Narratives are currently in beta

Announcement on 14 May, 2024

Experiences Is The Only Value Driving Segment For Disney As Streaming And Sports Fail To Drive Growth

- Disney’s CEO Bob Iger beat activist investor Nelson Peltz after a heightened campaign centered around shareholders. The company’s stock price saw an initial boost after Peltz announced the proxy fight. Incumbent management now has to keep performing in order to justify the expectations they set for shareholders.

- Disney's streaming applications, Disney+ and Hulu, are around break-even levels for the first time in Q2 2024, with a narrow loss of $18M compared to a loss of $659M a year prior. The entertainment segment revenues declined by 5% to $9.8B. The sports segment (ESPN) was mostly flat with 2% revenue growth and reported an 18% operating margin.

- Disney+ subscribers increased by 6.3M, reaching 117.6M global customers, while Hulu subscribers grew slightly to 50.2M, and ESPN+ subscribers fell to 24.8M from 25.2M YoY.

- Management anticipates softer streaming Q3 results, which in my opinion indicates an inability of Disney’s platform to transform into a profitable segment. The long-term expectations of management is that streaming will be a growth platform, but I fail to see sound reasoning behind this argument.

- I view the sports and streaming business as a difficult segment to transform, which will be under increased competition from Netflix and Amazon Prime.

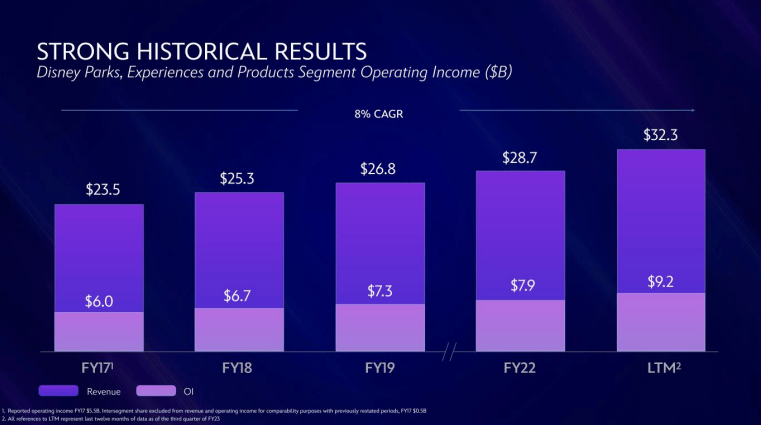

- Parks and experiences revenue rose by 10% to $8.4B, but Disneyland Resort in California saw lower profits due to cost inflation and higher labor expenses. Experiences are the key value driving segment of Disney at the moment. I anticipate that the company will keep driving growth in this segment and is the main reason I’m maintaining my 2028 forward value of $270B for Disney (translates to $192.5bn present value, or $100 per share).

- Disney needs to perform exceptionally well on the bottom-line in order to justify my valuation, and increase trailing 12-month net income from $1.7B to $13B, which is why there is significant risk with the company’s stock and I expect market reactions on a quarterly basis.

Key Takeaways

- Disney will transform to a tourism-centered company focusing on parks and resorts, a space lacking any serious competition.

- I expect sales to grow 4.3% over the next 5 years, primarily driven by Parks.

- Streaming business will struggle to produce profits, despite over 200 million subscribers.

- Post-transformation, Disney will revert to a stable company with 18% operating margins and $13B profits in 2028.

Catalysts

Disney Reorganizing Around Parks Is The Right Move For The Long-Term

Disney is undergoing a restructuring plan and recorded a $2.44B charge related to the removal of content to their direct to consumer service, cutting of 3rd party licenses, and $210M in severance fees.

The goal is to reorganize the business, cut $5.5B in costs, and terminate 7000 jobs. The new business consists of Entertainment (streaming), ESPN, and Parks. The new structure will be reported in the annual 2023 report, and while expensive in the short term, these changes should see margins improve.

Investing $60bn In A 29% Operating Profit Segment Should Transform Company Wide Margins

Disney plans to double its investment in its Parks segment over the next 10 years, from $30 billion to $60 billion. This investment will focus on expanding domestic and international parks, and cruise lines.

Disney's Parks business is a key value driver, and the company sees significant room for further expansion. Disney has over 1,000 acres of land for possible development to expand theme park space across its existing sites, and it is also planning to add three new cruise ships over the next two years.

The transformation is underway as the company is reporting sales growth by 13% YoY, primarily driven by the Shanghai and Hong Kong Disney resorts.

Disney Presentation: Parks Fundamental Performance

Disney also has the largest physical footprint of any global theme park travel business, with 12 parks across six sites around the world. Finally, Disney has seven of the top ten most attended theme parks in the world, and it is looking to reach more of its existing fans and create new fans.

Disney Presentation: Park Locations

Disney is in a unique position to capitalize on its physical assets as key peers compete-out streaming profits. While Disney is having difficulties producing returns on its digital assets, the company is close to a monopoly for its experiences and has a strong value proposition for parents wanting to give their kids quality time.

Streaming Will Have Challenges Providing Value Due To High Levels Of Competition

In Q3’23 streaming revenues increased by 9% to $5.5B and operating loss decreased from $-1.1B to $-0.5B. The segment will likely break even by the end of 2024, but is far from the anticipated performance when Disney+ launched in 2019. Streaming is set in a highly competitive space with Netflix, Warner Bros, Amazon Prime, etc. However, despite gaining 219.6 million subscribers, 105.7 million ex. Hotstar, the company is having difficulties producing a profit.

Disney Press Release: Number of Paid Subscribers

Disney is increasing the pricing of their ad-free tier by October and will crack-down on password sharing. This may provide a one-time benefit but reduce the potential for subscriber growth.

Assumptions

Strategizing Around Parks Will Help Disney Retain Market Leadership

I estimate that Disney will undergo a change in trajectory, maintaining a positive present value on its entertainment segment, somewhat capitalizing on ESPN, and converting Parks to a key profit center. The company has substantial competition in media both from streaming and alternative media platforms like YouTube. This is prompting Disney to focus on its Parks where it holds market leadership for the parents of young children, who feel compelled to take their kids at least once to a Disney park.

Revenue From Parks Will Almost Double Over The Next Five Years

I see Disney growing by 4.3% on average, and may have turbulent revenues until the new business model settles around $110B in sales in 2028. I estimate Parks to make up most of the future revenues and grow by 90% from $32B to $61B, this includes my assumption that Parks reach 90%+ occupancy levels within the next 5 years and that demand for Disney Cruises stays strong, continuing at the 98% booking rate we see now. The remaining revenue sources consist of ESPN with $30B, and Entertainment with $19B in five years.

Cost Cutting Measures And A Focus On Parks Will Give An Uplift To Operating profit

I assume that Disney will retain a high 25% operating margin for Parks, while the combined operating margin will be 18% due to cost cutting efforts in the Entertainment segment. This yields an operating profit of $20B in five years.

Disney’s Choice To Focus On Hard Assets Like Parks Will Improve Earnings Stability And Reduce Risks

Disney will revert to a stable company and derive revenues from hard assets like parks, resorts and cruises. This will result in a lower required return of around 8%. Simply Wall St’s current discount rate is 7.9% (3rd October), which I think is fair, so I’ll use that.

Disney Will Not Need To Reinvest As Much To Drive Growth, Improving The Bottom Line

As a stable company, Disney will have to reinvest a lower portion of its operating profit into driving growth (10%), along with a 25% tax rate, I estimate that the company will convert 65% of the operating profits to net profit, resulting in $13B in 2028.

Disney’s Earnings Multiple Will Converge At A Point Between The Hotel Industry And The Entertainment Industry

I assume that Disney will converge on a 20.6x PE ratio based on a weighted average for the Hotel & Resorts industry (55% x 21.4 median PE), and the Entertainment industry (45% x 19.5x median).

Risks

A Focus On Tourism Could See Performance Become Cyclical And Sensitive To Economic Downturns

While I assume stabilization from pivoting to Parks, Disney may be trading one set of risks for another as the tourism industry is cyclical and subject to a number of risks, such as economic downturns.

Competition Looms From Other Large Theme Park Operators

Disney is also facing increasing competition from other theme park operators, such as Universal Studios and Six Flags.

Pivoting Away From Entertainment Could Be Risky As It May Be A Transformative And Innovative Industry

The entertainment & media industry may transform faster than I anticipate, with distributed networks, creator marketplaces and smaller studios being able to leverage novel (possibly AI) technology to create content.

How well do narratives help inform your perspective?

Disclaimer

Read more narratives