Stock Analysis

Investors five-year losses continue as Bank of Gansu (HKG:2139) dips a further 17% this week, earnings continue to decline

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Bank of Gansu Co., Ltd. (HKG:2139) for five whole years - as the share price tanked 85%. And it's not just long term holders hurting, because the stock is down 63% in the last year. The last week also saw the share price slip down another 17%. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With the stock having lost 17% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Bank of Gansu

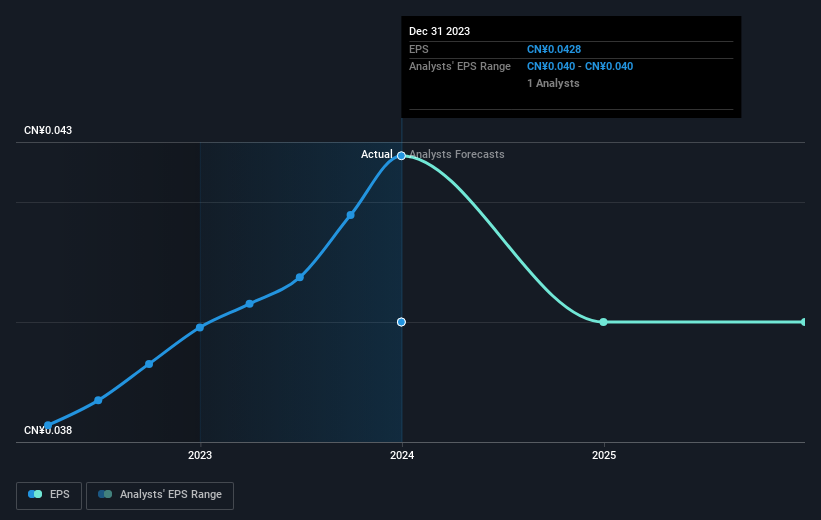

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Bank of Gansu's earnings per share (EPS) dropped by 34% each year. Notably, the share price has fallen at 31% per year, fairly close to the change in the EPS. This implies that the market has had a fairly steady view of the stock. Rather, the share price change has reflected changes in earnings per share.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Bank of Gansu's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Bank of Gansu shareholders are down 63% for the year. Unfortunately, that's worse than the broader market decline of 2.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Bank of Gansu you might want to consider these 3 valuation metrics.

Of course Bank of Gansu may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Bank of Gansu is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2139

Bank of Gansu

Together with its subsidiary, Pingliang Jingning Chengji Rural Bank Co., Ltd., provides various banking services in the People’s Republic of China.

Flawless balance sheet with proven track record.