Key Takeaways

- Expansion in global LNG and strategic acquisitions signal potential for revenue growth and diversification of the asset base.

- Commitment to returning significant value to shareholders and enhancing GHG emissions targets may boost investor attraction and EPS.

- Economic, regulatory, and operational challenges could negatively impact ConocoPhillips' profitability, cash flow, and competitive position in the oil and gas industry.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Expansion and development in key strategic initiatives, such as the advancement in global LNG strategy, FID at Port Arthur, and the acquisition of the remaining 50% of Surmont at an attractive price, signal potential for revenue growth and diversification of the asset base.

- Delivering on a plan to return $11 billion to shareholders in 2023 and announcing a plan for $9 billion in 2024 underlines a strong commitment to shareholder returns, possibly increasing EPS through buybacks.

- Record production and a preliminary reserve replacement ratio of 123% demonstrate effective resource management and operational efficiency, potentially improving revenue and net margins.

- Flagged deflation benefits of $200 million to $300 million, mainly in the Lower 48, coupled with a forecast of around 2% to 4% underlying growth pro forma for acquisitions and dispositions, indicate cost reductions and revenue growth opportunities.

- Enhancement and commitment towards GHG emissions intensity targets, including achieving the Gold Standard Pathway designation, may improve sustainability credentials, potentially making the stock more attractive to a broader base of investors concerned with ESG factors.

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

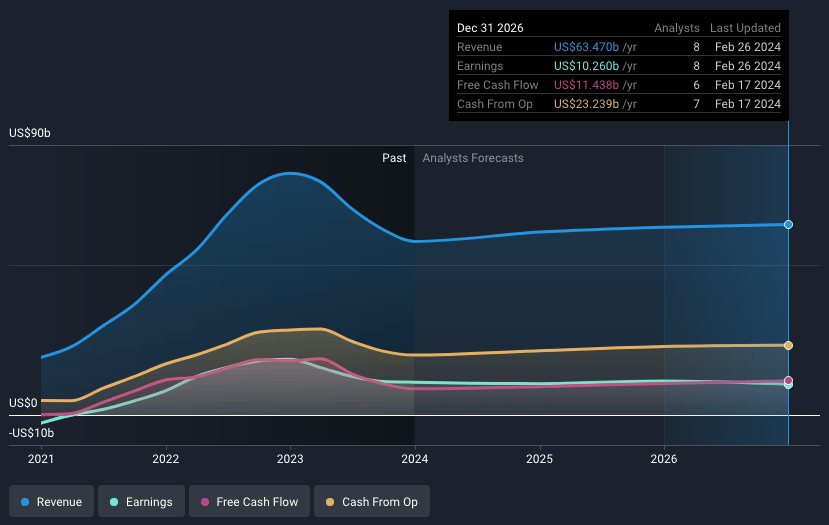

- Analysts are assuming ConocoPhillips's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.9% today to 16.3% in 3 years time.

- Analysts expect EPS to reach $9.39 ($10.4 billion in earnings) by about February 2027, up from $9.28 today.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- Global and regional economic conditions may adversely affect oil and gas demand and prices, potentially reducing ConocoPhillips' revenue and affecting its profitability.

- Fluctuations in commodity prices, particularly declines in oil and natural gas prices, could negatively impact ConocoPhillips' cash flow and ability to maintain or grow dividends.

- Regulatory and policy changes related to environmental concerns, including greenhouse gas emissions targets, could increase operational costs or limit project viability, impacting net margins.

- Operational risks associated with drilling and production activities, including challenges in resource replacement and execution of key strategic initiatives, may affect the company-s ability to sustain or increase production levels, impacting earnings.

- Competition within the oil and gas industry, especially in the LNG market and resource development areas, could affect ConocoPhillips' market position and pressure earnings.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.