Stock Analysis

Haulotte Group's (EPA:PIG) earnings have declined over five years, contributing to shareholders 63% loss

It's nice to see the Haulotte Group SA (EPA:PIG) share price up 16% in a week. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 68% during that time. Some might say the recent bounce is to be expected after such a bad drop. Of course, this could be the start of a turnaround.

While the stock has risen 16% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Haulotte Group

We don't think that Haulotte Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last half decade, Haulotte Group saw its revenue increase by 4.8% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 11% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Haulotte Group. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

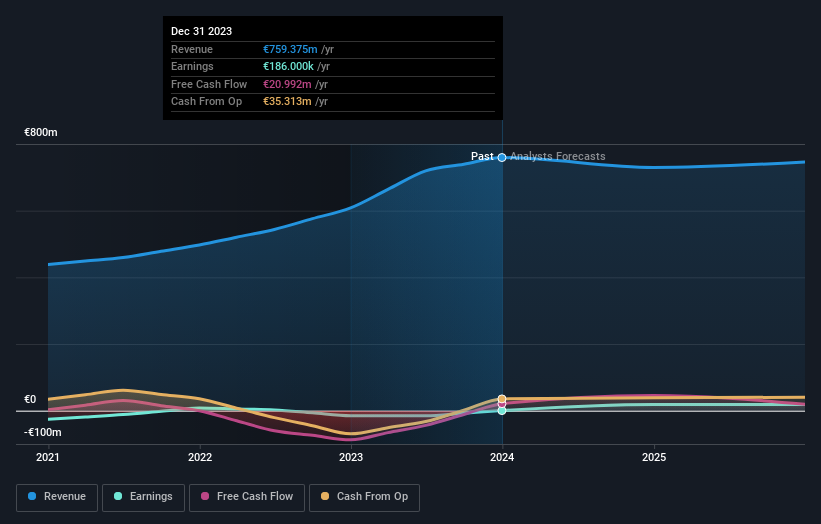

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Haulotte Group has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Haulotte Group stock, you should check out this free report showing analyst profit forecasts.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Haulotte Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Haulotte Group's TSR, which was a 63% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 9.2% in the last year, Haulotte Group shareholders lost 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Haulotte Group better, we need to consider many other factors. Take risks, for example - Haulotte Group has 2 warning signs (and 1 which is potentially serious) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Haulotte Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:PIG

Haulotte Group

Through its subsidiaries, designs, manufactures, and markets people and material lifting equipment.

Fair value with moderate growth potential.