- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (NYSE:SRE) Files US$1413 Million Shelf Registration For Common Stock Offering

Reviewed by Simply Wall St

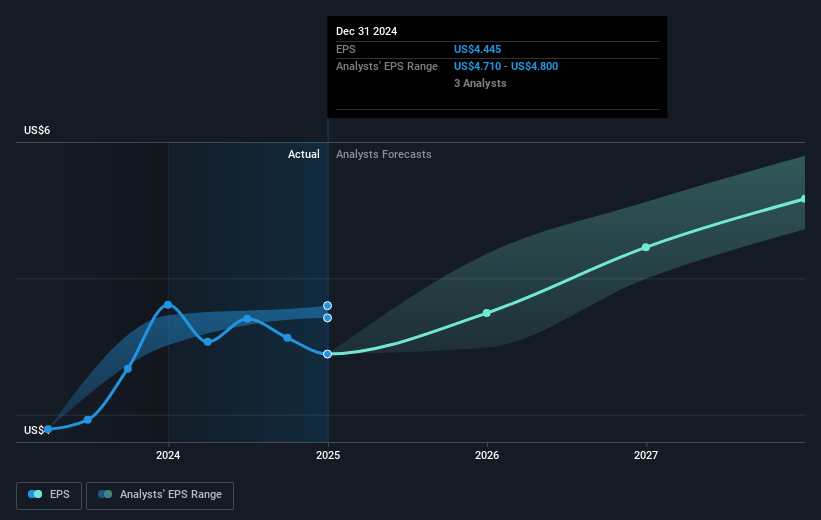

Sempra (NYSE:SRE) made headlines with its recent shelf registration filing to raise $1.4 billion, possibly influencing its share price, which saw an 11% decline over the past month. This move, aimed at bolstering its capital structure and supporting employee ownership, comes amidst mixed results from its latest earnings announcement. Sempra's fourth-quarter net income dropped to $676 million from $748 million last year, contributing to investor unease. Additionally, ongoing revisions to the company's earnings guidance for 2025 and 2026 may have fueled market uncertainty. The broader market context also played a role with the Dow Jones showing mixed performance and overall market volatility driven by geopolitical tensions, including new tariffs announced by President Trump. These various factors collectively contributed to Sempra's recent share price movement during a period of economic uncertainty, with investors cautious about potential impacts on broader market trends.

See the full analysis report here for a deeper understanding of Sempra.

Over the last five years, Sempra's total shareholder return, combining share price movements with dividends, reached 16.05%. Amid this longer-term growth, several corporate developments stand out. Despite recent shareholder proposals related to safety and environmental reporting not passing in May 2024, which might have concerned some investors, the company's major focus was on boosting infrastructure. A strategic agreement in December 2022 for long-term LNG supply to enhance the Port Arthur LNG project reflects this ambition. These initiatives underscore Sempra's commitment to long-term growth, even as short-term earnings faced pressure.

In the recent past, executive changes, such as the appointment of seasoned professionals like Anya Weaving and Kevin Sagara to the board in early 2025, marked a shift in leadership. Additionally, Sempra’s dividend policy, with incremental increases announced in February 2025, likely contributed to investor confidence despite broader market challenges over the past year, where it underperformed both the US market and the industry. Such moves highlight the company's strategic intent to bolster shareholder value over the long run.

- Unlock the insights behind Sempra's valuation and discover its true investment potential

- Discover the key vulnerabilities in Sempra's business with our detailed risk assessment.

- Already own Sempra? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives