- United States

- /

- Gas Utilities

- /

- NYSE:SPH

Suburban Propane Partners (SPH): Assessing Valuation as Renewable Investments Shape Future Growth Prospects

Reviewed by Simply Wall St

Suburban Propane Partners (SPH) is drawing attention with a steady performance in its Propane segment and new investments in renewable propane and renewable natural gas. These moves could set the stage for future expansion and attract investor interest.

See our latest analysis for Suburban Propane Partners.

Suburban Propane Partners has seen a notable uptick in its share price lately, with a 6.97% gain over the past month and a 10.36% increase year-to-date. Momentum appears to be sustained, as the partnership’s three-year total shareholder return stands at an impressive 54.24%. This reflects growing confidence in its renewable transition and ongoing operational strength.

If you’re looking to expand your search beyond energy names capitalizing on market trends, now’s a great moment to discover fast growing stocks with high insider ownership

With shares trading above some analyst targets and fundamentals pointing toward solid earnings growth, investors must consider whether Suburban Propane Partners still offers untapped value, or if expectations for future gains are already reflected in the price.

Most Popular Narrative: 15% Overvalued

The most widely followed narrative suggests that Suburban Propane Partners’ estimated fair value of $17.00 is about 15% below its last closing price of $19.50. This points to a consensus that the stock is currently trading at a premium, with optimism around growth drivers already factored into the share price.

Expanding renewable natural gas (RNG) capacity through ongoing upgrades and new facilities in Columbus, Ohio and Upstate New York positions the company to access higher-growth, lower-carbon markets and capitalize on a shift in demand toward cleaner fuels. This is likely to support future revenue and margin growth once projects are operational.

Curious about what’s fueling this ambitious valuation? The narrative hinges on specific, bold assumptions for future profit margins and the scale of renewable investments. Uncover which numbers shape the story behind the premium being assigned to Suburban Propane Partners by diving into the full breakdown.

Result: Fair Value of $17.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unseasonably warm winters or weaker renewable credit prices could quickly challenge assumptions and put downward pressure on Suburban Propane Partners' earnings outlook.

Find out about the key risks to this Suburban Propane Partners narrative.

Another View: Market Multiples Suggest a Different Story

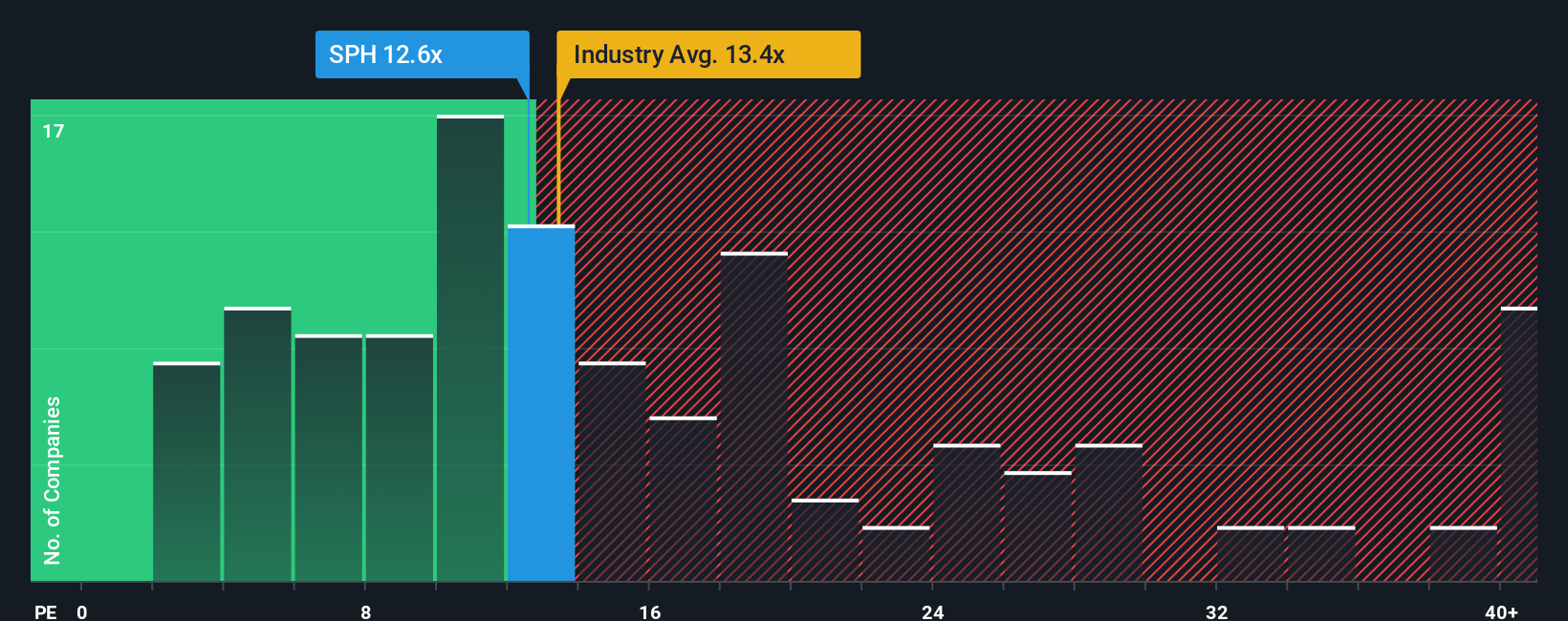

Looking through the lens of earnings, Suburban Propane Partners trades on a price-to-earnings ratio of 12.1x, which is comfortably lower than its industry peers at 17.8x and the global industry average at 14.2x. Its fair ratio is calculated at 18.5x, suggesting a future scenario where its valuation could move higher if market sentiment shifts. While this gap highlights a potential value opportunity, it also raises questions about current market skepticism or signals overlooked upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Suburban Propane Partners Narrative

Not convinced by the popular view or want to draw your own conclusions? You can piece together your own story using the underlying data in just a few minutes. Do it your way

A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities do not wait around. Unlock new ways to grow your portfolio by targeting unique sectors and company types that match your goals. Act before the crowd catches on.

- Boost your income stream by tapping into these 14 dividend stocks with yields > 3% to find companies delivering attractive yields above 3% with the financial health to sustain them.

- Catalyze your growth potential and seize tomorrow's success stories by starting with these 928 undervalued stocks based on cash flows based on robust cash flow analysis.

- Break into the next wave of innovation as artificial intelligence reshapes industries using these 25 AI penny stocks featuring the most promising AI-driven businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPH

Suburban Propane Partners

Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, renewable natural gas, fuel oil, and refined fuels in the United States.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026