Key Takeaways

- Increased investment in growth brands and successful commercialization of products like Breyanzi hint at significant revenue growth from market traction.

- Diversification in oncology through acquisitions and advancements in early-stage pipeline promise a robust future growth trajectory and potential revenue increase.

- Concerns around execution risks, slower growth for new products, negotiation uncertainties, competitive market challenges, and increased operational expenses impacting earnings and efficiency.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Increased investment in key growth brands like Camzyos and Sotyktu could lead to higher revenue growth as these newer products gain traction in their respective markets.

- The successful commercialization and expansion of Breyanzi, especially with FDA priority reviews for new indications, could significantly boost sales, impacting revenue growth positively.

- Advancements in the early-stage pipeline, notably with 10 Investigational New Drug (IND) submissions, suggest a strong future growth trajectory, potentially increasing future revenue as these products progress.

- Diversification and expansion of the oncology portfolio through acquisitions (e.g., Mirati acquisition, planned addition of bispecific ADC from SystImmune, and RayzeBio acquisition) could lead to revenue growth from new oncology products.

- Efforts to improve operational efficiencies and productivity, including prioritization of high-return projects and the absorption of operational expenses from acquisitions like Karuna, could enhance net margins.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Bristol-Myers Squibb's revenue will decrease by -0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.8% today to 24.3% in 3 years time.

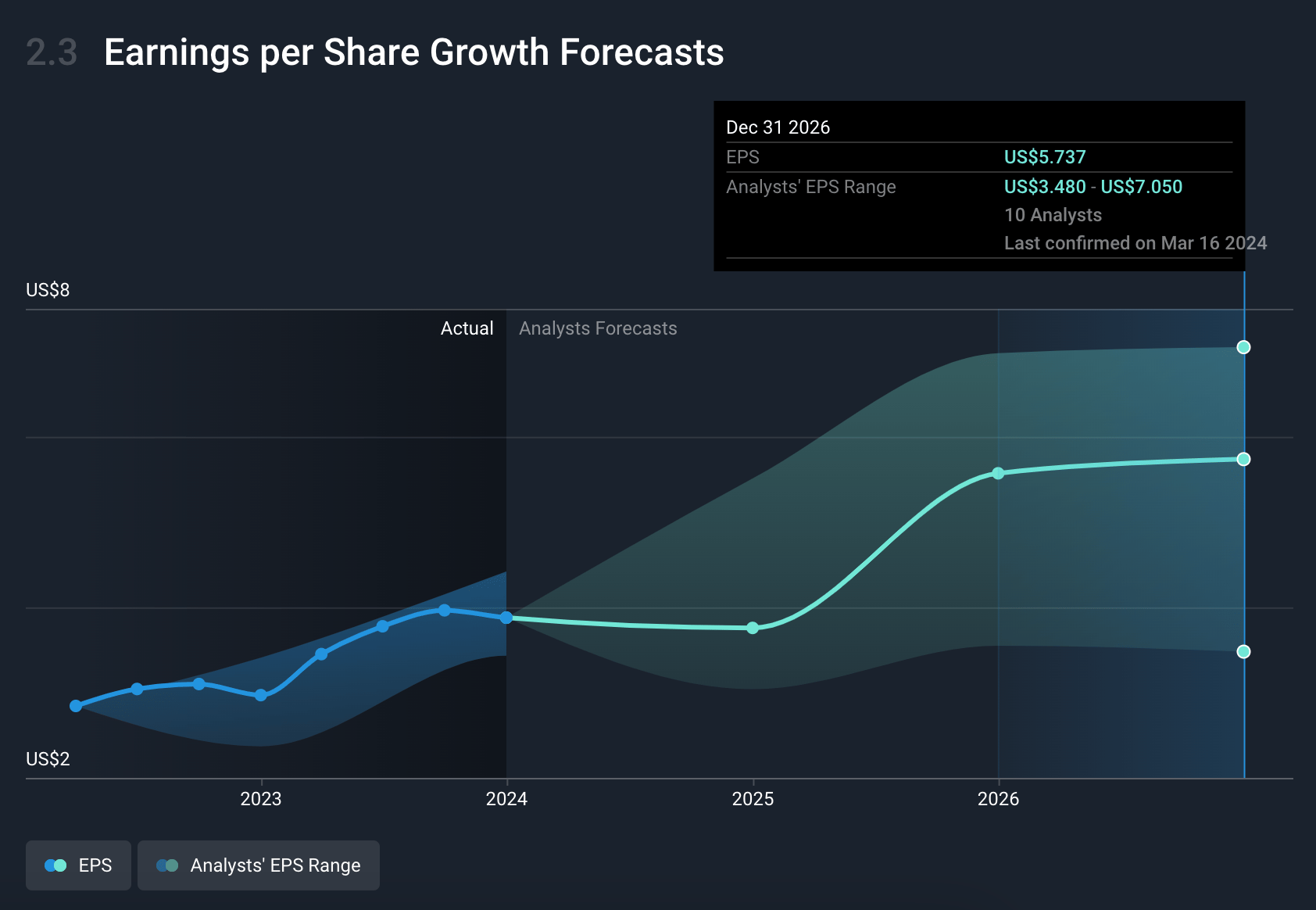

- Analysts expect earnings to reach $10.8 billion (and earnings per share of $5.72) by about March 2027, up from $8.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2027 earnings, down from 13.2x today.

- To value all of this in today’s dollars, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Concerns about execution and integration risks as Bristol-Myers Squibb navigates significant business development transactions and pipeline milestones, which could impact earnings and operational efficiency.

- Potential for slower-than-expected growth or market penetration for newly launched products like Camzyos and Sotyktu, impacting revenue projections.

- Uncertainty surrounding negotiations under the Inflation Reduction Act for Eliquis and its impact on net prices, which could affect revenue and margins.

- Challenges in expanding the use of cell therapies like Breyanzi and Abecma in competitive markets, which may influence revenue growth expectations.

- Risk of increased operational expenses as the company absorbs OpEx from recent acquisitions such as Karuna Therapeutics, potentially impacting net margins.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $55.25 for Bristol-Myers Squibb based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $44.3 billion, earnings will come to $10.8 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of $52.49, the analyst's price target of $55.25 is 5.0% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.