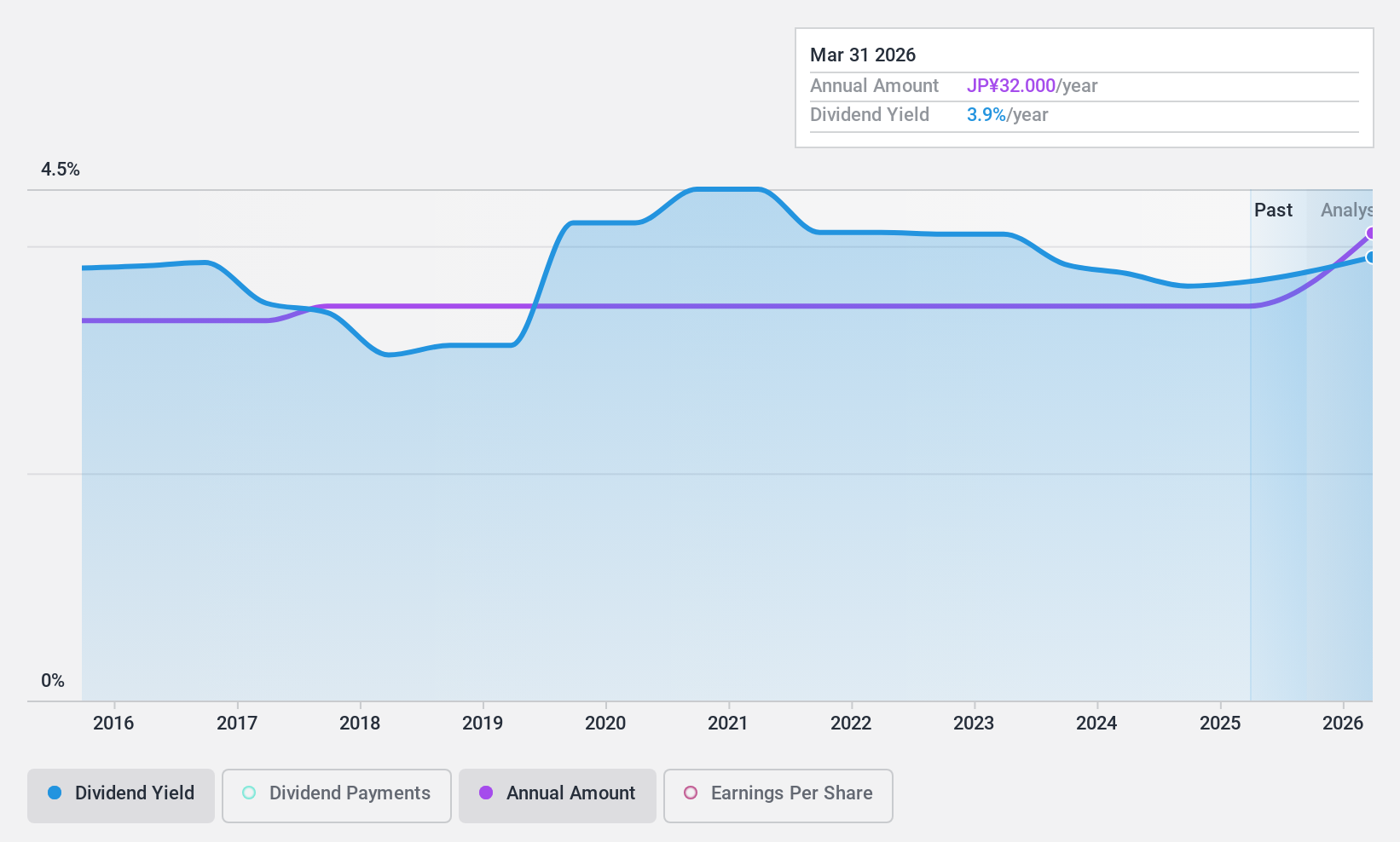

Fuji (TSE:8860)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fuji Corporation Limited specializes in designing, constructing, and selling detached houses and condominiums across Japan, with a market capitalization of approximately ¥28.35 billion.

Operations: Fuji Corporation Limited generates its revenue primarily through the design, construction, and sale of detached houses and condominiums in Japan.

Dividend Yield: 3.5%

Fuji Corporation Limited offers a dividend yield of 3.44%, positioning it in the top 25% of Japanese dividend payers. Despite this, its dividends are not well supported by cash flows, and the company lacks free cash flows entirely. However, Fuji has maintained stable and reliable dividends over the past decade and recently declared a special cash dividend of ¥3.00 on March 28, 2024. Additionally, with a low price-to-earnings ratio of 6.2x compared to the market average of 14.4x and an earnings growth of 19.4% last year, Fuji presents some attractive financial metrics for investors considering dividend stocks.

- Delve into the full analysis dividend report here for a deeper understanding of Fuji.

- Upon reviewing our latest valuation report, Fuji's share price might be too optimistic.

Make It Happen

- Discover the full array of 299 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Fuji is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8860

Fuji

Designs, constructs, and sells detached houses and condominiums in Japan.

Solid track record established dividend payer.