Key Takeaways

- Merck's strategic acquisitions and collaborations, notably with Prometheus and Daiichi Sankyo, aim for long-term growth by diversifying in oncology and beyond.

- Significant R&D investments underline a promising pipeline of therapies and vaccines, signaling potential revenue boosts from innovation market introductions.

- Merck faces challenges from competition in oncology, pipeline risks, KEYTRUDA competition post-2028, operational issues with new launches, and foreign exchange impacts.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The acquisition of Prometheus and collaboration with Daiichi Sankyo signal a strategic expansion in Merck's pipeline, potentially driving long-term growth through diversification in oncology and other areas, which could lead to revenue growth through new product launches. - Ongoing and increased investments in R&D, highlighted by a commitment of over $30 billion, suggest a strong pipeline of transformative therapies and vaccines, poised to enhance revenue growth as these innovations reach the market.

- The anticipation of FDA action on sotatercept for the treatment of pulmonary arterial hypertension and the preparedness for its strong uptake demonstrate an immediate catalyst for revenue growth in the cardiometabolic disease segment.

- The FDA's priority review of V116 as a new vaccine for pneumococcal disease in adults and its potential to achieve majority market share signifies an upcoming catalyst for robust growth in the vaccines segment, impacting revenue positively.

- Merck's focus on expanding its leadership in oncology through the advancement of clinical programs and diversification of late-stage programs indicates a strategic move to sustain long-term growth in this high-revenue segment by potentially improving net margins through the successful commercialization of novel candidates.

Assumptions

How have these above catalysts been quantified?

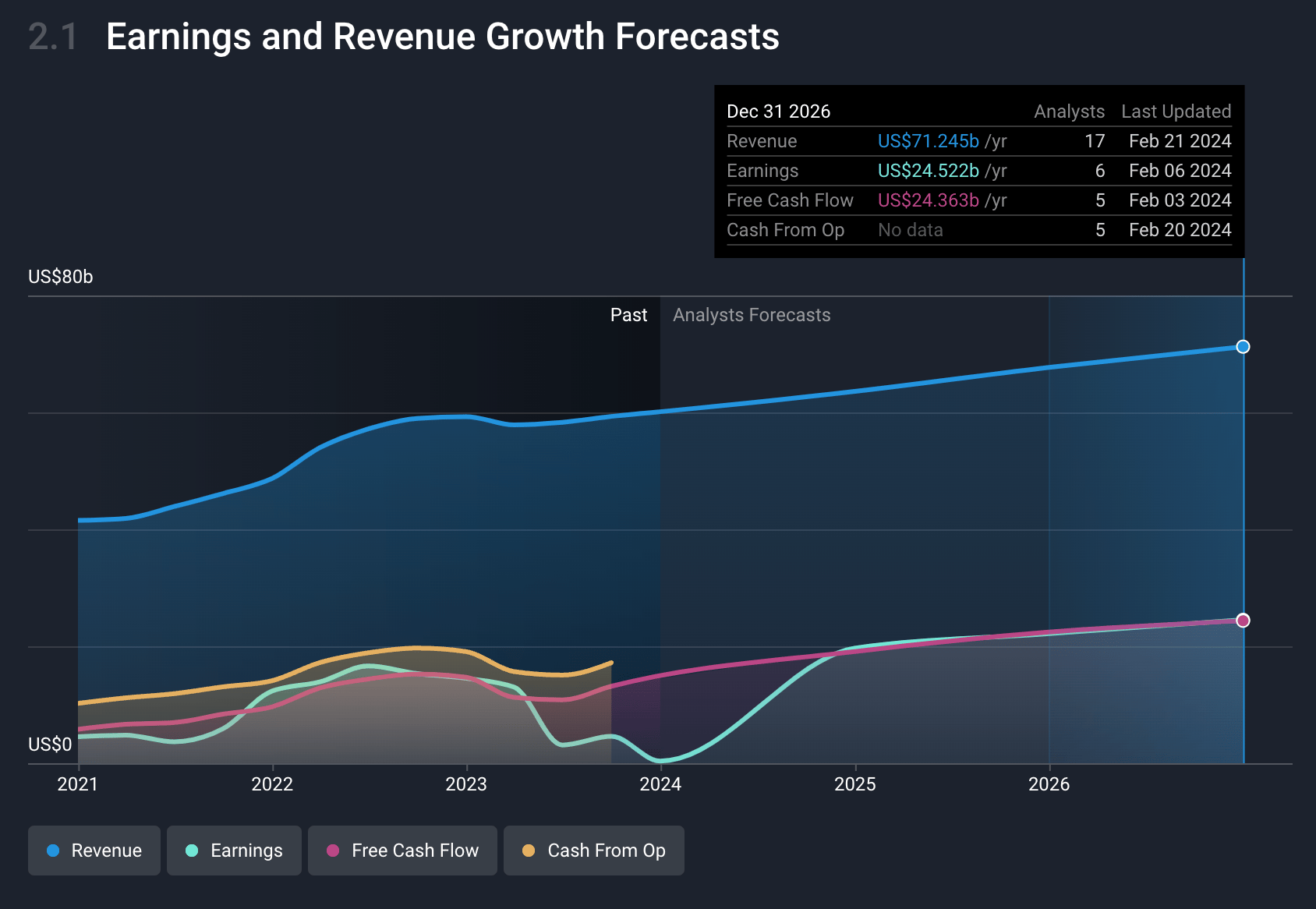

- Analysts are assuming Merck's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.6% today to 34.4% in 3 years time.

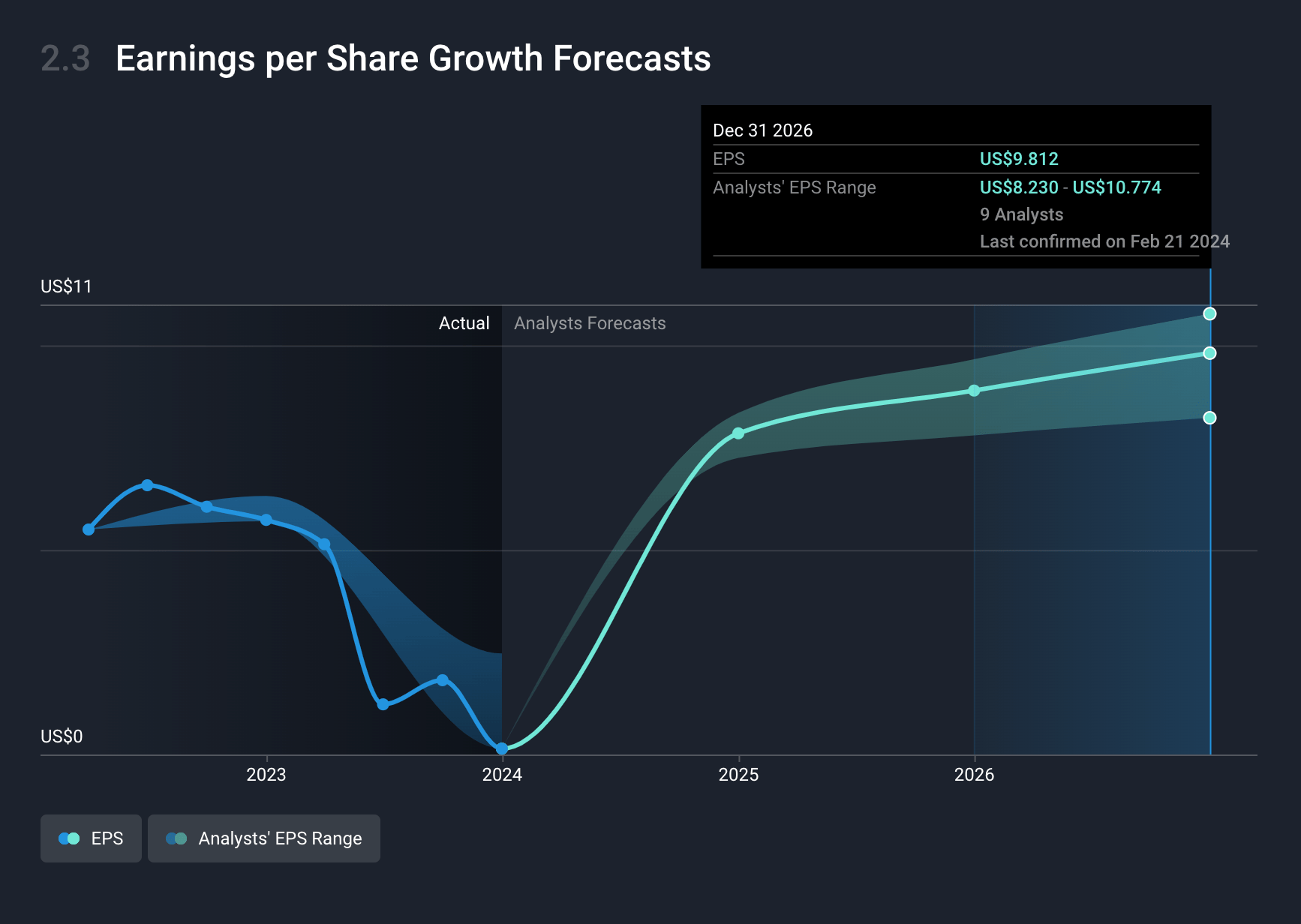

- Analysts expect EPS to reach $9.78 ($24.5 billion in earnings) by about February 2027, up from $0.14 today.

Risks

What could happen that would invalidate this narrative?

- Heightened competition in the oncology market could erode market share and impact Merck's revenues, given its significant investment and forecasted growth in this area.

- Risks associated with pipeline projects failing to meet clinical endpoints or getting delayed regulatory approvals, impacting expected future earnings.

- Reliance on key products like KEYTRUDA facing biosimilar competition after 2028, potentially affecting net margins due to price pressures and lower sales.

- Operational and execution challenges related to scaling up for sotatercept and V116 launches, potentially impacting revenue growth and profit margins if not managed efficiently.

- Potential adverse effects from fluctuating foreign exchange rates could negatively impact reported revenues and earnings, as indicated by the expected 2% hit from foreign exchange challenges including the Argentine peso devaluation.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.