Stock Analysis

Despite shrinking by CN¥1.8b in the past week, Shijiazhuang ChangShan BeiMing TechnologyLtd (SZSE:000158) shareholders are still up 19% over 3 years

While Shijiazhuang ChangShan BeiMing Technology Co.,Ltd (SZSE:000158) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 21% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 19% during that period.

In light of the stock dropping 13% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Shijiazhuang ChangShan BeiMing TechnologyLtd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years of share price growth, Shijiazhuang ChangShan BeiMing TechnologyLtd actually saw its earnings per share (EPS) drop 88% per year.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The revenue drop of 2.6% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between Shijiazhuang ChangShan BeiMing TechnologyLtd's share price and its historic fundamental data. Further research may be required!

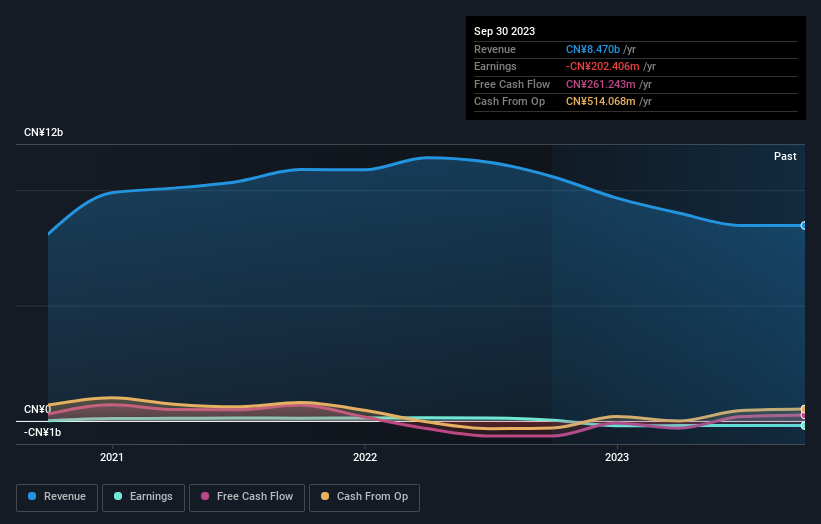

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While it's certainly disappointing to see that Shijiazhuang ChangShan BeiMing TechnologyLtd shares lost 9.8% throughout the year, that wasn't as bad as the market loss of 16%. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Shijiazhuang ChangShan BeiMing TechnologyLtd is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Shijiazhuang ChangShan BeiMing TechnologyLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000158

Shijiazhuang ChangShan BeiMing TechnologyLtd

Manufactures and sells textile products in China.

Good value with imperfect balance sheet.