Stock Analysis

Investors bid Hazer Group (ASX:HZR) up AU$15m despite increasing losses YoY, taking five-year CAGR to 18%

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. For example, the Hazer Group Limited (ASX:HZR) share price has soared 119% in the last half decade. Most would be very happy with that. On top of that, the share price is up 39% in about a quarter.

Since the stock has added AU$15m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Hazer Group

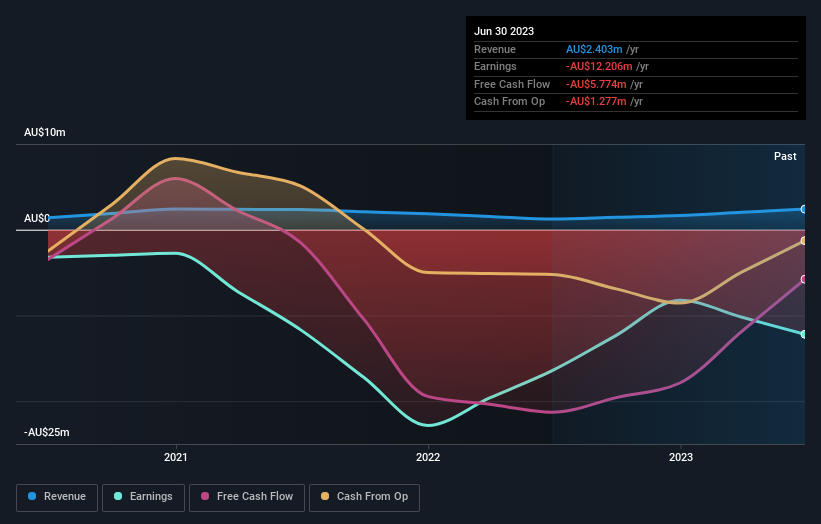

Hazer Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Hazer Group can boast revenue growth at a rate of 12% per year. That's a pretty good long term growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 17% per year over in that time. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hazer Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Hazer Group's TSR, at 125% is higher than its share price return of 119%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that Hazer Group has rewarded shareholders with a total shareholder return of 27% in the last twelve months. That's better than the annualised return of 18% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Hazer Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Hazer Group (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Hazer Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HZR

Hazer Group

Operates as a clean technology development company in Australia.

Flawless balance sheet with limited growth.