Stock Analysis

Revenues Not Telling The Story For Jilin Jlu Communication Design Institute Co.,Ltd. (SZSE:300597) After Shares Rise 32%

Those holding Jilin Jlu Communication Design Institute Co.,Ltd. (SZSE:300597) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

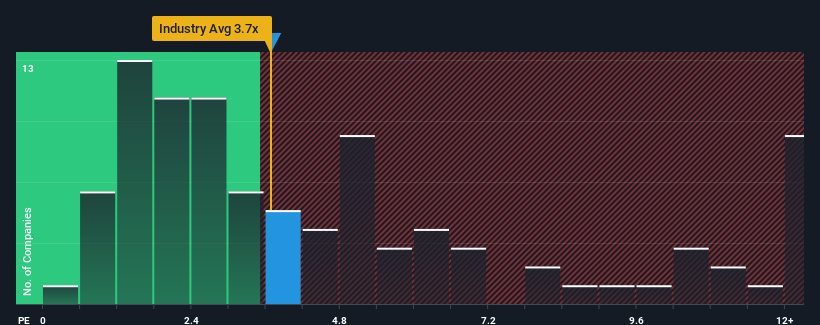

Although its price has surged higher, you could still be forgiven for feeling indifferent about Jilin Jlu Communication Design InstituteLtd's P/S ratio of 3.7x, since the median price-to-sales (or "P/S") ratio for the IT industry in China is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Jilin Jlu Communication Design InstituteLtd

What Does Jilin Jlu Communication Design InstituteLtd's Recent Performance Look Like?

It looks like revenue growth has deserted Jilin Jlu Communication Design InstituteLtd recently, which is not something to boast about. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Although there are no analyst estimates available for Jilin Jlu Communication Design InstituteLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Jilin Jlu Communication Design InstituteLtd's Revenue Growth Trending?

Jilin Jlu Communication Design InstituteLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 41% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Jilin Jlu Communication Design InstituteLtd's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Jilin Jlu Communication Design InstituteLtd's P/S Mean For Investors?

Jilin Jlu Communication Design InstituteLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Jilin Jlu Communication Design InstituteLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Having said that, be aware Jilin Jlu Communication Design InstituteLtd is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Jilin Jlu Communication Design InstituteLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300597

Jilin Jlu Communication Design InstituteLtd

Jilin Jlu Communication Design Institute Co.,Ltd.

Adequate balance sheet and slightly overvalued.