Update shared on07 Jul 2025

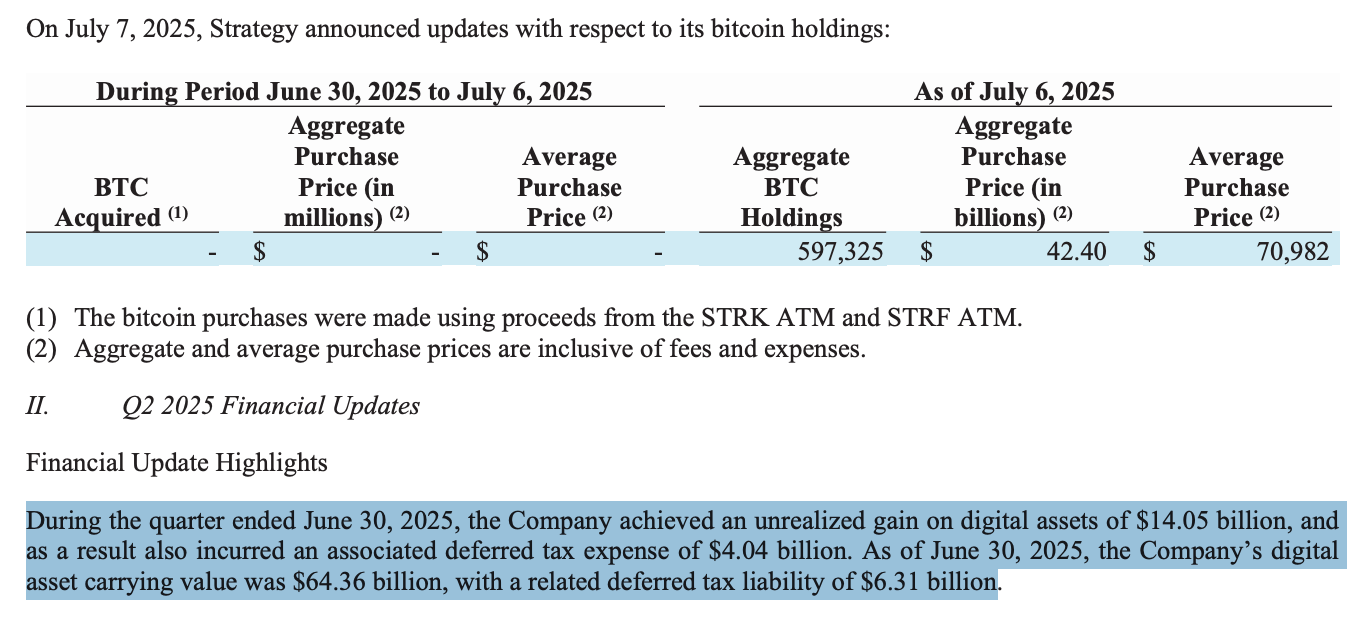

MicroStrategy, now rebranded as Strategy, continues to execute its radical evolution from enterprise software firm to Bitcoin-native financial platform. In Q2 2025, the company reported an eye-catching $14.5 billion in unrealised profit under the newly adopted fair value accounting standard.

This was the first full quarter in which Bitcoin appreciation flowed through to the income statement, giving the company GAAP net profitability for the trailing 12 months. While these gains are non-cash and reflect Bitcoin price movements rather than operational cash flow, they meet formal accounting standards and, critically, clear the final hurdle for potential inclusion in the S&P 500.

With this, Strategy now qualifies for consideration in America’s most tracked index. According to independent estimates, it has generated over $11 billion in net profit over the past year due to fair value gains. Although inclusion is not guaranteed (the S&P committee exercises full discretion) Strategy’s eligibility means that any S&P 500 index investor could soon gain indirect Bitcoin exposure through the company’s shares. This would mark a milestone moment: the first time Bitcoin becomes a part of the S&P 500, even if by proxy.

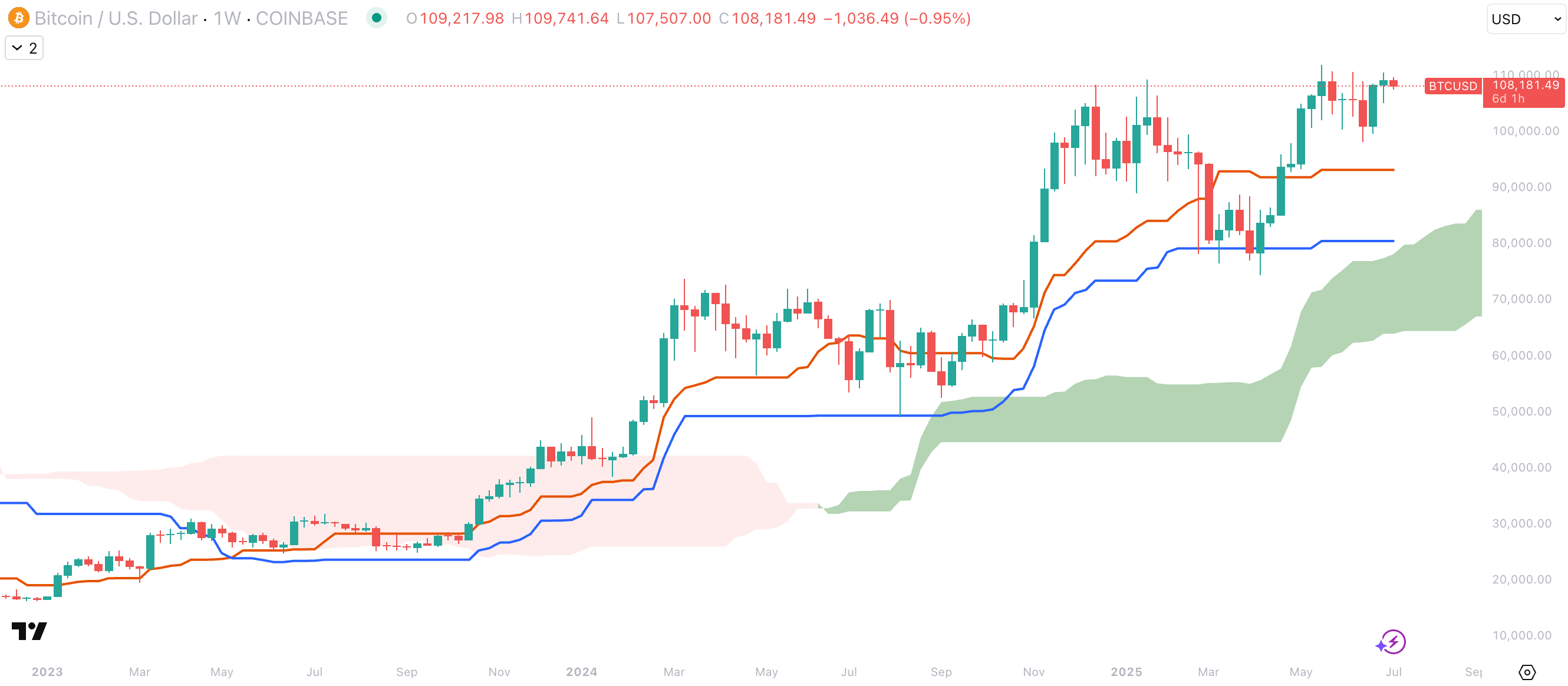

Since this thesis was first published in late 2024, Bitcoin has been consolidating around that level. As expected, we are now in a supply rotation phase, with long-term holders from the 2011 to 2013 cycle selling into strength while ETFs and institutions absorb that supply.

Strategy has remained committed and has expanded its capital plans, moving from the original 21 21 Plan to an even more ambitious 42 42 Plan, targeting $84 billion by the end of 2027 to grow its Bitcoin treasury. Notably, the company has not issued any new shares or preferred equity since June, preserving over $40 billion in ATM capacity as dry powder for future Bitcoin acquisitions.

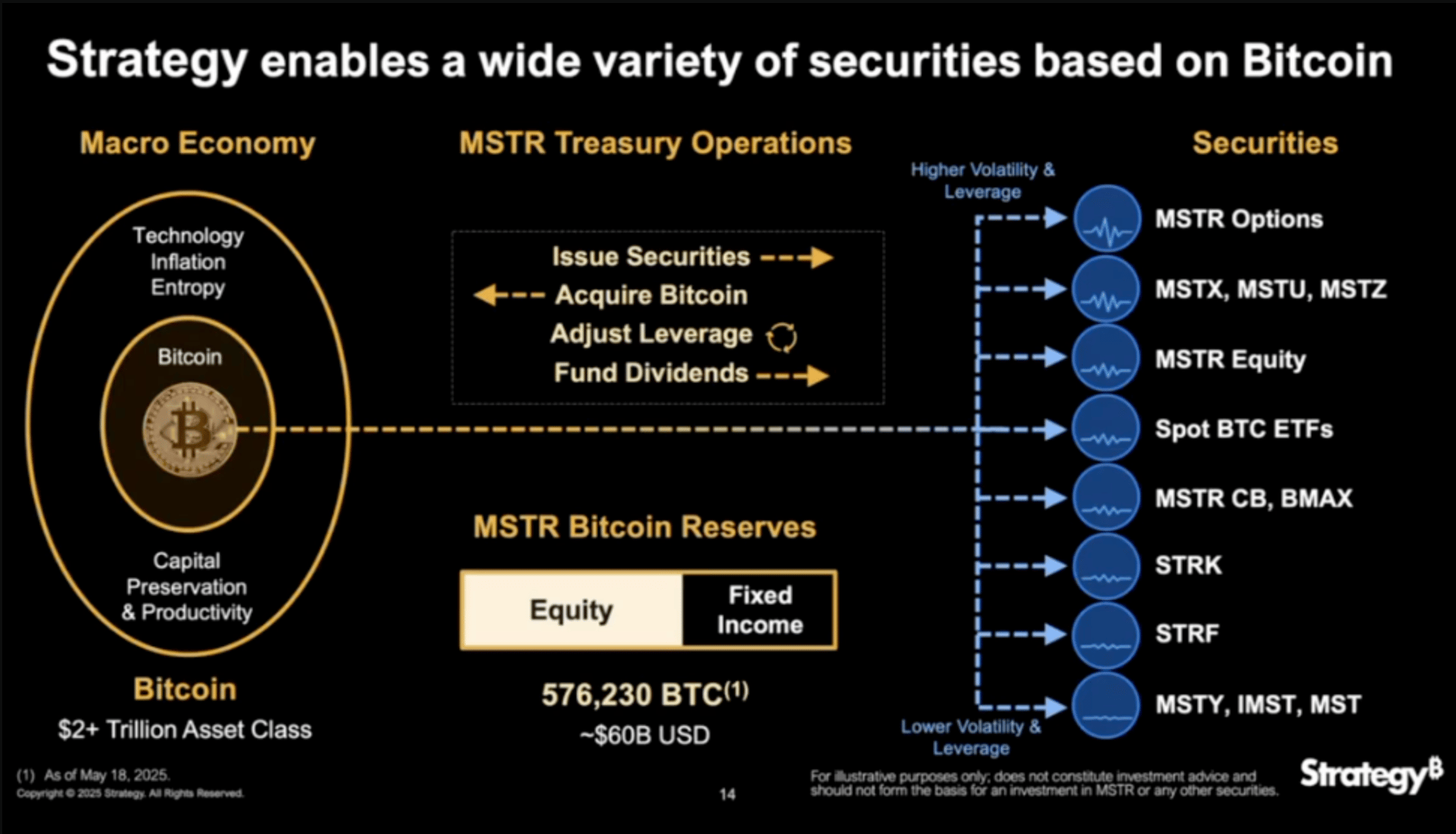

The rebrand to Strategy reflects more than a name change. It marks the company’s shift from software vendor to Bitcoin financialisation platform. Through instruments like Strike and Strife preferred shares, Strategy is pioneering new ways to raise capital without immediately diluting existing shareholders. This positions the company as more than a corporate holder of Bitcoin; it is now an active financial architect of Bitcoin-native capital structures.

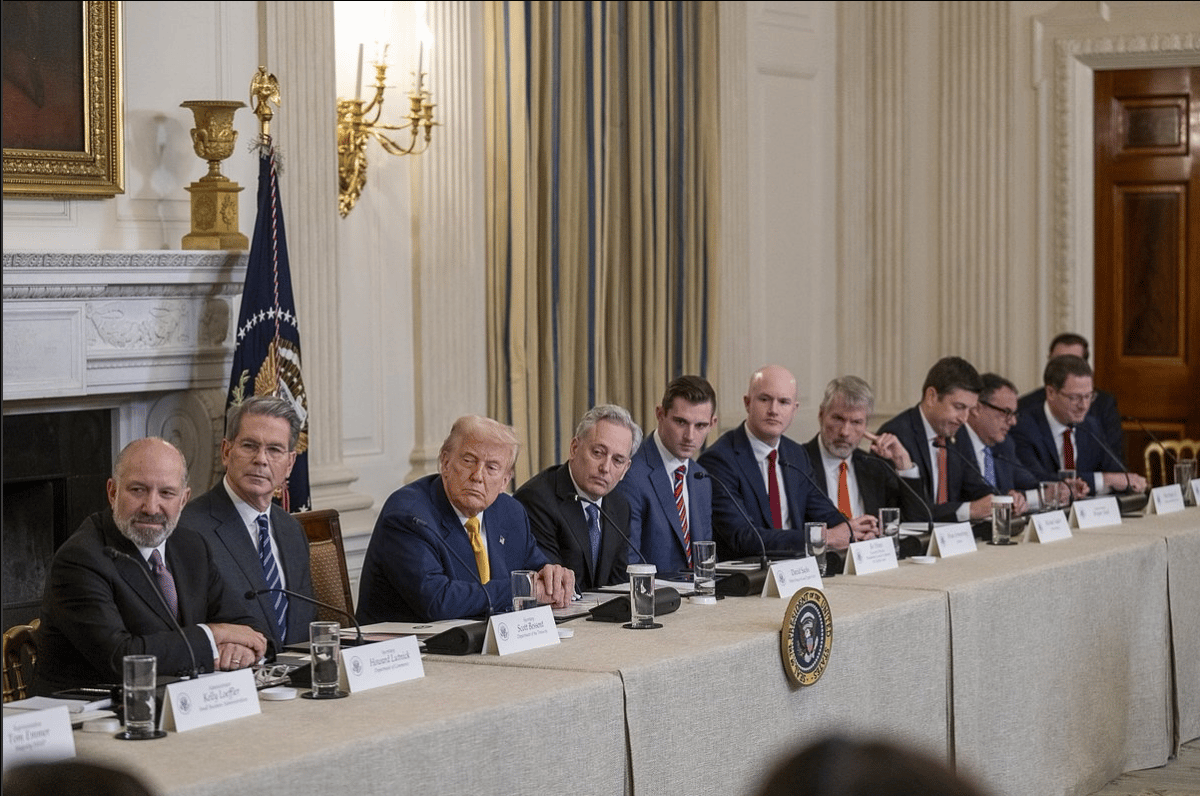

The regulatory environment has also moved in Strategy’s favour. Following the Republican victory in the 2024 US elections, crypto-friendly figures like Chris Bessent have taken Treasury roles, and a new SEC Chair with a supportive stance toward digital assets has been appointed. Michael Saylor has attended several White House events alongside key industry leaders, reinforcing the firm’s political alignment.

Meanwhile, the passing of the GENIUS Bill has established a regulated framework for stablecoins, and a second wave of pro-Bitcoin legislation, led by Senator Cynthia Lummis, is progressing. Most significantly, the US government has committed to holding Bitcoin as a strategic reserve asset, starting by freezing all current holdings and exploring ways to acquire more—such as through Bitcoin-backed bonds—without adding pressure to the federal deficit.

However, Strategy is no longer the only firm executing this playbook. A wave of Bitcoin treasury companies has emerged, most notably Twenty One Capital (NASDAQ: XXI), which now holds over 42,000 BTC and is backed by Tether, SoftBank, and Jack Mallers. These companies are replicating Strategy’s capital structure with PIPE deals, convertible notes, and speculative issuance, showing that the demand for public Bitcoin exposure is broadening.

A word of caution... Treasury Bubble Risk?

This trend also introduces risk. Many of these new Bitcoin treasury companies operate less like businesses and more like speculative vehicles, relying on continuous capital inflows rather than revenue. If sentiment shifts or liquidity dries up, forced selling from multiple firms could trigger a sharp downturn in Bitcoin, which would affect Strategy’s mark-to-market valuation as well. The risk is now systemic. While Strategy remains the most structurally sound and seasoned of these firms, it is no longer isolated and may still feel the effects if the broader Bitcoin treasury trend turns from asset accumulation to liquidation.

Despite these risks, the investment case remains intact. My base case fair value of $663 per share remains unchanged, based on partial execution of the 42 42 Plan and continued Bitcoin appreciation. After the current consolidation resolves and selling pressure from early holders abates, I expect Bitcoin to resume its long-term upward trend. For investors with conviction in Bitcoin’s trajectory, Strategy continues to represent the most asymmetric and compelling vehicle to gain exposure—now with the added tailwind of profitability, regulatory alignment, and potential S&P 500 inclusion.

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:MSTR. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.