- United States

- /

- Gas Utilities

- /

- NYSE:SPH

Suburban Propane Partners (SPH): Evaluating Valuation Following Recent Gains and Improved Shareholder Returns

Reviewed by Simply Wall St

Suburban Propane Partners (SPH) shares have gained around 2% in today’s trading session. Investors may be taking notice of the partnership’s recent steady performance and are paying attention to how its fundamentals compare within the current market environment.

See our latest analysis for Suburban Propane Partners.

Suburban Propane Partners' share price has quietly built positive momentum lately, rising 2.1% today and notching a 10% year-to-date gain. Investors searching for long-term reliability may find the 18.1% total shareholder return over the last twelve months especially compelling. This underscores lasting appetite for the stock’s steady fundamentals.

If you’re looking for another angle on market movers, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with Suburban Propane Partners’ strong gains and fundamentals, is the current price still an attractive entry point? Alternatively, do recent returns suggest markets have already factored in the partnership’s growth prospects?

Most Popular Narrative: 14.4% Overvalued

Suburban Propane Partners' last close of $19.44 sits noticeably above the most-followed narrative’s fair value estimate of $17. Rather than confirming strong upside, this narrative casts doubt on how much room is left for further price gains.

"Market share and earnings stability are reinforced by targeted acquisitions, operational improvements, and enduring demand for core propane services in rural and off-grid areas."

Want to know if these stable cash flows justify today’s price? The narrative leans on a powerful mix of future profit growth, margin expansion, and earnings transformation. But which assumptions are they really betting on for value gains? Find out exactly how the narrative crunches the numbers and what future moves could swing the fair value calculation.

Result: Fair Value of $17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company’s heavy reliance on weather-driven demand and persistent cost inflation could quickly undermine its recent earnings momentum and long-term outlook.

Find out about the key risks to this Suburban Propane Partners narrative.

Another View: What Do Market Multiples Suggest?

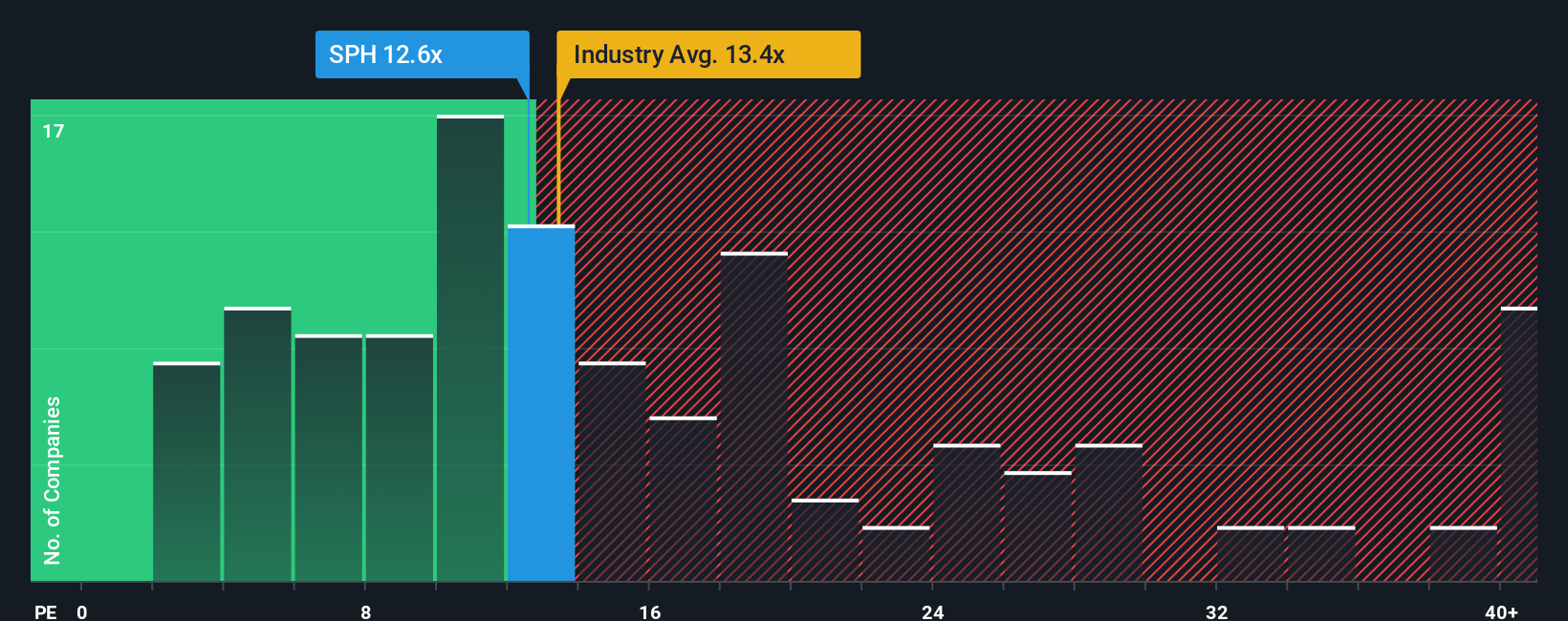

Looking from a different angle, the company trades at a price-to-earnings ratio of 11.9x, noticeably below both its peer average of 17.5x and the global gas utilities industry average of 14.1x. This is also lower than the fair ratio of 16.5x that the market could move toward over time. For investors, this gap could signal mispricing or an overlooked opportunity, but does it really mean Suburban Propane Partners is a bargain, or are there risks not yet reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Suburban Propane Partners Narrative

If you feel inspired to chart your own path or question these perspectives, you can easily craft your own view in just a few minutes. Do it your way

A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for a single opportunity. Expand your horizons and stay ahead with fresh strategies by acting on today’s hottest investment trends below.

- Tap into high-yield income potential with these 16 dividend stocks with yields > 3%. This screener features well-established companies offering robust dividend returns above market averages.

- Capitalize on the innovation boom by starting with these 25 AI penny stocks. Discover pioneers shaping artificial intelligence across multiple industries.

- Seize rare value opportunities by targeting stocks that stand out as underappreciated. these 886 undervalued stocks based on cash flows highlights cash flow-based picks for potential value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPH

Suburban Propane Partners

Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, fuel oil, and refined fuels in the United States.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives