Key Takeaways

- Focus on value-based care and strategic exits from less profitable markets like Brazil suggests a push for operational efficiency and shareholder value enhancement.

- Investments in digital and AI technologies, along with expansion in Medicare Advantage, aim to boost efficiency, customer service, and sustainable revenue growth.

- Shifts in Medicare Advantage funding and care patterns among seniors, alongside competition and regulatory changes, pose risks to UnitedHealth Group's profitability and growth.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Optum Health's strategic growth plan, focusing on value-based care, is expected to positively impact revenue by serving an additional 750,000 patients under such arrangements, which could significantly boost patient engagement and improve health outcomes, driving revenue growth.

- The sale of Brazil operations, as part of a strategic move to focus on core growth opportunities, suggests an optimization of capital deployment that could improve operational efficiency and enhance shareholder value by reallocating resources towards more profitable areas.

- Continued investments in digital engagement and AI across UnitedHealth Group, particularly within UnitedHealthcare and Optum Rx, are likely to increase efficiency, improve customer service, and reduce costs, which could positively impact net margins by lowering operating costs.

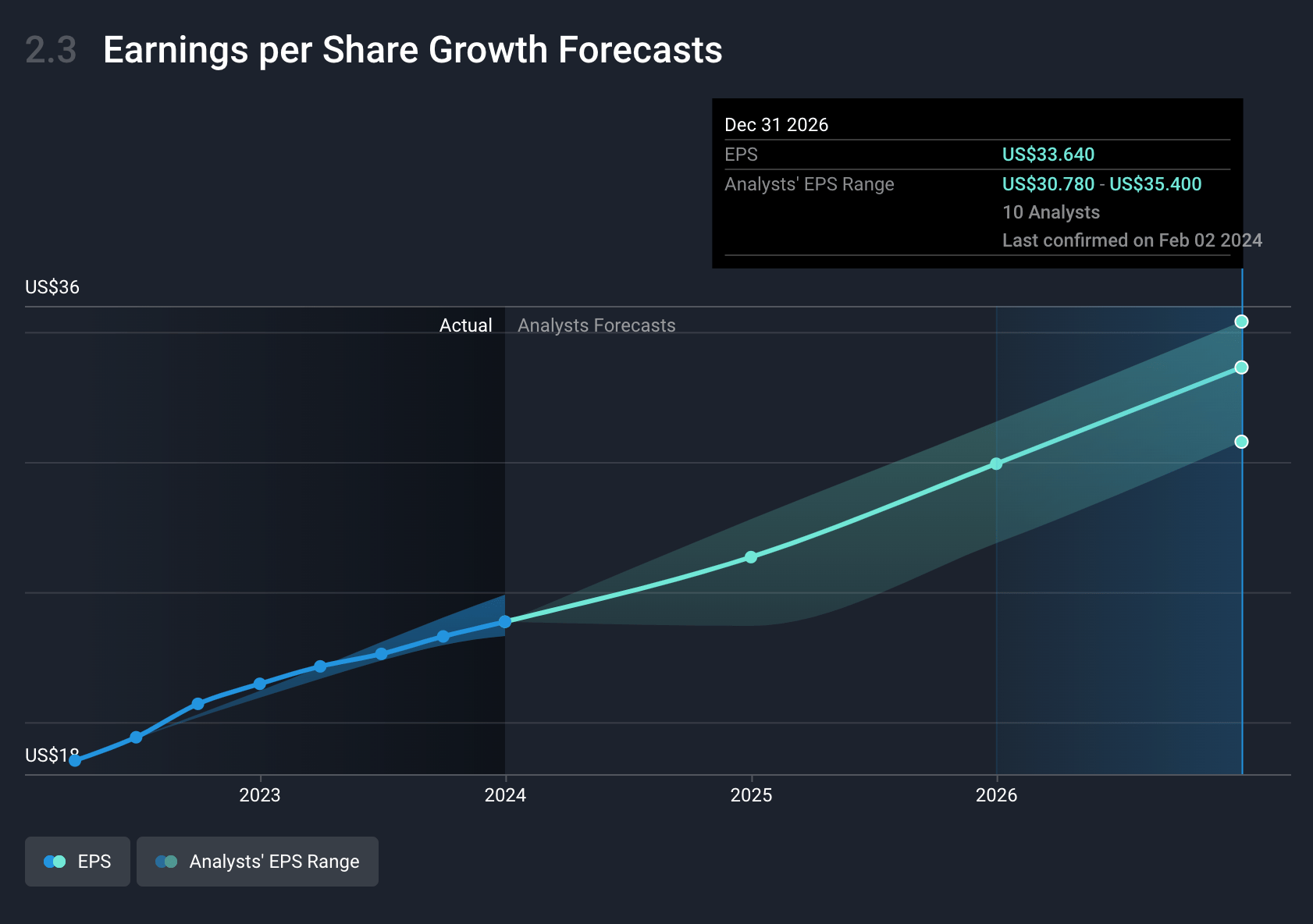

- The commitment to a 13% to 16% long-term adjusted earnings per share growth rate demonstrates confidence in the company-s future growth trajectory, likely reflecting strategic initiatives that could drive revenue growth and margin expansion.

- The expansion within Medicare Advantage and commercial offerings, highlighted by gaining new consumers and effective management of supplemental benefits, indicates potential for sustainable membership growth and revenue expansion, positively impacting earnings through increased scale and market penetration.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming UnitedHealth Group's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 6.6% in 3 years time.

- Analysts expect EPS to reach $33.64 ($30.5 billion in earnings) by about February 2027, up from $24.2 today.

Risks

What could happen that would invalidate this narrative?

- The reduced Medicare Advantage funding outlook and pressure from shift in care activity among seniors could impact future profitability and growth margins, creating risks for revenue sustainability and net margins.

- The need for considerable investments to adapt to reduced MA funding and the pressure to manage care patterns effectively could strain operational efficiencies and impact earnings.

- Competition in Medicare Advantage and commercial offerings, along with aggressive market pricing, poses risks to retaining and growing membership, potentially affecting revenue growth. - Dependence on the successful expansion and engagement in value-based care and digital health innovations carries execution risk, which could impact revenue and growth prospects if not effectively managed.

- Regulatory changes and health system contract disputes in the Medicare Advantage space could lead to network disruption and member dissatisfaction, impacting membership growth and revenue.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.