Stock Analysis

- India

- /

- Consumer Finance

- /

- NSEI:MUTHOOTCAP

Earnings growth of 1.9% over 5 years hasn't been enough to translate into positive returns for Muthoot Capital Services (NSE:MUTHOOTCAP) shareholders

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. Zooming in on an example, the Muthoot Capital Services Limited (NSE:MUTHOOTCAP) share price dropped 62% in the last half decade. That's an unpleasant experience for long term holders. The falls have accelerated recently, with the share price down 10% in the last three months.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Muthoot Capital Services

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Muthoot Capital Services moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Arguably, the revenue drop of 18% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

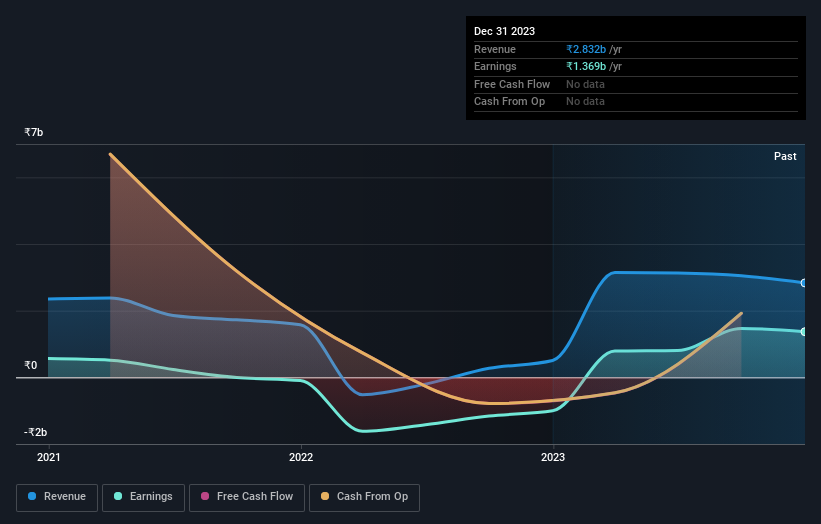

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Muthoot Capital Services stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Muthoot Capital Services shareholders are down 9.1% for the year, but the market itself is up 44%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Muthoot Capital Services has 4 warning signs (and 2 which make us uncomfortable) we think you should know about.

We will like Muthoot Capital Services better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Muthoot Capital Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MUTHOOTCAP

Muthoot Capital Services

A non-banking finance company (NBFC), provides fund and non-fund based financial services.

Mediocre balance sheet and slightly overvalued.