- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Southwest Gas Holdings (SWX): Assessing Valuation After Recent Share Price Gains and Sector Optimism

Reviewed by Simply Wall St

See our latest analysis for Southwest Gas Holdings.

Southwest Gas Holdings has posted a 1-year total shareholder return of just over 10%, with steady upward momentum since the start of 2024. Recent share price gains reflect renewed optimism about future growth, as investors react to sector trends and improving fundamentals.

If you’re interested in expanding your watchlist beyond utilities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares now trading just below analyst price targets after a healthy run-up, investors are left to wonder whether Southwest Gas Holdings is still undervalued or if the market has already priced in future growth.

Most Popular Narrative: 4.6% Undervalued

At $79.84, Southwest Gas Holdings trades just below the most widely followed fair value estimate of $83.67. With updated assumptions and raised targets, many are asking what is really driving this modest upside.

Favorable regulatory developments such as Nevada's new alternative ratemaking legislation and progress on formula rates in Arizona and California provide visibility into faster cost recovery and mitigated regulatory lag. This should enhance margin stability and earnings predictability.

Curious why the narrative values SWX higher than the current price? The foundation: new growth bets, margin headwinds, and an industry-standard profit multiple. Want to know the bold financial projections hidden underneath? Read the rest to uncover the surprising levers shaping this analyst consensus.

Result: Fair Value of $83.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating decarbonization trends and tighter regulatory caps could put pressure on Southwest Gas Holdings’s long-term growth and test the bullish valuation thesis.

Find out about the key risks to this Southwest Gas Holdings narrative.

Another View: Market Ratios Point to Risk

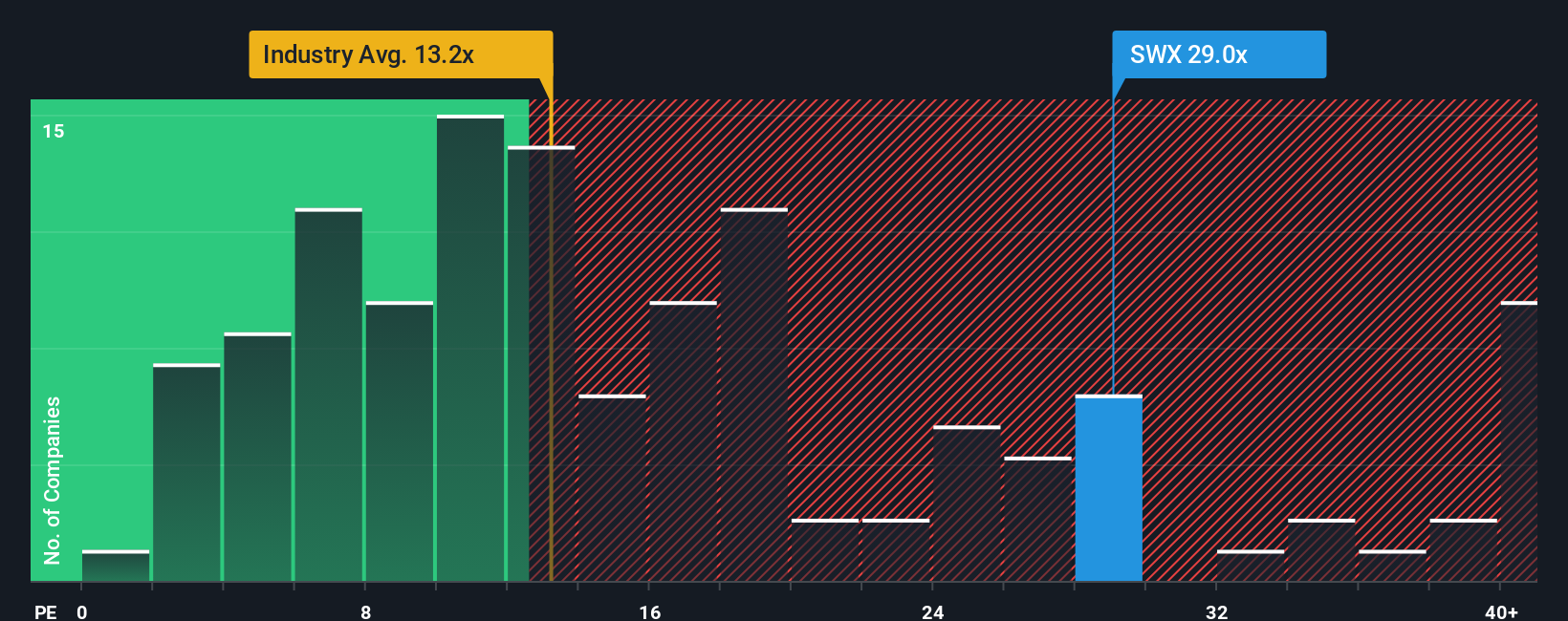

Looking at Southwest Gas Holdings through the lens of market price-to-earnings ratios, the shares look more expensive than many might expect. The company’s P/E ratio stands at 24.2x, noticeably above industry peers averaging 13.8x and even higher than the fair ratio of 22.6x. This significant premium means investors are paying up for expected growth, which introduces downside risk if future performance disappoints. Is this optimism justified? Could price corrections lie ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Gas Holdings Narrative

If you want to dig into the numbers yourself and build a different story, you can construct your own perspective in just a few minutes. Do it your way

A great starting point for your Southwest Gas Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Jump on fresh opportunities and position yourself ahead of the crowd. These unique lists highlight stocks making waves in dynamic, fast-moving sectors right now.

- Target high yields with stocks boasting above-average returns by starting with these 16 dividend stocks with yields > 3%. See which companies deliver strong income potential.

- Capitalize on innovation in medicine by browsing these 32 healthcare AI stocks, where tomorrow’s AI breakthroughs are reshaping the healthcare landscape.

- Get an edge on disruptive trends by reviewing these 82 cryptocurrency and blockchain stocks and uncovering businesses at the forefront of blockchain and digital asset solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives