Stock Analysis

- Japan

- /

- Professional Services

- /

- TSE:9562

Is Business Coach Inc.'s (TSE:9562) Stock Price Struggling As A Result Of Its Mixed Financials?

It is hard to get excited after looking at Business Coach's (TSE:9562) recent performance, when its stock has declined 17% over the past three months. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Particularly, we will be paying attention to Business Coach's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Business Coach

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Business Coach is:

6.7% = JP¥54m ÷ JP¥803m (Based on the trailing twelve months to December 2023).

The 'return' is the income the business earned over the last year. That means that for every ¥1 worth of shareholders' equity, the company generated ¥0.07 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Business Coach's Earnings Growth And 6.7% ROE

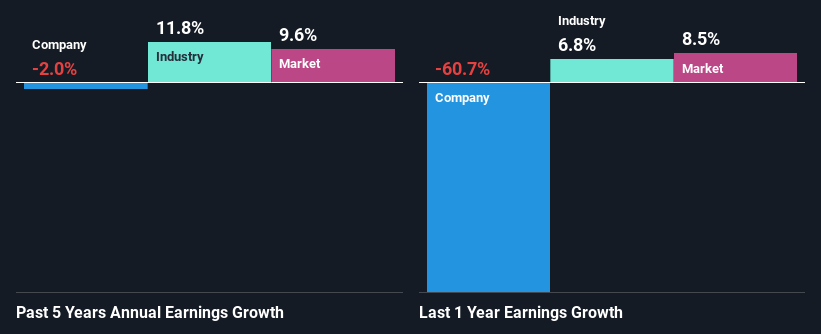

When you first look at it, Business Coach's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 13% either. Therefore, Business Coach's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

Next, on comparing with the industry net income growth, we found that the industry grew its earnings by 12% over the last few years.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Business Coach fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Business Coach Using Its Retained Earnings Effectively?

Business Coach doesn't pay any regular dividends, meaning that potentially all of its profits are being reinvested in the business. However, this doesn't explain why the company hasn't seen any growth. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Summary

In total, we're a bit ambivalent about Business Coach's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Business Coach's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Valuation is complex, but we're helping make it simple.

Find out whether Business Coach is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9562

Business Coach

Engages in the human resource development business in Japan.

Excellent balance sheet and slightly overvalued.