The Market is Finally Waking Up to Tesla

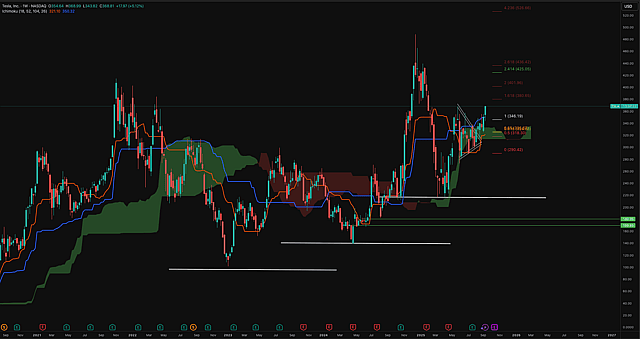

Tesla has officially hit my previous fair value target of $360, and after digging into their recent progress, I’m convinced the stock is heading towards $400 by the end of the year. The story here is simple: they are executing incredibly well on all the things that matter for long-term growth. Plus, Elon is back, ,fully focused on the company with a new incentive package designed to keep him at the helm for another ten years, giving him the authority to lead without bureaucracy (as long as he continues to deliver massive growth).

I think the market is finally starting to wake up to Tesla's real potential, but with the masses still focused on hating Elon because their media told them to, there's still time to get a decent entry. I expect a major repricing of the stock in the next two years as the world finally realises that Tesla is not a car company.

Here’s a quick look at what’s fuelling this update.

Robotaxi is Becoming a Reality

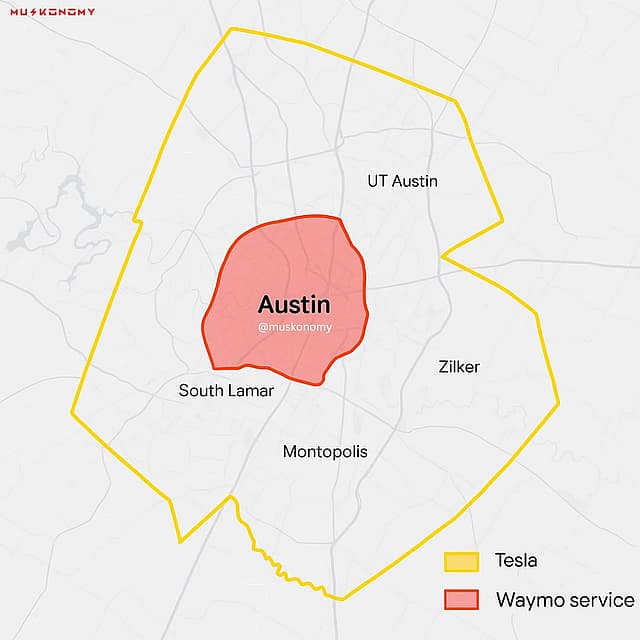

The Robotaxi deployment in Austin is moving along nicely. They're racking up thousands of miles of real-world driving data, and you can see the software getting smarter. The plan to start removing safety drivers by the end of the year shows just how confident they're getting.

I think the market is also finally acknowledging that Tesla’s vision-only approach, using just cameras and neural networks, ,is the key to scaling this quickly and affordably. This is how they will win. I still expect the disbelievers in the comments talking about how you need LiDAR, but the real-world results are starting to speak for themselves.

And now we're seeing the first signs of their aggressive expansion plans. Beyond Austin, they're already targeting a whole new wave of cities across the country. We're talking about key locations like Palo Alto, Brooklyn, Houston, Miami, and Tempe, among others. This isn't a slow, city-by-city rollout like the competition; this is the groundwork for a rapid, nationwide network. Slowly, and then suddenly, Tesla's autonomous network is going to be everywhere.

Megablock is a Game-Changer for the Energy Business

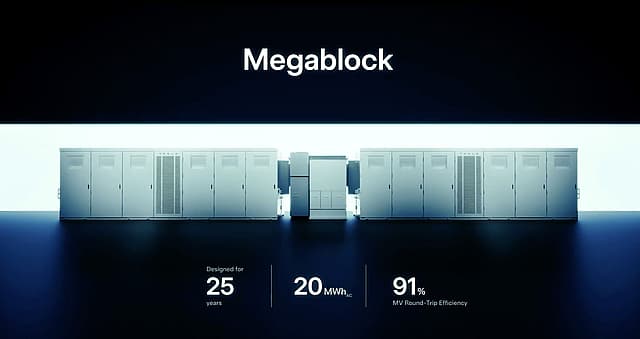

Tesla just dropped a bomb on the energy storage world with the new Megablock. This is a huge deal. It’s a massive, pre-packaged system that bundles multiple Megapacks together, and it’s designed for lightning-fast deployment.

Here are the key stats:

- 23% faster to install on-site.

- Up to 40% lower all-in construction costs.

- A massive 20 MWh of energy per block.

Deliveries start in 2026, and this innovation will supercharge the growth of their energy business, which is already becoming a powerhouse.

Car Sales Have Strong Tailwinds

I think the market is underestimating Tesla's Q3 deliveries. The $7,500 EV tax credit is ending this month, which should pull a ton of demand forward as people rush to get their orders in.

Beyond that, they're still crushing it globally. News just came out that Tesla has captured a massive 30% share of Japan’s EV market, a market that has been notoriously tough for foreign automakers to crack.

With the stock chart looking strong and seasonality favouring a rally into November and December, I see a lot of momentum building into the year-end.

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:TSLA. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.