Update shared on13 Sep 2025

Fair value Decreased 3.85%Here’s the freshest, need-to-know on Cerrado Gold (TSXV: CERT / OTCQX: CRDOF), focused on your three pillars:

Gold/Silver bull market (macro tailwind)

- Gold just printed successive all-time highs around $3,600–$3,670/oz on growing Fed-cut expectations, a weaker USD and record central-bank buying. Major houses (ANZ) now see $3,800 YE-2025 and a possible $4,000 peak by mid-2026. (Financial Times)

- Silver is riding gold’s coattails: UBS lifted targets (mid-$40s), and YTD the metal pushed into the $37–$41/oz zone recently, with structural deficits and ETF inflows cited. (Investing.com)

Implication for Cerrado: the macro tape is the best it’s been—higher gold/silver prices directly amplify MDN margins today and improve project finance odds for Lagoa Salgada.

Extending Don Nicolás (Argentina)

- Production trending up / guidance raised: Q1-2025 MDN output 11,163 GEO; heap-leach set a record and 2025 guidance was increased to 55–60k GEO, with underground production slated to start H2-2025. (Panorama Minero)

- Q2-2025: output 11,437 GEO; heap-leach hit another record with 7,864 GEO; crushing circuit expansion enabled the ramp. (Cerrado Gold)

- Company commentary (late-Mar/May updates) indicated ~55k oz pa for the next 3–4 years as underground (Paloma) comes online, supporting life-of-mine extension efforts. (Cerrado Gold)

Read: MDN’s heap-leach expansion + underground start-up are tangible steps that help bridge the short nominal LOM and create a platform for deeper exploration (drilling from underground is cheaper & more precise). (Panorama Minero)

Successfully financing & building Lagoa Salgada (Portugal)

- Acquisition closed (Ascendant → 80% LS): Cerrado completed the all-share acquisition on May 16, 2025, consolidating 80% of Lagoa Salgada. (Cerrado Gold)

- Permitting momentum: On July 14, 2025, Portugal’s environment agency (APA) allowed Article 16 procedures—Cerrado/Redcorp can submit EIA revisions to address comments without restarting the full process. They have ~180 days to file the revised docs; several improvements (e.g., eliminating cyanide, enhanced aquifer protection, real-time environmental monitoring) are already baked into the Optimized Feasibility Study (OFS). (Cerrado Gold)

- OFS & financing timeline: Company materials/partners indicate the OFS targeted for Sept-2025, with project-finance options advancing in parallel while the EIA is updated. (lt.morningstar.com)

Read: The Article-16 path materially de-risks permitting (no full re-start) and lets Cerrado push OFS, engineering and financing concurrently—supporting the 2026 construction / 2027 production pathway you’re modeling. (Cerrado Gold)

Bonus liquidity note

Cerrado also disclosed US$8.75M received from Hochschild (MDC deal milestone), improving near-term liquidity alongside MDN cash generation. (Junior Mining Network)

Bottom line (quick take)

- Macro: Strongest gold backdrop in history; silver firm—clear positive delta to MDN margins and LS bankability. (Financial Times)

- MDN life-extension: Active—heap-leach expansions working, underground mining commencing H2-2025, guidance up. Execution now matters quarter-to-quarter. (Panorama Minero)

- Lagoa Salgada: Permit track improved via Article-16; OFS near-term; financing discussions ongoing during the EIA-revision window. This keeps the 2026/27 timeline plausible if metals stay strong and lenders like the revised plan. (Cerrado Gold)

The short mine life at Don Nicolás (Argentina) has been the main overhang for Cerrado. Here’s what the latest tells us:

⛏️ Current Published LOM

- Earlier technical disclosures pegged Don Nicolás at ~4 years of reserves (heap leach + UG blend). That was the figure investors have been using.

- This is what you referred to in your April 2025 summary — short and worrisome without new discoveries.

📢 What Changed in 2025

- Q1-2025 update: heap-leach throughput and recovery beat expectations → management raised 2025 guidance to 55–60k GEO and confirmed underground (Paloma) production start in H2-2025.

- Q2-2025: heap-leach hit another record (7,864 GEO in the quarter) and the crushing circuit expansion was completed. Total output 11,437 GEO.

- Management commentary: production can hold at ~55k oz/year for 3–4 years, as UG feed ramps in and heap-leach continues strong. This effectively backfills the “4-year cliff.”

🔍 Why Underground Matters

- By driving underground development at Paloma/other zones, they can:

- Access deeper ore that hasn’t been drilled from surface.

- Drill from underground more cheaply, which often leads to step-out extensions.

- Incrementally add years to mine life with less exploration cost vs surface programs.

⚠️ Risks

- Still no large reserve base yet: It’s “rolling 3–4 years” — they need to keep drilling to stay ahead.

- Exploration risk: If new ore isn’t found at scale, Don Nicolás could still face a hard stop later this decade.

- Argentina jurisdiction: Currency controls, inflation, and political risk could make funding exploration or repatriating cash difficult.

✅ Bottom Line

- The “4-year mine life” headline is no longer a hard stop — ongoing heap-leach strength + UG start give a running 3–4 years of visibility.

- If underground exploration is successful, life can extend materially, but Cerrado hasn’t yet booked those ounces into reserves.

- For valuation: Don Nicolás is best treated as a cash-flowing bridge asset (generating ~$50M FCF in 2025 at $2,900 gold) that supports Lagoa Salgada and buys time for Sorcier.

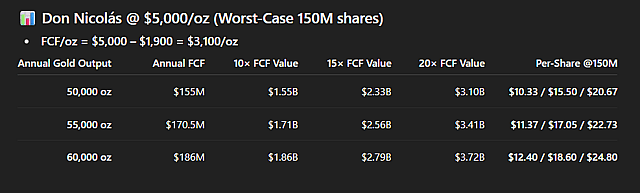

Don Nicolás FCF model at $5,000 gold, but this time using a worst-case fully diluted share count.

From Cerrado’s share structure page:

- Basic: ~134M

- Options: ~5.4M

- Warrants + other dilutives: when maxed out, it looks closer to ~150M fully diluted (rounding up for safety).

✅ Takeaway

- With 150M shares fully diluted, the per-share upside is trimmed by ~⅓ vs the 100M assumption.

- Still, at $5,000 gold, even the low output case (50k oz) suggests a $10–21/share valuation range under 10–20× FCF multiples.

- This excludes Lagoa Salgada (silver/base metals) and Sorcier (iron ore), which could add significantly more upside if they reach production.

🏗️ Assumptions

- Don Nicolás (Argentina, gold):

- Output: 50k–60k oz/year

- Cost: $1,900/oz

- Gold price: $5,000/oz → FCF/oz = $3,100

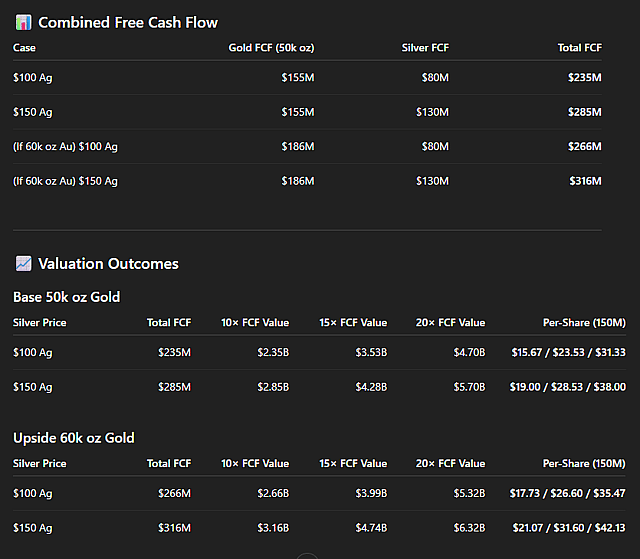

- Lagoa Salgada (Portugal, silver):

- Output: 1M oz Ag/year

- Cost: $20/oz

- Silver price: $100–150/oz → FCF/oz = $80–130

- Shares Outstanding: 150M (worst-case fully diluted)

- Multiples: 10×, 15×, 20× FCF

✅ Takeaway

- At $5,000 gold & $100 silver, Cerrado could trade in the $15–35/share range.

- At $5,000 gold & $150 silver, the valuation jumps to $19–42/share, even under 150M diluted shares.

- This excludes Sorcier (iron ore), which could add another ~$250M FCF post-2030 if developed or sold.

Disclaimer

The user RockeTeller has a position in TSXV:CERT. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.