Update shared on14 Nov 2024

Fair value Increased 0.11%Amazon Is Building The Platform To Compete For Advertising Spend

- Amazon grew TTM revenues by 12% and maintains strong performance driven by AWS.

- The company’s e-comm business is decelerating given rising competitors, its sheer market share and existing revenue base.

- In my view, Amazon’s key growth drivers will be AWS and advertising, the latter of which is increasingly limiting Google growth.

- By extending my forecasts from 2028 to 2029, my fair value for AMZN grew to $161 per share.

- While edge technologies like Kuiper and robotics may open new growth opportunities, it is too early to include them in a present value analysis.

Amazon’s trailing 12-month revenues grew close to 12% to $620B, 3rd quarter sales grew 11% to $159B. AWS was the key growth driver, increasing 19% to $27.5B, and now makes up 17% of the net revenues. The company is well underway to reaching my 2028 revenue forecast of $809B, and is ahead of my 8.5% annual revenue growth estimates.

Online stores were the lowest growing segment with 7.2%, indicating some difficulty for adding sales to the large $61B quarterly base.

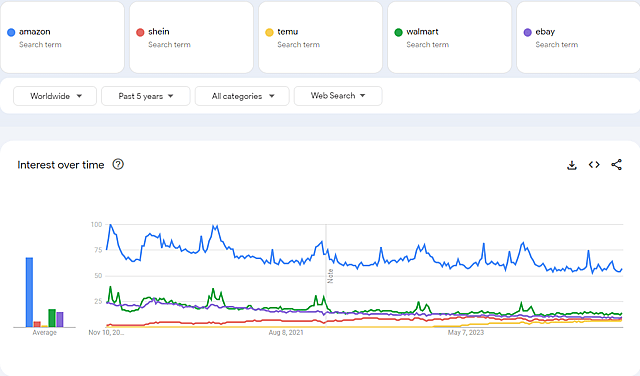

Google Trends: search queries for Amazon vs peers

The chart above shows that the company is facing increased competition, indicating that Amazon will need to defend its e-comm market share, rather than focusing on growth.

For the next quarter, management has guided a revenue growth rate between 7% and 11%, up to $188.5B. I expect the company to attain its mid to high-end of its internal estimates, but am not yet moving to change my top-line 2028 target of $809B. I discuss Amazon's growth opportunities, capex spend and efforts to optimize profitability below.

Amazon Demonstrates A Sustained Improvement To It’s Bottom-Line

Operating income rose to $60.6B up 130% on a TTM basis, practically confirming Amazon’s dedication to optimize the bottom-line. The company has now begun to successfully leverage its market share in order to scale up profitability. Amazon has also been working internally in this field and the company is implementing a series of steps to remove bureaucracy, leading to a decreased employee count, including removing middle-management positions. Shifting the story from growth to profitability will likely continue to have effects on the employment structure. In a “growth” scenario, most tech companies sought to acquire talent not because it was necessarily essential, but because they wanted to limit the access to talent for competitors. In the new “profitability” approach, tech companies are seeking to optimize costs. This leads to an over-correction on the side of reducing employees & projects, which has the effect of reducing salary expectations for new and existing team members. This is partly why AMZN can now better manage dilution via stock-based compensation (p. 15).

New Infrastructure CapEx Spend Will Be A Key Growth Driver

While optimizing profitability may take away some of the growth potential, Amazon is tackling this by continuing to reinvest into infrastructure capex. The CEO noted that AMZN plans to spend $75B on capex in 2024, and suspects that the company will spend more in 2025. Most of the rise in spend is due to generative AI.

Should Amazon continue reinvesting at the elevated rate, then a higher sustained growth rate may be possible and I will revise my revenue growth forecasts upwards. In my view, the company is intensely working on decreasing their reliance on NVIDIA chips, and developing internal solutions will reduce the future chip infrastructure spend. Amazon launched optimized EC2 instances based on their latest Gravitron4 processor, delivering 75% more memory bandwidth, and 30% better compute, than the previous generation.

While most of the infrastructure spend is aimed at generative AI, this doesn’t necessarily mean that it is a failed investment should AI demand flatten in the period ahead. Amazon AWS is primarily a cloud service and can easily reorient the new capacity into general compute needs.

Growth Verticals And Edge Technologies Maintain Investor Enthusiasm

Amazon’s Q3 advertising revenue grew almost 19% to $14.3B, and subscriptions (Prime) increased 11% to $11.3B.

Prime seems to have been knocked down in the earnings release priority list, with the only notable info being that the LOTR series is getting a second season. While there is no important flagship news in this area, I still consider that the total Prime package has the largest value proposition of all streamers and anticipate Amazon to keep growing their share among media competitors.

Advertising is a different story, and perhaps one of the largest growth verticals for the company after AWS. The appeal for advertisers lies in the change of shopping behavior in the last few years, where many new users have been onboarded to the platform and now directly search for products on Amazon. This is in contrast to the past, where fewer people were direct users, tended to start their search queries on Google, and ending up on Amazon after seeing organic search results or ads for products listed on Amazon. This means that the world of online advertising spend is segmenting into physical products and services. While Google held dominance in both areas in the past, it now increasingly has to share customers’ advertising spend with Amazon. In my opinion, advertisers will keep both their Google and Amazon advertising channels, but will allocate a lower portion of their budgets on Google, leading to a growth in advertising revenue and margins for Amazon.

Amazon’s edge technologies like project Kuiper and robotics keep developing, but it is too early to incorporate them into a financial forecast. While Tesla is pitching autonomous robots as a consumer product, Amazon seems to have a much more focused approach and is working on specialized robots that can be used in warehouses. I believe that Amazon has the right approach and higher likelihood to make a viable product, however this vision also limits the media buzz that the project generates and Tesla’s equity may be the one initially benefiting.

Valuation Implications

Despite the strong performance of Amazon in the past few quarters, I am maintaining my 2028 revenue estimate at $809B given the sheer size of the company’s base revenues and market share. I anticipate that the strongest continued growth avenues will be AWS and advertising.

However, just by extending my forecasts to 2029 using a 8.5% revenue CAGR I get revenues of $878B for Amazon. Using my 10% net profit margin and a forward PE of 27x, I arrive at a future value of $2.37T for Amazon. Discounted back to today using a 7% rate, I get a present value of $1.7T or $161 per share.

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NasdaqGS:AMZN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.