- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (SRE): Exploring Valuation as Shares Climb on Strong Earnings Growth

Reviewed by Simply Wall St

Sempra (SRE) shares have been quietly trending higher over the past three months, climbing nearly 13%. Investors are taking note as the stock edges up, particularly because the company’s latest quarterly results show annual earnings growth exceeding 10%.

See our latest analysis for Sempra.

Momentum looks to be building for Sempra, with the stock's price climbing nearly 13% over the last three months and delivering a solid 1-year total shareholder return of almost 14%. Recent performance suggests that investors are warming up to the company's growth prospects and steadier earnings trajectory.

If steady gains like these have you wondering where else opportunity might be brewing, it's a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with Sempra trading just shy of analyst targets and its recent outperformance attracting fresh attention, investors may be wondering whether they are looking at an undervalued utility or if the current price is already reflecting its future growth potential.

Most Popular Narrative: 2.1% Undervalued

Compared to the most widely followed narrative, Sempra’s fair value is just above the last close price. This points to a near-balanced view on valuation, with a slight upside according to popular assumptions. Here is one of the pivotal arguments supporting this outlook:

The rollout and completion of major LNG export projects (ECA Phase 1 nearing completion, Port Arthur Phase 1 advancing, and strong commercial momentum for Phase 2) positions Sempra to benefit from sustained global demand for U.S. LNG as a transition fuel, significantly increasing future cash flows and long-term revenue generation.

Curious how such ambitious projects shape this valuation story? One bold assumption could tip the scales for future revenues or margins. Will these aggressive targets hold up as the next few years unfold, or is something being overlooked? The details behind this fair value may surprise you.

Result: Fair Value of $94.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if regulatory shifts or wildfires impact Sempra’s utilities, earnings and valuation could face significant pressure even with today’s positive outlook.

Find out about the key risks to this Sempra narrative.

Another View: What Do Multiples Say?

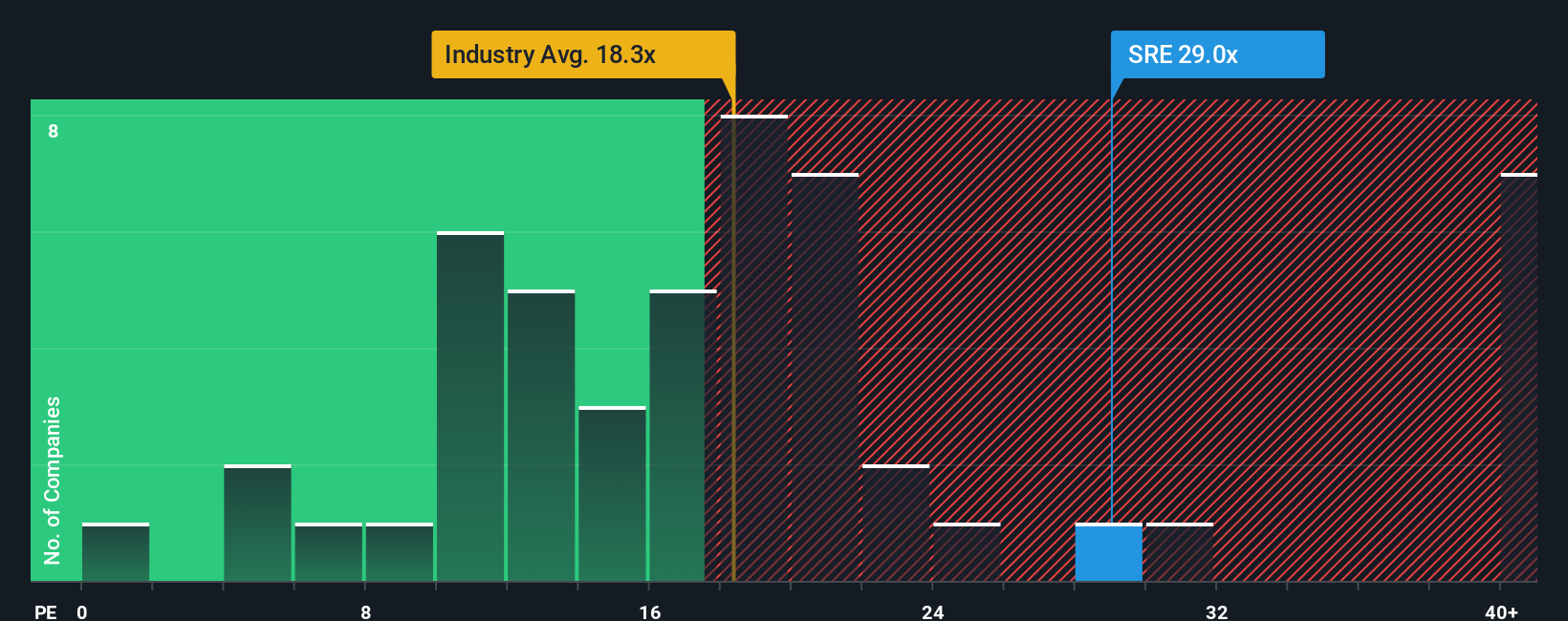

Looking at Sempra’s valuation through the price-to-earnings lens tells a different story. Its P/E ratio is 22.5x, noticeably higher than both its peer average of 20.1x and the global industry’s 18.2x. While the fair ratio is 25.5x, the current premium hints at increased valuation risk unless growth accelerates. Could the market be overestimating Sempra’s future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sempra Narrative

If you feel the current storyline leaves questions unanswered, or you’d rather dig into the numbers yourself, it takes only a few minutes to build your own perspective. Do it your way

A great starting point for your Sempra research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Act now and expand your watchlist by targeting stocks with standout potential. The market moves fast, and unique wins often go to bold early movers.

- Tap into high-growth sectors chasing the next frontier by reviewing these 26 AI penny stocks disrupting industries from healthcare to automation.

- Capture consistent income streams by checking out these 21 dividend stocks with yields > 3% featuring reliable companies with yields above 3%.

- Pounce on emerging blockchain leaders when you scan these 81 cryptocurrency and blockchain stocks, where innovation and transformation fuel new opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives