Update shared on06 Aug 2025

Fair value Increased 16%Palantir Did It Again!

Palantir came into Q2 priced for perfection... and delivered.

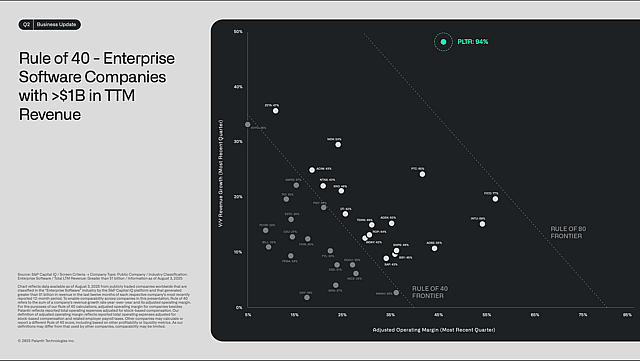

Revenue grew +46% year over year, blowing past already high expectations and pushing the Rule of 40 to a staggering 94. That’s elite, full stop. Even under standard accounting (including stock-based compensation), it still lands at a robust ~75, comfortably outperforming big tech players like Microsoft and Meta. This level of operational efficiency is almost unheard of for a company of this scale, and reinforces Palantir’s unique position in the AI and defense ecosystem.

Commercial traction remains robust, with U.S. commercial revenue up +69% YoY and international commercial up +28%. Momentum in AIP (Artificial Intelligence Platform) deployments continues to grow, with over 660 bootcamps held in Q2 alone, a testament to Palantir’s strategy of deeply embedding its tech into customer workflows.

On the government side, revenue grew +33% YoY, driven by strong U.S. demand. Notably, management guided for continued acceleration in government contracts in the second half of the year, as major awards from Q1 begin ramping.

Palantir also expanded its GAAP profitability, delivering $727M in TTM adjusted operating income with 44% margins. Free cash flow continues to climb as well, reaching $226M in Q2, up +42% YoY.

See Palantir’s full Q2 2025 business update: https://investors.palantir.com/files/Palantir%20Q2%202025%20Business%20Update.pdf

Still a premium business, with a premium price

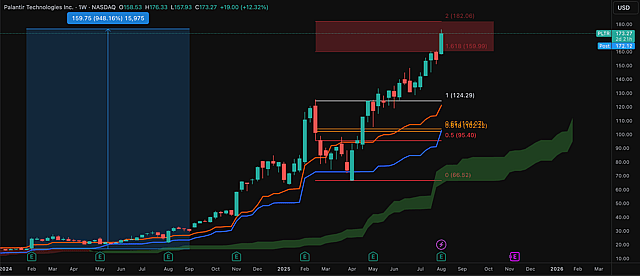

The market responded quickly pushing the stock above $175. That puts Palantir up 10x from the 2024 lows, and cements its status as one of the most powerful AI narratives in public markets.

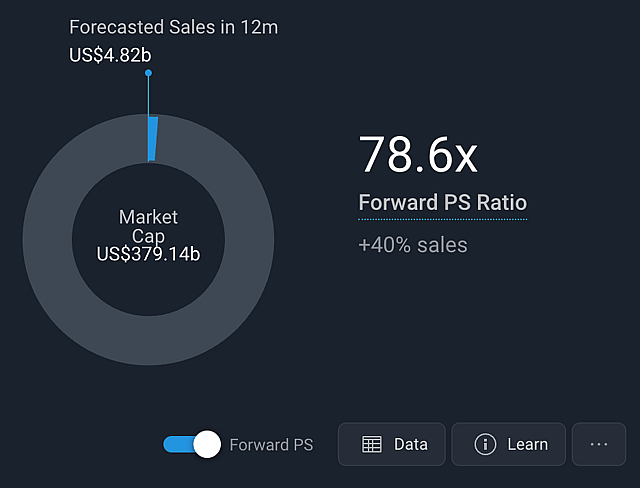

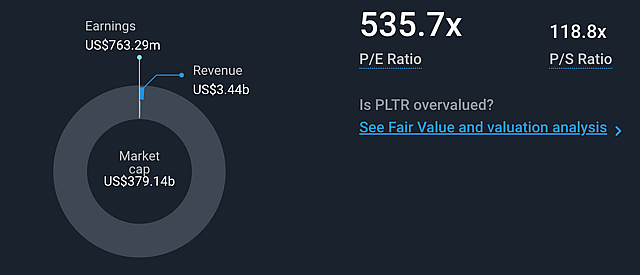

But at these levels, the stock trades at over 78x forward P/S. Even after another blockbuster quarter, it’s hard to argue the stock isn’t still priced for perfection.

Holding my ground (...and trimming a little)

My long-term view hasn’t changed: Palantir is still a company I want to own. Its position at the intersection of government, national security, and next-gen commercial infrastructure is unmatched. Execution remains strong. Momentum is real.

But valuation still matters. At $170+ and trading at over 500x earnings, the risk/reward just isn’t there for new buyers.

To be clear, I don’t think Palantir will ever be “cheap.” It will likely always carry a premium, and rightly so. But in my view, a 30%+ pullback from all-time highs would present a real opportunity, even if the stock remains above what I’d consider an already optimistic fair value.

If that reset comes during a broader market correction, I’ll consider adding. Until then, I’m holding my core position, trimming a bit to reallocate gains into ideas with more upside, and keeping a close watch.

Palantir did everything it needed to. That doesn’t guarantee near term upside, but the long term story certainly remains fully intact.

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:PLTR. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.